Written by: Jacob Dayan

In 2019, eCommerce accounted for $3.5 trillion in retail sales worldwide. Translation: There’s a lot of money to be made through online sales.

Are you going to open a business that relies extensively—if not exclusively—on eCommerce? Then it’s important that you brush up on the basics of eCommerce accounting.

Good accounting is how you’ll gauge the health of your business and grow your profits. Bad accounting could lead to the failure of your company, or worse: trouble with the IRS.

Are you just preparing to launch your eCommerce business? Keep reading—we’ll give you some important bookkeeping notes that’ll have you ready to do good accounting by the time you open your doors (figuratively speaking).

Already own a business that’s up and running? Jump ahead and read our tips on how to make your eCommerce accounting more efficient and lucrative.

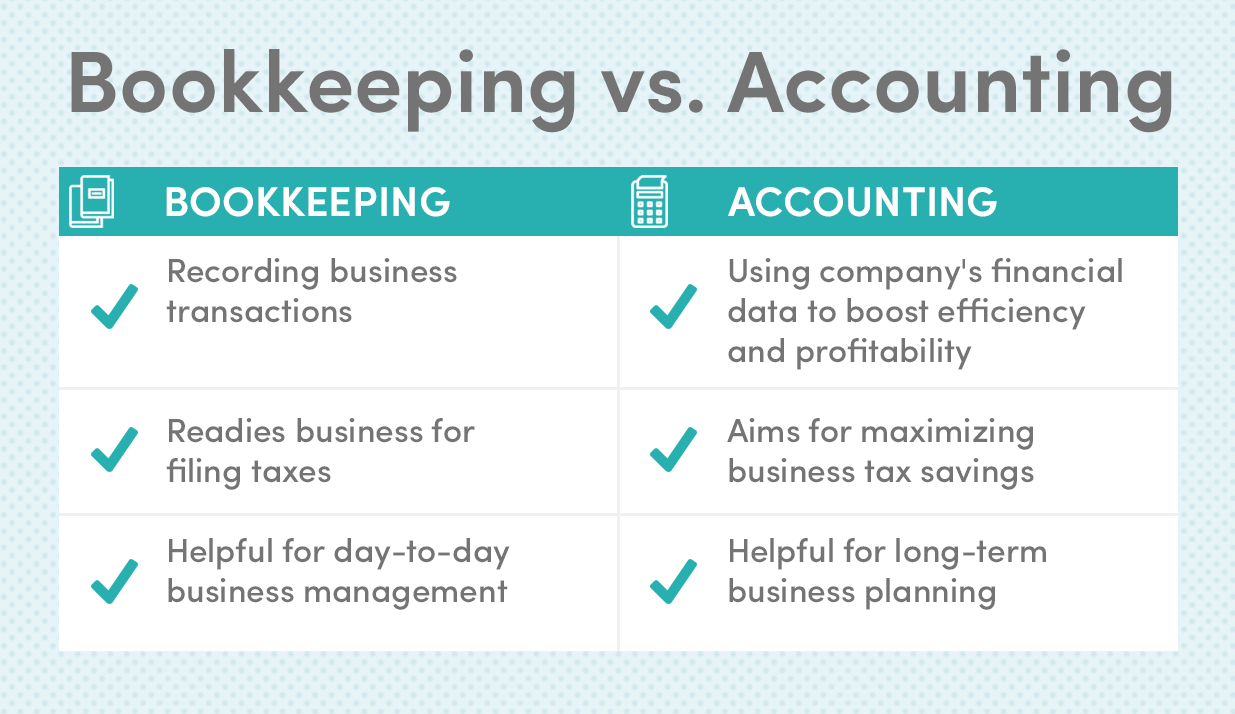

You might hear some people use the terms “bookkeeping” and “accounting” interchangeably. But they are not the same thing. Bookkeeping and accounting are definitely related practices and you can’t really do one without the other, but there are different processes and end goals for each.

