Written by: Nick Charveron Nick

Being a new business owner is no easy task. But if you’ve finally succeeded in getting your dream company up and running, it’s time to hire some new employees. There’s nothing more fulfilling than realizing you created a business that allows you to provide people with jobs so they can make a living. However, in order to make that living, your employees need to get paid. Whether you’re just hiring one person or a few dozen, you need to know how to set up payroll. For many new business owners like you, setting up payroll and learning how to do payroll manually may seem like an overwhelming task.

To ease your worries and ensure you process every paycheck correctly and on time, we’ve created a “how-to” guide to get you started. By following these eight steps on how to do payroll, you’ll be able to leave the office and get back to work with your satisfied, and properly compensated, workers. Use these links to quickly jump through the article or read our guide start-to-finish for a comprehensive overview of how to set up payroll.

Before you learn how to set up payroll, you need to make sure you have all the groundwork in place. This means you need to obtain a business tax ID, which is your employer identification number (EIN). To apply for an EIN, you must have a social security number or Individual Taxpayer Identification Number and apply on the IRS website, through fax, or by mail. An EIN is a nine-digit number assigned to business entities to identify taxpayers who are required to file various business tax returns.

Employers, sole proprietors, corporations, partnerships, nonprofit associations, trusts, estates of decedents, government agencies, certain individuals, and other business entities are required to have an EIN. Along with an EIN, businesses also need proper business licenses issued by local, state, and federal agencies, along with additional paperwork. It is assumed, however, that if you’re looking to set up payroll, you already have your business established. If you’re looking to start a business, you can refer to our entity formation section. Or, if you need assistance starting your business, you can talk to one of our FinancePal professionals to learn about our entity formation services.

Along with your EIN, you may need to obtain a local or state business ID before setting up payroll, if required by the state you’re operating in. Your EIN and state tax ID work like a social security number, but for your business. Obtaining a state tax ID is similar to obtaining a federal tax ID but varies by state. It’s worth researching the tax obligations of your state to determine income tax and employment tax laws, so you know how much you need to pay instate taxes. To find out how to obtain your state tax ID, you can look up your state on the U.S. Small Business Administration website.

The next step in learning how to start payroll is collecting your employee’s information. The information you’re going to need to gather from your employees includes their:

Additionally, you’ll need to collect the following forms from your employees for tax purposes:

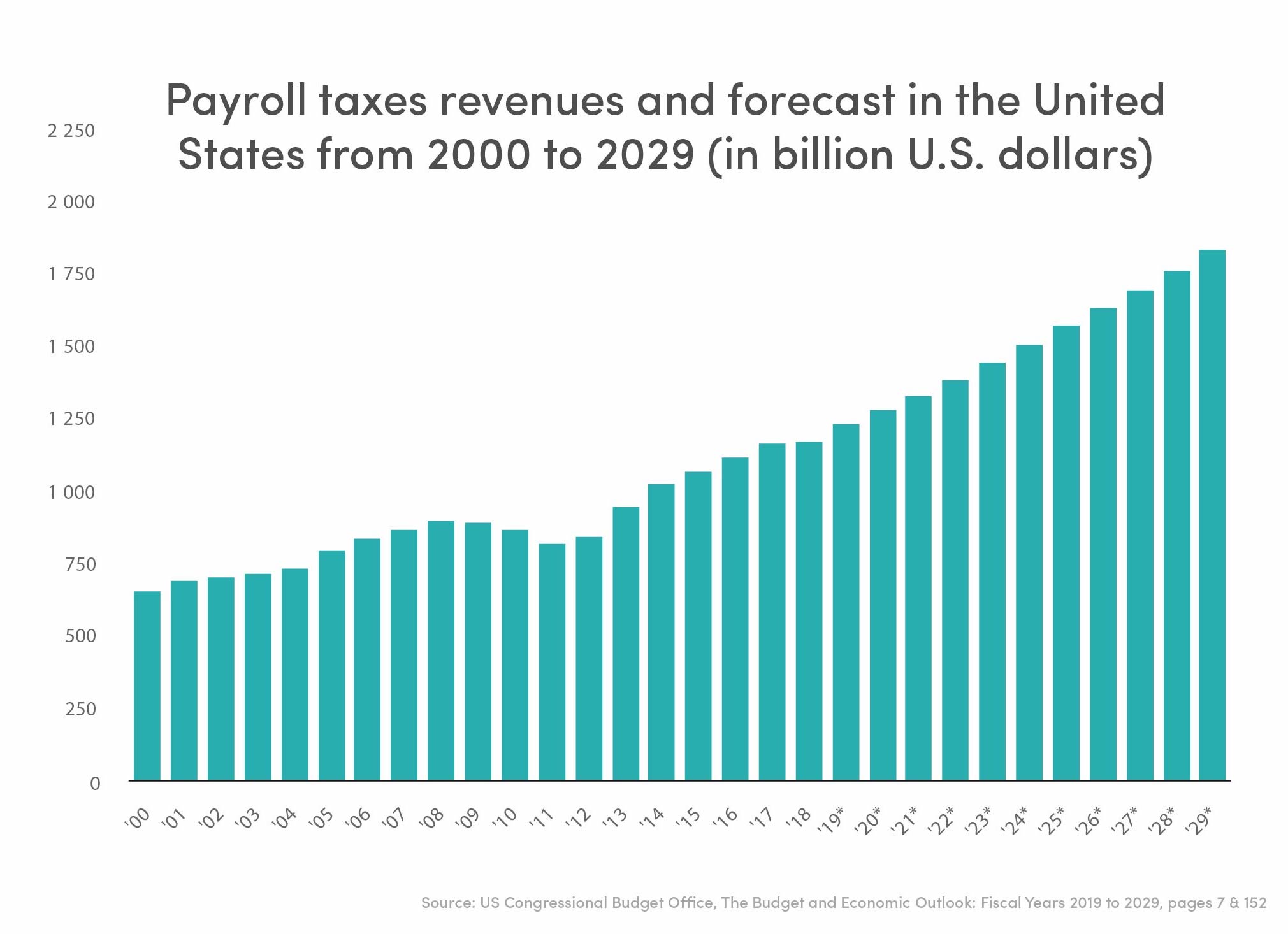

Aside from your employees’ tax forms, you’ll also need to file a variety of tax forms for your business. As a new business owner, investing in small business bookkeeping services will ensure you maximize your tax savings by avoiding liabilities and penalties. When running payroll, you need to ensure your employees and business entity are contributing to Social Security and Medicare taxes. You’ll also need to make sure your business is paying Federal Unemployment Tax. Currently, payroll taxes, mainly put towards Social Security and Medicare Part A, are the second-largest source of revenues, averaging 34 percent of total revenues. This stat shows how important payroll taxes are to contributing to these major federal programs.

To ensure you’re doing your due diligence for the American public, here’s how you can pay these taxes:

If you’re a new employer, you can refer to the IRS’s Employer’s Tax Guide for details on enrollment. You must also deposit federal income tax semiweekly or monthly.

However, there is no wage cap on Medicare taxes like Social Security taxes. So, married filers who earn more than $250,000, married tax filers who file separately and earn more than $125,000, and single filers who earn more than $200,000 are taxed an additional 0.9 percent, bringing the total to 2.35 percent. As the employer, however, you would still only have to pay 1.45 percent in taxes.

Similar to paying Social Security taxes, you can pay your Medicare taxes using the Electronic Federal Tax Payment System.

The next step for how to do payroll requires just a few more tax forms. When you begin to set up payroll, you need to decide on how you’re going to classify your workers. There are three ways to classify your workers, which includes:

Full-time employees are considered direct hire employees, which means they work for you under your supervision. With full-time employees, you (the employer) will have to complete and issue each employee IRS Form W2. On this form, you report wages paid to an employee and how much money you withheld from their paychecks for tax purposes.

Part-time or seasonal employees are also considered direct hire employees because they work for you under your supervision. The only difference is that part-time employees classify as workers who work less than 35 hours a week, as opposed to full-time workers who work 40 hours a week. Part-time employees will also receive IRS Form W2 at the end of the year. Employees will use their W2 form when filling out IRS Form 1040 to complete their personal federal income tax returns.

An independent contractor is a person or business that provides services under a written or verbal contract but are not under your direct supervision. For example, if you’re starting a new business, you may hire a web developer to start up your online store. In the previous section where we talked about IRS Form W-9, we mention you will need it to complete IRS Form 1099-MISC.

If you hire contract employees, you will give them, as well as the IRS, a 1099-MISC Form if you pay them more than $600 during the year. Form 1099-MISC reports miscellaneous earnings, such as from rent, prizes, awards, and royalties. However, it is most popular for payments that were made in lieu of dividends, which applies to contract workers. On the form, the amount of earning will appear as nonemployee compensation.

Because independent contractors are considered self-employed, they are responsible for paying the taxes they owe at the end of the year. When it comes to paying independent contractors, you can decide how to pay their gross wages based on your agreement. For example, you can pay them for hours worked, when they reach certain stages in the project, or at the end of the project.

