Written by: Jacob Dayan

So, you’ve turned your great idea into a lucrative business opportunity, started making sales, and are now thinking about processes that can help take your business to the next level. As a startup owner, your focus is likely set on acquiring customers and generating revenue. While those aspects are key to your business’ success, so are your finances.

Accounting for startups is especially important because, in order to maintain accurate financial records, you need to implement an accounting system, including bookkeeping, that will allow you to keep financial transactions organized as this side of your business becomes increasingly complex.

Our guide to bookkeeping tips and accounting for startups will help you get a better understanding for why you need to make your business’ financials a priority and how to go about doing so. If you have specific questions about startup accounting or bookkeeping, use these jump links to navigate the guide:

Why Is Accounting Important for the Startup of a Business?

Accounting vs. Bookkeeping for Startups

How Do Startups Set up Accounting?

What Are the Basics of Accounting for Startups?

7 Bookkeeping Tips for Startups

When Should You Hire an Accountant

Why FinancePal Is a Trusted Accounting Solution for Startups

You’re Ready to Set up Your Startup’s Accounting System

Accounting is an essential part of any business, even during the startup phase. Once you’ve gotten your idea off the ground, established the structure of your business, and figured out your basic logistics, you need to start thinking about accounting. Since money is what will ultimately drive the success of your startup, how you manage your finances will play a significant role in the viability of your company.

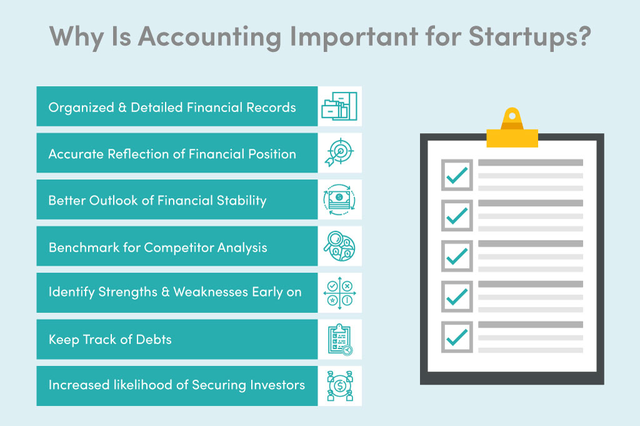

While it might seem that your expenses are not complex enough to require such formal management, doing so can significantly benefit your business in the long run. Some of the most noteworthy benefits of setting up accounting during the startup of your business include:

Similarly, failing to implement accounting processes right from the get-go can have costly consequences for your startup. Risks of neglecting your startup’s accounting include:

For these reasons (among others), it is typically recommended that businesses make accounting a priority from the very start. That said, accounting doesn’t need to be a big, intimidating process.

Keep reading to learn more about accounting basics and how you can implement a useful accounting system for your startup.

Despite the common misconception, bookkeeping and accounting are not the same thing. However, they are both critical to the financial health of your business. Let’s quickly define these two concepts to make it easier to understand the difference between accounting and bookkeeping:

Bookkeeping: Day-to-day tracking of business finances and maintaining records. The responsibilities of a bookkeeper can include collecting and recording invoices from clients, paying your suppliers, reconciling bank accounts, and more.

Example: When you receive a bill from one of your vendors, your bookkeeper will ensure that it is paid and record the transaction.

Accounting: Using business financial records to analyze the health of the company and make recommendations. As part of their job function, your accountant will be responsible for reviewing financial reports for accuracy, helping with the company’s budget, and ensuring that financial reporting is in compliance.

Example: Once the financial statements have been generated, the accountant will review them for any inaccuracies and use the documents to advise you on budgeting and other financial matters.

As you can see, bookkeeping and accounting go hand in hand, but the two functions are usually divided up into two different roles—the bookkeeper and the accountant. While the bookkeeper handles tracking all of your transactions and keeping your financial records up to date, the accountant will review your financial records to identify issues and recommend solutions for improving the financial well-being and growth of your business.

While it’s true that accounting should be a priority, during the startup phase, you can begin with simple measures and increase the formality of your accounting processes as you grow your business.