Bookkeeping refers to the day-to-day task of recording your company transactions and financial records. This is an activity that’s a part of your daily business operation. The main goal is to keep your business finances documented and organized. It’s pretty bureaucratic stuff.

Accounting is the process by which you utilize your company’s financial data to make your business more efficient and profitable. An accountant carefully analyzes a company’s finances and figures out the best way to cut costs, prepare for taxes, and grow the company.

You can’t do good accounting unless you do accurate bookkeeping. Likewise, it’s harder to do accurate bookkeeping if you don’t have an efficient accounting process.

As we continue, you’ll get a better idea of what constitutes bookkeeping and accounting. You can also read our blog on bookkeeping vs. accounting if you want more information.

eCommerce bookkeeping is very similar to bookkeeping for any other business. Here’s everything you need to know.

The single most important aspect of bookkeeping is that you record all the transactions that your business makes. A transaction is any instance in which money enters or leaves your company. So far as bookkeeping is concerned, these transactions are sales-related.

Any time a customer buys a product from your eCommerce website, that’s a transaction that needs to be recorded. Any time your company purchases something that it’s going to sell online, that’s also a transaction that needs to be recorded.

Here are 6 types of transactions that you’ll need to keep track of:

Why it’s important for accounting:

So why do you need to record all these transactions, anyway?

First, you need to record transactions so you can accurately file taxes. Every business is expected to pay taxes to federal, state, and local tax authorities. You need to keep track of all your transactions so you know what your company owes in taxes.

There’s another reason why you need to record your transactions: so you can determine your company’s gross profit. Your gross profit is how much your company earned when accounting for sales, operating expenses, and the cost of goods sold. Your gross profit will help you determine the overall financial health of your business when you’re doing accounting work. We’ll go over this in more detail a little later.

Both retail and eCommerce businesses have to deal with returns and chargebacks.

Let’s talk about a return, first. A return is when a customer wants to return a product and get a full or partial refund. Every company has a different refund policy—it’s totally up to you to decide what your company’s refund policy is. But let’s assume you decide to honor the refund. Basically, money will leave your account and be paid to the customer—so it should be recorded as an expense, right?

Not necessarily. Returns are usually recorded in their own transaction category, “returns and chargebacks.” But they should also be subtracted from your “revenue” category. You should also make note of whether or not the product is returned to your inventory or discarded.

Now let’s talk about a chargeback. A chargeback is when a credit card company asks you to return money to a customer’s credit card because it was a fraudulent payment. Chargebacks also usually come with an additional processing fee that you pay to the credit card company—usually about $10. Just like a return, a chargeback should be recorded in the “returns and chargebacks” category. You should also subtract money from revenue, but only the amount paid back to the customer and not the processing fee.

Why it’s important for accounting: Returns and chargebacks may hurt your revenue, but they’re not necessarily indicative of your business’ health—unless you have too many of them. This information will ultimately help you assess the quality of the products you’re selling.

Both retail and eCommerce businesses need to keep track of inventory—that is, monitoring all the items you have in stock that are available for customers to buy. If you’re doing accounting for a business, it’s important that you know what the inventory is at any given point during the year.

Why it’s important for accounting: This information will help you with budgeting.

