Written by: Jacob Dayan

El periodo contable es una de las reglas de oro de la contabilidad que todos los contadores deben seguir. Este artículo repasa lo que es, los diferentes tipos de periodos contables y por qué es tan importante.

Un periodo contable es un lapso de tiempo durante el año fiscal o año natural en el que los contadores realizan funciones como la recopilación y agregación de datos y la creación de estados financieros. Los estados financieros realizados durante estos periodos son muy importantes para atraer a posibles inversionistas o conseguir préstamos de los bancos.

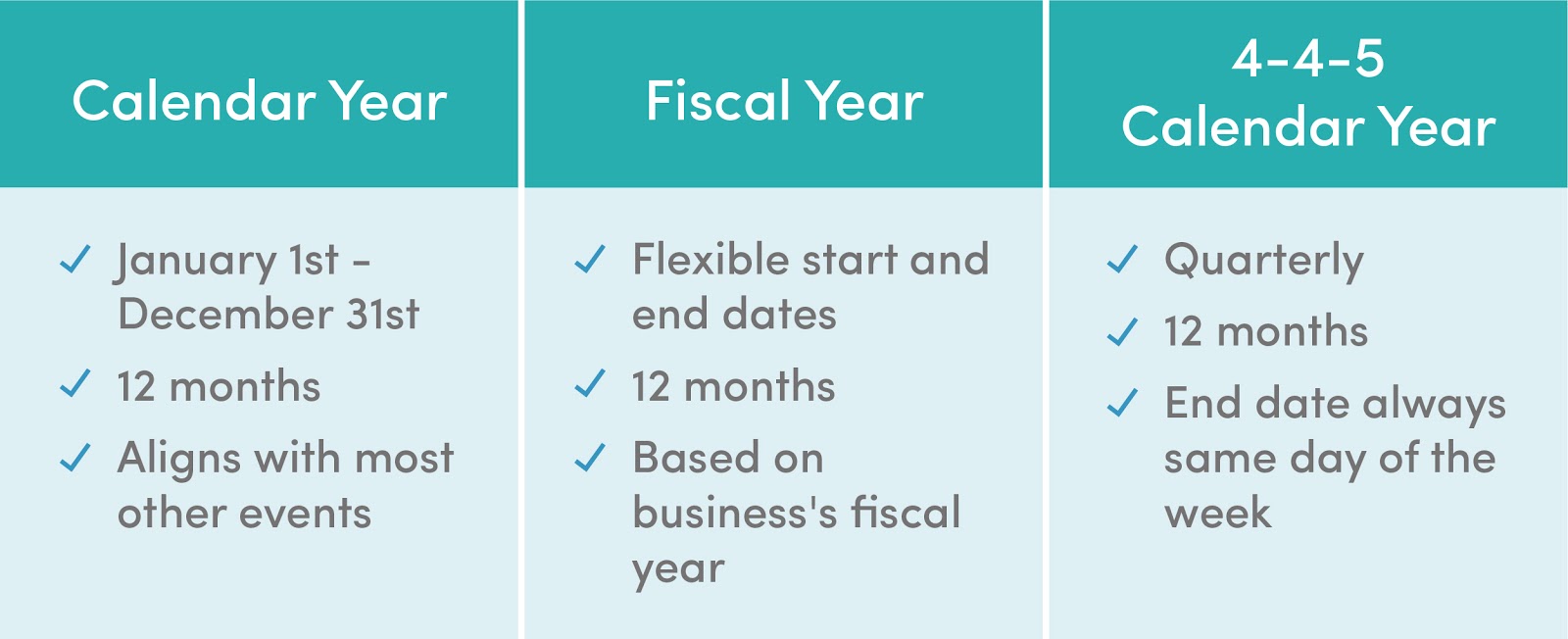

Un periodo contable puede consistir en cualquier plazo establecido, aunque los más comunes son la semana, el mes, el trimestre y el año fiscal o el año natural. Las empresas que cotizan en bolsa están obligadas a presentar informes trimestrales a la Comisión del Mercado de Valores (SEC).

Los periodos contables pueden (y de hecho lo hacen) sobreponerse. Por ejemplo, los contadores pueden agregar datos para crear una cuenta de resultados para el mes de febrero. Aunque la cuenta de resultados resultante sólo representará el periodo contable de febrero, el mes de febrero también estará representado en los estados financieros trimestrales del primer trimestre.

En primer lugar, los periodos contables deben ser consistentes. Por ejemplo, si un contador crea estados financieros mensualmente, debe hacerlo para cada mes de cada año natural. Esto se llama periodicidad, y tener una buena periodicidad dará a los responsables de la toma de decisiones, a los inversionistas y a los bancos una muestra grande y congruente a partir de la cual podrán juzgar la salud y las perspectivas financieras de una empresa.