To set up accounting for your startup, here are 7 easy steps you should follow:

Opening a bank account for your startup is fairly simple and takes just a few steps to set up. To begin, you’ll need to figure out which banking institution you’d like to open an account with. For some business owners, convenience is key, so you could consider opening your business account with the same bank you use for your personal account—most banks offer both types of accounts. Or, you could shop around to find the best perks like low fees, locations near where you live or work, or other benefits that are important to you.

When you’re ready to open your business account, you’ll need to provide certain identification information and business documentation, such as a partnership agreement (if you have one), your Employer Identification Number (EIN), and fictitious business name certificate (if applicable).

In the beginning, most of your transactions will likely be sales and expenses. Closely tracking these numbers is critical for keeping accurate financial records. Basically, you want to establish a bookkeeping system.

You also want to keep all the records of payments, both those you’ve made and received. This will not only allow you to provide proof should your records ever be audited, but also enable you to refer back to them in case you encounter a discrepancy.

When you first start out, it can be challenging to keep track of all the money you’re owed. To help you avoid losing money, potentially making errors in your books, and struggling to collect money from clients, you will need to figure out how you’re going to handle payments. In most cases, a simple invoicing system will do.

As with any other sector of your business, you’re going to want to monitor certain aspects of your startup’s finances. To keep an eye on the health of your business finances, you will want to regularly check a few key metrics, including:

If you’re going to have employees, you’ll need to have a payroll system. Having payroll in place when you bring on your first hire will help you ensure that they are paid on time and accurately, which will benefit you both. Don’t worry if you don’t know how to set up payroll, you can use our step-by-step guide or sign up for our flexible payroll services.

As a startup owner, your time is limited. And if you’re not particularly experienced in business finances, handling bookkeeping and accounting on your own can not only be time-consuming, but leaves you at risk of making mistakes that can be both costly and detrimental to the growth of your startup.

Instead, you should find a professional service that you can rely on to handle these important responsibilities for you. Before settling on a provider, make sure you do your research. If you’re going to use an outsourced provider, you want to know your business’ finances are in the best of hands.

As with many business resources, cloud-based accounting and bookkeeping services are the premier choice for many modern businesses. Many owners favor cloud-based services for accounting and bookkeeping, as well as other tools, because it ensures that their records are always up to date, they don’t have to worry about losing important data, and it is easy to scale and change as their startup grows.

When you’re setting up your business’ accounting, you should also research tax obligations to determine how your choices could impact you when taxes are due. For example, you may be responsible for paying sales and use taxes, and if you don’t, you could face penalties from the IRS. On the other hand, being familiar with small business taxes can also help you take advantage of certain tax credits and deductions, which can help save you money.

For more accounting tips for startups to help your business become a financial success, check out this helpful checklist for startups from NYC.gov. Need help setting up accounting for your small business? FinancePal makes it easy.

Any credible source for accounting tips for startups will emphasize the importance of having an understanding of accounting basics. Before you make any decisions, you should be familiar with certain aspects of accounting, including:

Let’s cover the accounting basics you should know…

Some of the best accounting advice for startups is to know your basic accounting terms. This way, whether you’re doing your bookkeeping and accounting on your own or a professional is handling it for you, you will be able to understand what is going on with your startup’s financial situation.

While we don’t expect you to become an expert, here are some of the most important accounting and bookkeeping terms you should be familiar with:

The accounting method you choose for your business can have a long-lasting impact on your financial records. While it can be changed, it is important to understand how the different accounting methods work and why you should use one over the other. When choosing between cash vs. accrual basis accounting, here are the most important factors you should keep in mind:

Cash Basis Accounting: In cash basis accounting, transactions are recorded when money is sent or received for goods or services.

Accrual Basis Accounting: In accrual basis accounting, transactions are recorded when goods or services are exchanged, regardless of payment.

Whether you are going to be handling your accounting or a professional will, there are five basic accounting principles that should always be followed:

1. The Revenue Principle

Revenue is earned when a sale is made and the goods are provided to the other party, not when you simply collect the money for the goods or services.