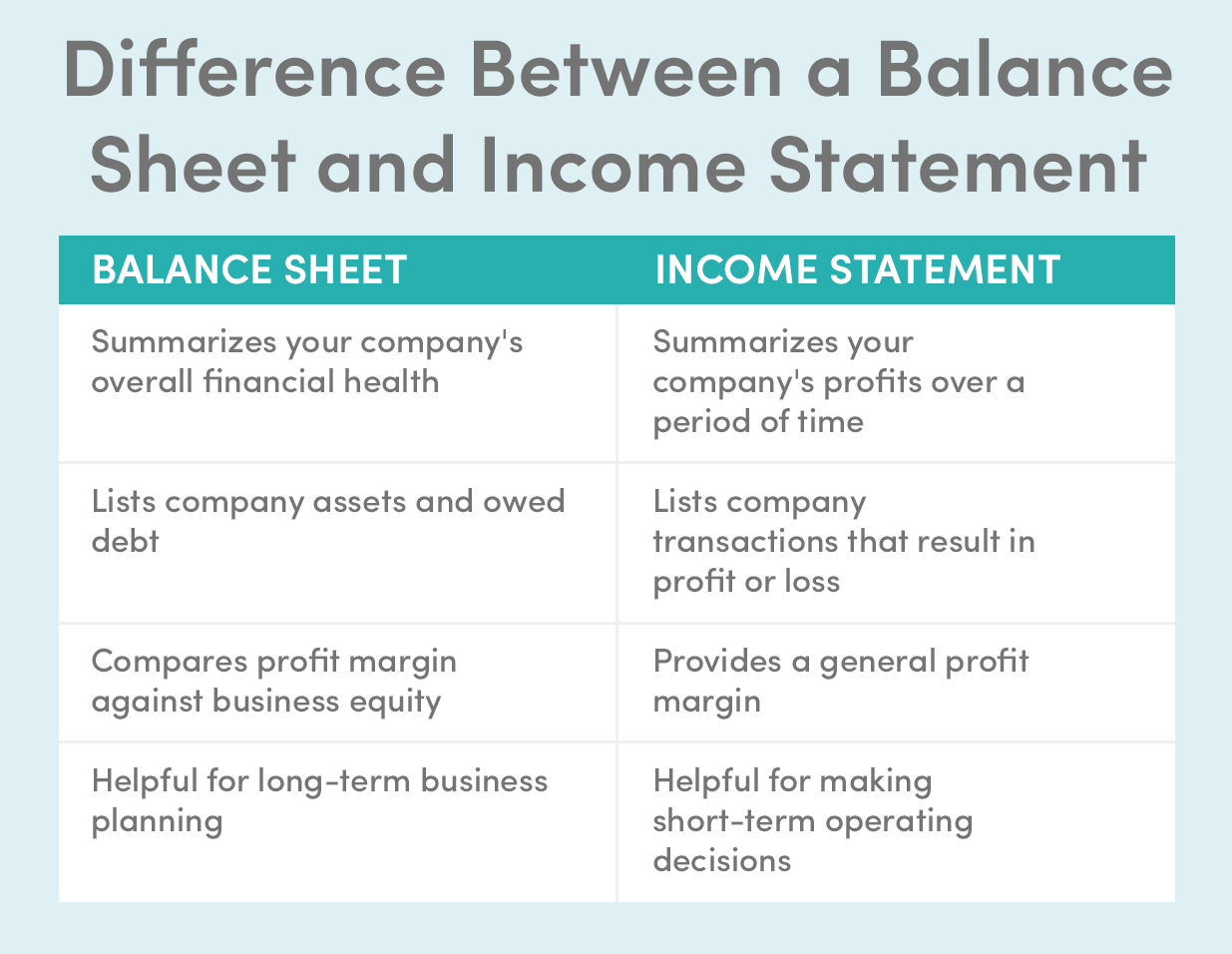

The task of preparing financial statements may fall upon either the bookkeeper or the accountant. But if you’re a small business owner, then the responsibility probably falls on you, regardless. The financial statements are, in one respect, the end result of the bookkeeping process. They summarize all of your company’s financial information, and these numbers will help you make financial decisions. Yes, both retail and eCommerce businesses must prepare financial statements.

There are 4 kinds of financial statements:

Let’s discuss the income statement, first. The income statement shows how profitable your business was over a period of time—typically over a month, quarter, or year. For any given period, the income statement summarizes:

So that’s it right? Your income statement is all you need for accounting.

Not exactly. An income statement only gives you a short-term picture of your company’s financial health. If you want a long-term picture, you’ll also need to prepare your company’s balance sheet.