Now that all that tax stuff is out of the way, it’s time to get to the fun part! The next step in learning how to set up payroll is deciding how you want to pay your employees. These options include:

If you have employees who are going to work different hours week by week, it’s best to pay them hourly. For example, if you only need an employee for 15 hours one week, and 33 hours the next week, an hourly pay will suit this schedule best. Hourly workers typically classify as “non-exempt.” Non-exempt is a legal term that means hourly workers are allowed to work overtime and get paid for it. Overtime is when a worker logs in more than 40 hours a week, and the employer pays time and a half, which is 1.5 times the employee’s regular hourly rate.

If you expect to hire employees who work the same number of hours, week by week, it’s best to give them a salary. Both part-time and full-time workers can be paid a salary. So, whether you hire someone to work 15, 23, 32, or 40 hours a week, they can all be paid a salary if their hours stay the same.

With a salary, there’s no hour-by-hour pay standard. Instead, an employer will create a fixed regular payment that is expressed as a yearly total. For example, a salaried employee can have an annual income of $60,000. With 52 weeks in a year, this employee will earn roughly $1,153 every week before taxes and other withholdings are subtracted.

The difference between salaried employees and hourly employees is their exemption status. Whereas non-exempt hourly employees are subject to overtime pay, salaried employees are not. Salaried employees are typically exempt unless stated otherwise, and cannot receive overtime pay if they decide to work more than 40 hours a week.

Another popular form of payment is commission. Employees who receive a commission typically receive a low-paying salary but make increased profits based on the number of sales they make. Commissioned employees are usually sales staff. For example, most car dealers receive a base salary but earn a commission for the number of car sales they make.

As you decide on how you’re going to pay your employees, it’s important to keep in mind minimum wage laws. Whether you decide on hourly, salary, or commission, all employees must earn the federal minimum wage, which is set at $7.25 an hour. However, some states and even cities have established their own minimum wages, reaching up to $15 an hour. Some states may also establish different minimum wages for specific employees, such as waitresses or barbers, who receive tips.

So, verify your state and local laws to ensure you’re complying with regulations and paying your employees their deserved amount. You can check your state’s minimum wage laws on the Department of Justice Website here.

Once you’ve decided how you plan on paying your employees, it’s time to choose when to pay them. This step in learning how to set up payroll is important because you must comply with the Federal Labor Standards Act and state payday requirements for when and how you pay employees. Typically, employees must be paid on a regular cycle or pay date within seven to thirty days from when they worked and earned their pay. Here are your pay period options:

For businesses with part-time or entry-level workers, such as retail stores and restaurants, it common to pay employees each week. This is because these employees are more prone to working overtime, so a weekly pay schedule will allow you to determine if an employee worked more than 40 hours. This also means you will run your payroll 52 times a year, which can become costly if your payroll service provider chargers per payroll run.

A biweekly payroll is the most common method of payroll because it reduces the number of payroll runs to 26 times per year. However, this means employees must be aware they have to budget their expenses, so they don’t run out of money before the next pay cycle. A biweekly payroll is typically used by entities that hire professional staff who are exempt from overtime pay and receive a salary.

Bimonthly is similar to biweekly, but instead of getting paid for 26 weeks throughout the year, employees will get paid 24 weeks throughout the year. This is because the payroll will only run twice a month, usually on the 1st and 16th of each month. Employers will either calculate the number of hours an employee worked between pay cycles, or if they’re salaried, divide their annual salary by 24.

Governmental agencies and large corporations who have all-salaried exempt staff usually set up a monthly payroll. While this is the most straightforward form of payment for these types of businesses and agencies, it’s not preferred by employees because they will have to wait 28-31 days between paychecks. This means employees must budget wisely and efficiently to avoid spending too much money at the beginning of the month.