Example: Let’s say you have your own web design startup. An application of the revenue principle would be recording the revenue for the work when you complete the project and deliver it to the client, regardless of when they pay you for the services.

2. The Expense Principle

An expense is incurred when the business receives the goods or services, not when you get the bill.

Example: If you’re having a mural painted in your startup’s office, you should account for that expense when the service is performed, not when you receive the invoice from the artist.

3. The Matching Principle

Expenses should match with revenue. So, when you sell an item, you should account for the expense of the materials used to create that item when that good is purchased.

Example: Let’s say you have your own floral shop. An application of the matching principle would be recording the cost of goods sold (for the flowers, pots, and other supplies used to create your products) when you sell the potted plants, bouquets, etc.

4. The Cost Principle

The historical cost should be used when recording expenses, not their current market value.

Example: Say you’ve purchased a piece of real estate or another asset, you will record the cost you actually paid for the asset, regardless of whether the resell value has changed or not.

5. The Objectivity Principle

A business’ financial information should be based on objective, verifiable data.

Example: When a transaction is recorded, factual documentation should be used to verify the transaction information, so there is no room for bias (regarding the objective value) or error.

The accounting cycle is the process that is followed when recording business transactions. There are eight basic steps in the accounting cycle that should be completed in order to ensure the utmost accuracy.

1. Identify & Analyze Transactions

Find all of the transactions that have taken place over the period. Transactions are usually found by reviewing invoices, bank statements, etc.

2. Record Transactions

Transactions are recorded in their corresponding journals—most transactions will be part of the general journal. Two entries should be made for every transaction, a debit and a credit.

3. Post Journal Entries

Journal entries need to be posted to the general ledger. Entries will need to be added to the correct account, such as cash, expense, or inventory.

4. Calculate Unadjusted Trial Balance

This is an opportunity to find errors by checking to see if the debits and credits match by totaling both up.

5. Create a Worksheet & Make Adjusting Entries

This step allows you to make adjusting entries to correct any mistakes or oversights that occurred earlier on.

6. Adjust Trial Balance

Once adjusting entries are made, an adjusted trial balance needs to be calculated to verify that mistakes have been corrected.

7. Generate Financial Statements

Now that the records should be accurate, the information can be used to generate financial statements for the period.

8. Close the Books

All temporary accounts (income, expenses, and withdrawals) are closed and the accounting cycle restarts for the next period.

As you can see, there is a lot that goes into maintaining accurate books and financial records. With all the responsibilities you already have as a business owner, taking on these financial responsibilities may become overwhelming, especially if you have not overseen business finances before.

Now that we’ve covered the basics of accounting for startups, let’s switch our focus to some bookkeeping essentials.

When it comes to bookkeeping for startups, there are several key pieces of advice to keep in mind:

Following these tips will save you time and frustration, and help to ensure your books are accurate and up to date.

When it comes to accounting for startups, no two businesses are the same. That said, you should hire an accountant as soon as your business begins making money and it’s viable. While you might not have much financial activity early on, you can use their guidance to make sound financial decisions for your startup.

Typically, the earlier, the better, because you will be set up with the best financial practices from the beginning.

FinancePal doesn’t just help with accounting, we also provide bookkeeping for startups.

FinancePal has helped many startups and small businesses get off on the right financial foot by providing reliable, accessible, and affordable online accounting and bookkeeping services. Regardless of how far along you are in getting your startup off the ground, our streamlined bookkeeping platform will help you stay on top of your finances.

In addition to up-to-date and accurate financial records, you’ll have access to weekly and monthly financial statements—allowing you to plan for future needs, grow strategically, and secure the investors you need to make your startup a success. At FinancePal, we make accounting for startups easier than ever.

Take the next step in your startup’s path to success by implementing your own accounting system. When you’re ready, consider updating your accounting practices to a more sophisticated system that will take the burden of bookkeeping and accounting off your shoulders and into the hands of the pros.

At FinancePal, we take pride in helping businesses like yours succeed with our advanced, customer-oriented, online startup accounting and bookkeeping services. And, our team of financial experts are always available to provide accounting advice for startups who want to make sure their business is in the best possible position.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.