The balance sheet also takes into account your company’s overall wealth, including assets and liabilities. First, it provides a brief summary of the income statement but doesn’t include the list of transactions that occurred. Then, it accounts for:

Subtract liabilities from assets and you’re left with your company’s overall equity. Knowing your company’s equity will help you make long-term decisions for your business.

You don’t need to worry about the cash flow statement or the shareholders’ equity statement. The cash flow statement only needs to be prepared for companies that do accrual accounting (we’ll go over that in the accounting section). The shareholders’ equity statement is for larger companies.

All this bookkeeping stuff sounds like a lot of work, doesn’t it?

Yup. It is a lot of work.

And we haven’t even touched accounting yet.

Large companies enlist several full-time bookkeepers to record their financial data. Unfortunately, small businesses don’t usually have the money to hire bookkeepers, so the bookkeeping tasks fall upon the already-overburdened business owner.

Thankfully, the digital age has made it easier than ever for small business owners to do both. Nowadays, there are software programs available that will handle literally every aspect of bookkeeping for your business. That includes recording transactions, managing inventories, keeping track of returns and chargebacks, and preparing financial statements.

FinancePal is one of those software programs that’s built to do comprehensive small business bookkeeping for your company, including point of sale. And what’s great about using software like FinancePal is that it’s already digitally-based, so it’s easy to integrate with your eCommerce site. It’s also far cheaper than hiring a bookkeeper, and it’s more efficient.

“The sooner we drop the ‘e’ out of ‘e-commerce’ and just call it commerce, the better.”

That’s a quote by Bob Willett, former President of Best Buy International. Bob has a point. The customer experience in retail commerce is vastly different than the customer experience in eCommerce, but business management is roughly the same for each.

Accounting for an eCommerce business is pretty much the same thing as accounting for retail. But eCommerce businesses do have a few accounting obstacles that retail companies don’t have to deal with quite as much.

We’ve broken down the eCommerce accounting process into 7 steps that will help you be an accountant-extraordinaire for your company.

When you open a new business, you’ll have to elect a business entity. There are several different types of business entities you can choose from, but most small businesses elect to be either a sole proprietorship or limited liability company (LLC). Some companies may choose to be an S Corp.

Your business entity has an effect on how you’re taxed, and that’s why it’s important to choose the one that’s the most financially advantageous for your company. However, this is a pretty complicated topic that’s worthy of its own blog post. Consider speaking with one of our knowledgeable team members to learn more about business entity formation.