Al utilizar los periodos contables, otra regla de oro es el principio de concordancia. El principio de concordancia es un principio clave del método contable de devengo. Exige que los gastos se contabilicen en el periodo en el que se produjeron; del mismo modo, todos los ingresos deben contabilizarse en el periodo en el que se obtuvieron.

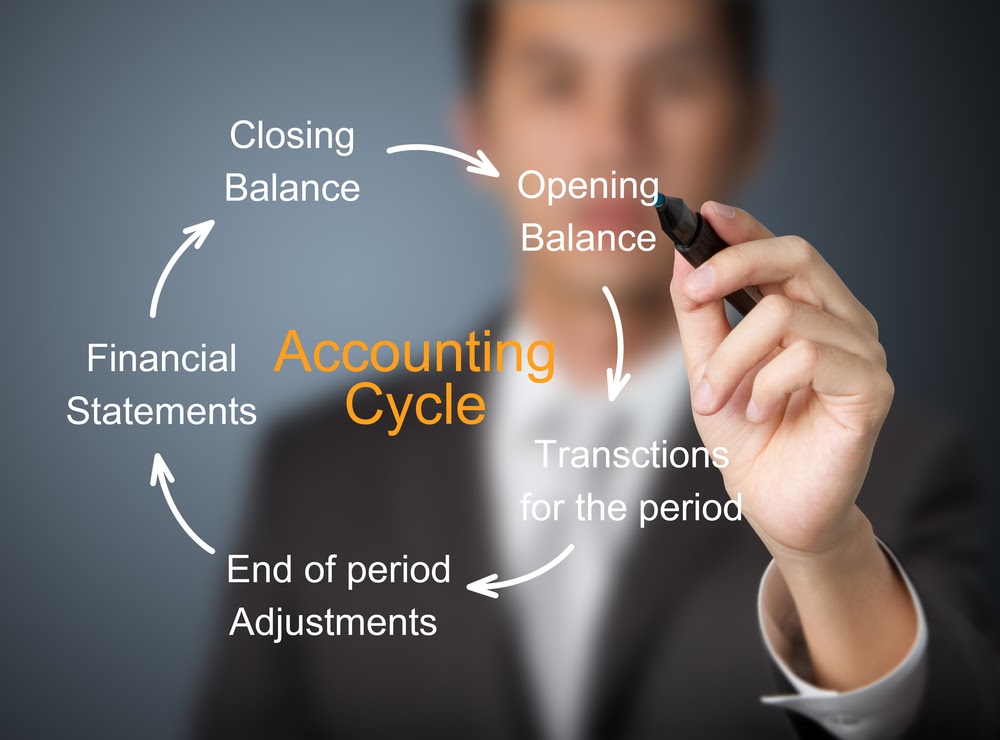

El periodo contable es el tiempo que se tarda en completar el ciclo contable. Cuando se abre el periodo contable, los contadores comienzan el ciclo con entradas de reversión y terminan el ciclo cerrando entradas y produciendo estados financieros cuando el periodo contable culmina. El ciclo vuelve a empezar cuando se inicia el siguiente periodo contable.

Existen varios periodos contables estándar, entre ellos:

Al final de cada ejercicio contable, los contadores de una empresa elaboran estados financieros como el balance, cuenta de pérdidas y ganancias, el estado de flujo de efectivo y el estado de cambios en el capital. Unos estados financieros bien elaborados, junto con una periodicidad adecuada, son fundamentales para que los inversionistas y los bancos puedan calibrar la salud financiera de una empresa.

Y, en caso de que su empresa se vea sometida a una auditoría del IRS, la periodicidad será su salvación. El IRS puede ser muy implacable cuando se trata de errores o incoherencias en los estados financieros; no tienen inconveniente en añadir multas y tarifas a su balance.

Un buen contador es un impecable cumplidor de las reglas, y hay un montón de reglas en las finanzas empresariales. Muchos propietarios de pequeñas empresas que intentan llevar su propia contabilidad encuentran que es tedioso, complicado y requiere mucho tiempo.

Para una pequeña empresa, externalizar la contabilidad y el manejo de libros contables a una empresa externa es rápido, fácil y gratificante. Cada día son más los propietarios de pequeñas empresas que se pasan al manejo de libros y a la contabilidad con FinancePal.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Leer Más

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Los fundamentos de la contabilidad para bares y restaurantes

Consejos para corporaciones de como evitar deudas durante las fiestas

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Póngase en contacto con nosotros hoy mismo para obtener más información sobre su prueba gratuita.

Al introducir su número de teléfono y hacer clic en el botón "Obtener cotización", usted proporciona su firma electrónica y su consentimiento para que FinancePal se ponga en contacto con usted con información y ofertas en el número de teléfono proporcionado mediante un sistema automatizado, mensajes pregrabados y/o mensajes de texto. El consentimiento no es necesario como condición de compra. Pueden aplicarse tarifas de mensajes y datos.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.