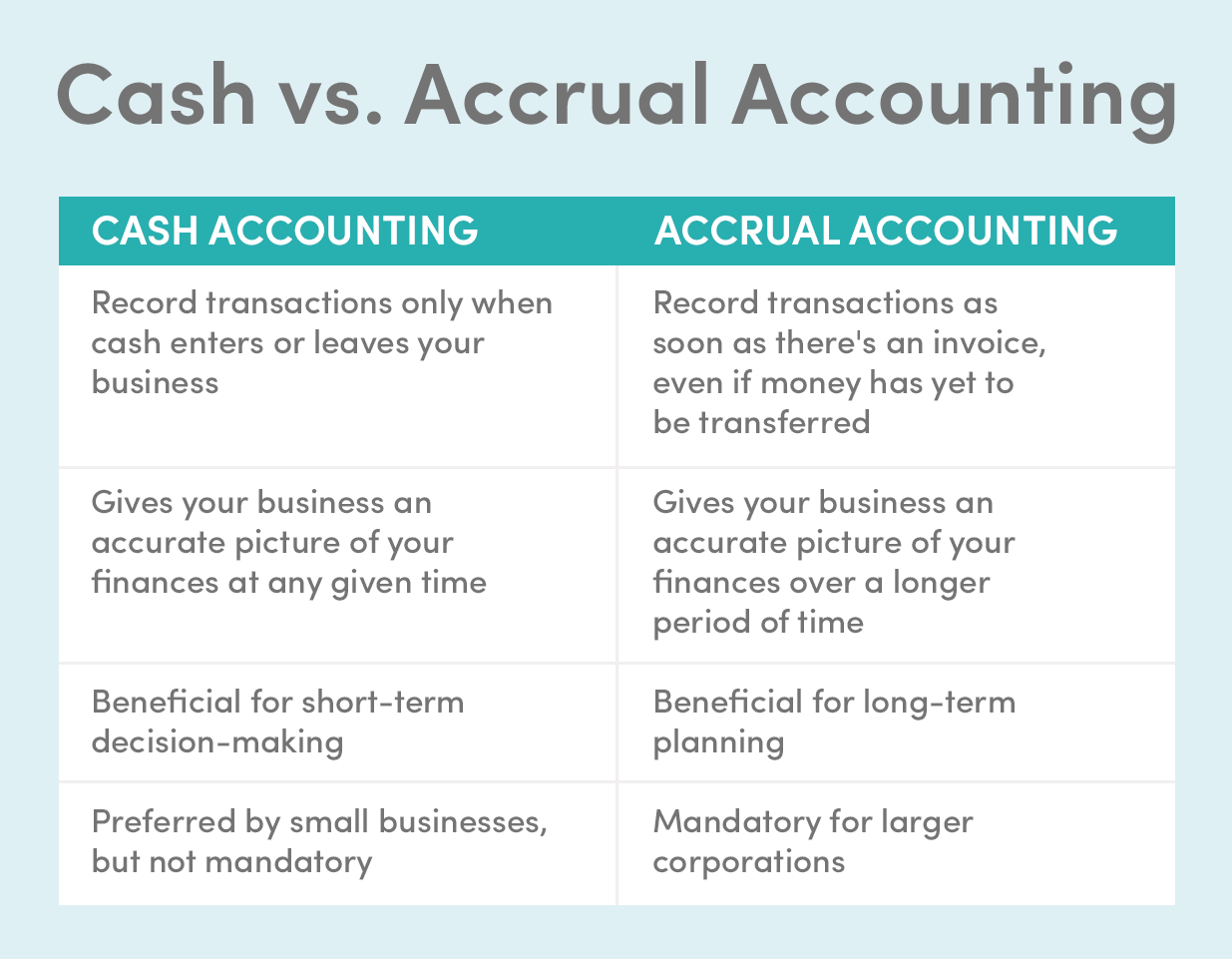

If you’re doing accounting for a startup company, you need to choose the accounting method that your company is going to use. There are two kinds of accounting methods: cash accounting and accrual accounting.

This is also a pretty complicated topic and you can learn more about it by reading our blog on cash vs. accrual basis accounting. But let’s summarize the differences between the two.

Cash accounting means that you only record transactions the moment that money enters or leaves your business.

Accrual accounting means that you record transactions as soon as they occur. Let’s say that your business has ordered more inventory to be delivered by the end of the week. You won’t actually pay for the inventory until it arrives, but you’ll still record the impending transaction under the accrual system.

Most small businesses choose to do cash accounting because it gives you a better idea of how much money your company has at any given time. Another benefit of cash accounting is that you’ll only be taxed on money that’s currently in the bank—not money that’s going to be in the bank.

Accrual accounting is tricky because soon-to-be revenue and soon-to-be expenses are reflected in your account, but they don’t actually represent how much money is sitting in your account. For that reason, it’s not ideal for making day-to-day financial decisions, which are the ones small businesses most commonly make—you don’t want to order $1,000 in inventory when there’s actually only $800 available in your spending account.

Still, accrual accounting can be helpful in making long-term decisions, so long as you keep a handle on it.

You’ll want to stick with your accounting method once you choose one. Although you can ask the IRS to change your accounting method at any time, it does require a lot of paperwork—and you probably have enough paperwork to deal with as it is.

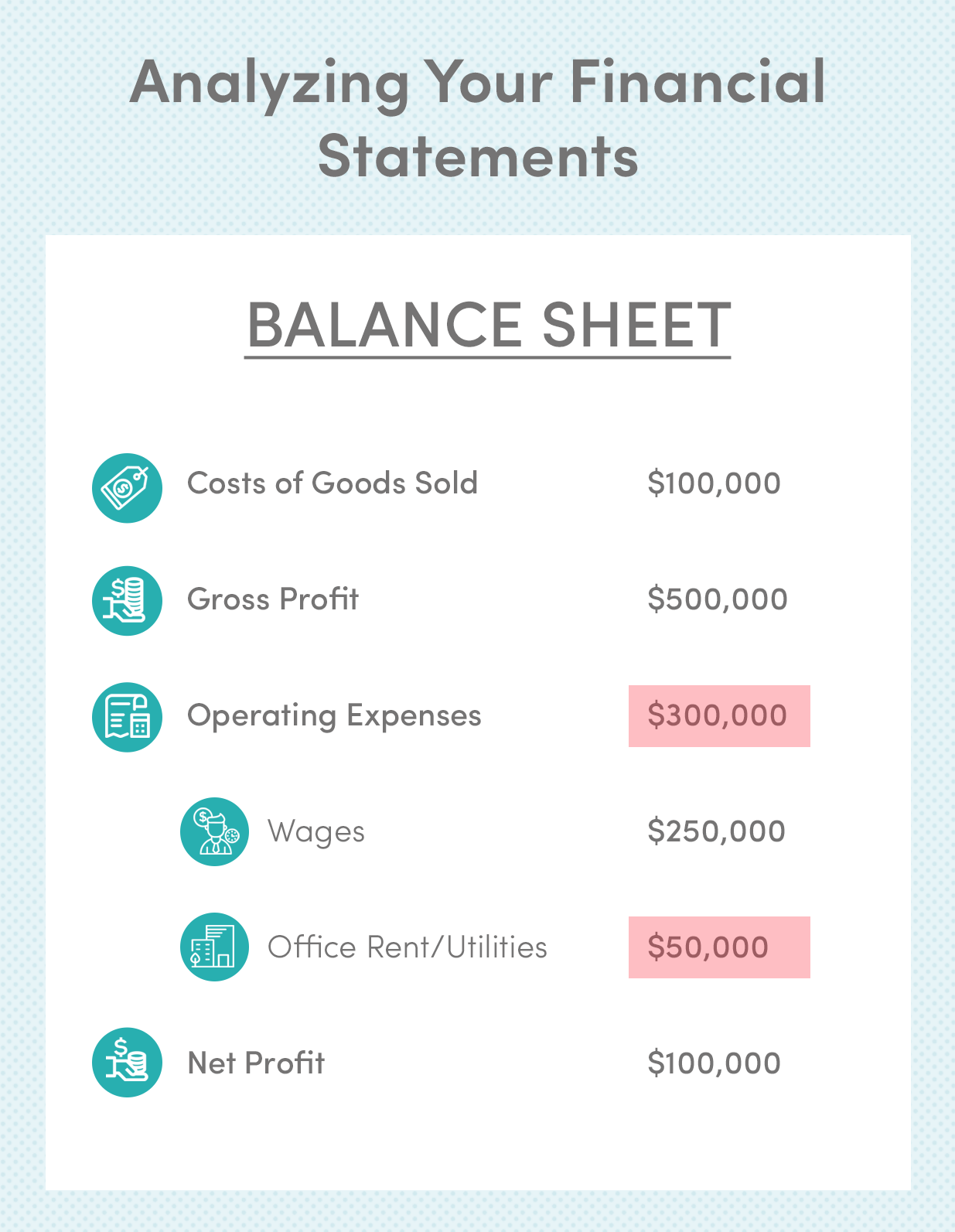

Bookkeeping is more of a day-to-day process, but the goal of accounting is to make your business more profitable in the long-term. One of the best ways to boost your company’s profitability is to cut costs.

How do you know which costs to cut? That’s when you’ve got to utilize your handy-dandy financial statements, especially the income statement. Your income statement will list the majority of your company’s expenses, including the cost of goods sold and operating expenses.

Pore over these documents and find where there’s the heaviest amount of costs. Think about ways that you can minimize these costs. Can you get by with one less employee? Can you buy cheaper goods to sell? Can you rent a less expensive office space?

You might not be able to dramatically cut your costs, but if you trim a little fat where you can, it’ll add up over a period of time.

Here’s the question that all business owners and accountants lose sleep over: how can I boost the profitability of my business?

There’s no universal answer, unfortunately, but your financial statements might be able to provide some clues.

Are there any products that are selling extremely well? Maybe you can sell more products of that type. Is there a correlation between increased spending on marketing, and higher sales in a certain category? Maybe you can continue running that marketing campaign or targeting that specific audience.

Use your balance sheets to find where sales are coming in, and, if possible, how and why they’re coming in. That may give you some ideas on how you can boost your company’s profits.

Small businesses are more susceptible to slow periods, whether they’re brick-and-mortar or eCommerce-based. For example, you might be very profitable during the summer, but struggling to make ends meet during the winter (this is also called the “feast-and-famine” cycle).

You can overcome the slow periods by budgeting throughout the year. Use your financial statements to determine how much money you need stashed away in a business savings account to pay your rent and wages during the slow season. Then put a little money away throughout the year to prepare yourself.

You should also keep track of how your inventory changes throughout the year. Do you sell less of a certain product during March? Then only stock a limited amount of that product so you don’t waste money buying anything that’s not going to sell right away.

Do you sell more of a certain product in April? Then be sure to stock plenty of it that month so you’ll have lots of products available to sell.

Tracking your inventory highs-and-lows is both a cost-cutting measure and a profit-boosting tactic.

This is both a bookkeeping responsibility and an accounting responsibility. At the end of the year, you can save money on taxes by claiming tax-deductible expenses that your business made. Some of these expenses include:

The more money that you save on taxes, the more money you’ll have to put into your business savings, to reinvest in your business, or to pocket.

Here’s one accounting challenge that’s a unique burden to eCommerce companies: use tax.

In the early days of eCommerce, businesses could sell products across state lines without worrying about the tax obligations of that state. An eCommerce business in Oregon—which doesn’t charge sales tax—could sell products to a buyer in California—which does charge sales tax—and it would be up to the buyer to report use tax on the transaction.

But times have changed. Since eCommerce has become such a large part of the economy, interstate trading laws have evolved. In 2020, if you sell a certain amount of products to another state or if you make enough revenue selling to buyers in another state, you’re technically considered a legally-operating business entity in that state, and you’ll be required to pay that state’s sales tax on the transaction.

Let’s say that your eCommerce business operates in California. You sell $100 worth of revenue to buyers in Ohio—which meets the minimum threshold for sales tax—and now you’re obligated to pay Ohio’s sales tax on each of your transactions to Ohio buyers.

This is technically a bookkeeping concern, but it’s also an accounting concern, for two reasons:

Read our blog on sales and use tax for more information on that subject.

One of the most important accounting tips for small businesses is that you’ve got to stay organized. Organization is the only way that you’re going to find time to prepare your financial statements and analyze them to develop business strategies. Organization is also how you’ll stay on top of making your regular tax payments and ensuring that all your transactions are being accurately recorded.

Just like with bookkeeping, the best way to stay on top of your accounting tasks is to utilize a small business accounting service. These services, like FinancePal, will handle the majority of your accounting tasks to help you cut costs and boost your profits.

FinancePal is helpful for both startup companies and established businesses. If you’re a startup company, you can use FinancePal to set up payroll and establish your point of sale systems.

If you’re an established company, you can use FinancePal to streamline your bookkeeping and accounting operations. In fact, FinancePal can actually help you catch up on bookkeeping, in case your transaction records aren’t up-to-date.

As a business owner, your schedule is probably stretched razor-thin. Your time is best spent managing your employees and making business decisions—it’s wise to let services like FinancePal do the eCommerce accounting and bookkeeping for you.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.