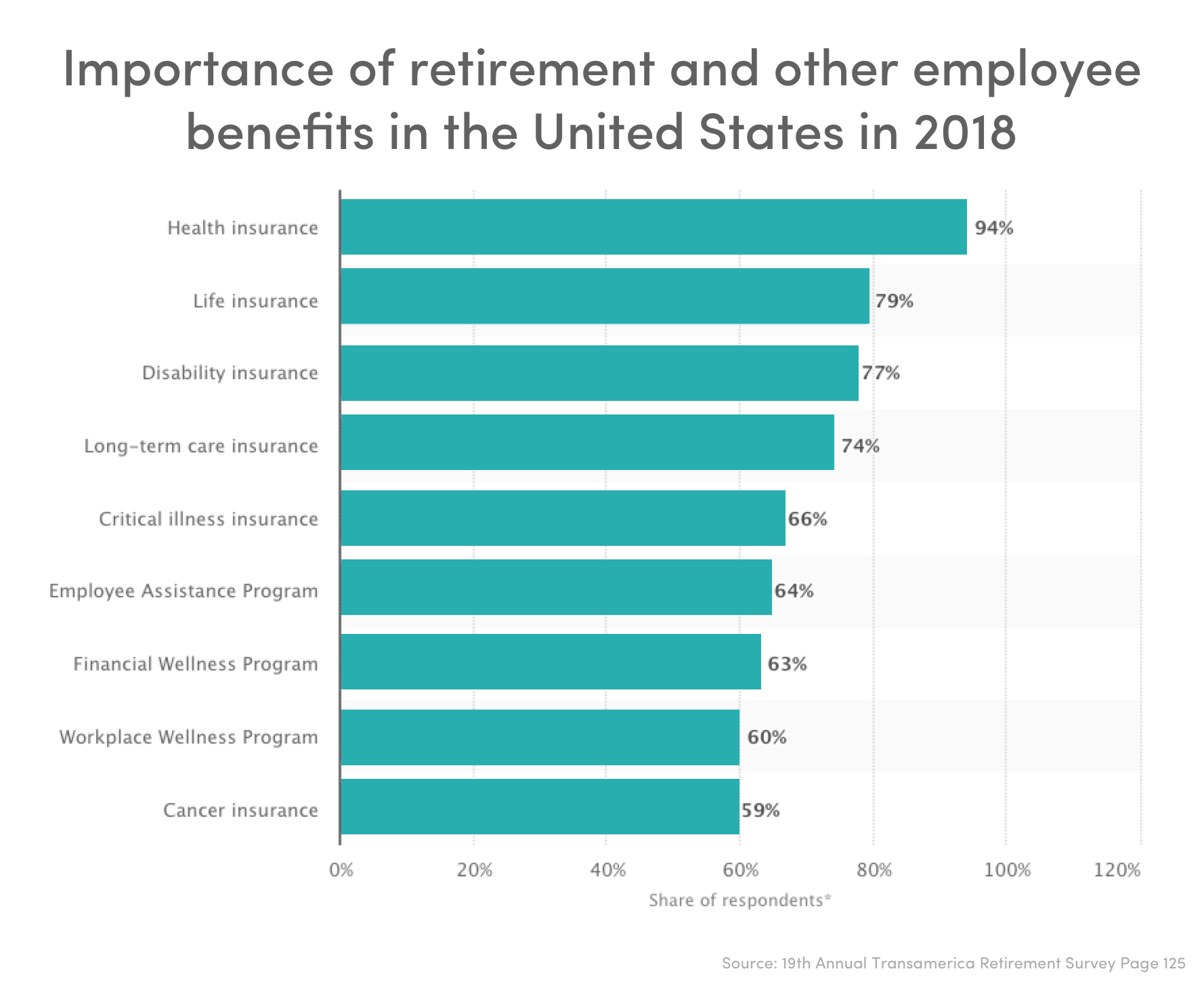

As an employer, you’re not required to offer employee benefits, such as paid-time-off and commuting benefits. However, if you do, you’re more likely to retain employees, have increased employee satisfaction, and an overall enhanced workplace environment. The 2019 Job Seeker Nation Study found that the main benefits U.S. job seekers expect from employers in 2019 include healthcare (72 percent), 401(k) program (52 percent), 401(k) matching (42 percent), and parental leave (30 percent), just to name a few.

Some of the most popular benefits you should decide on when setting up payroll include:

You made it! Hopefully, these small business accounting tips have served you well so far as you embark on the final step of learning how to do payroll. The last piece to the payroll puzzle is determining how you want to set up your payroll. Setting up payroll can take a few forms, from doing it by hand to hiring a payroll professional. Take a look at the various ways you can set up payroll below.

If you want to go the old-fashioned route, you can do your payroll by hand. If you’re wondering how to do payroll manually, all you need is a payroll calculator and an accounting system, such as QuickBooks payroll, and you can calculate it all on your own. However, if you have more employees, it will take more time, pulling you away from your customers, products, and business. There’s also more room for error, which can lead to disgruntled employees and even legal consequences. Knowing how to do payroll manually correctly and efficiently is important as a new business owner to ensure everything goes smoothly during each pay cycle.

Another option for payroll is using specialized software, such as Square Payroll, Gusto, or QuickBooks Payroll. Using a proven software will give you the tools you need to run your payroll while saving you time and headaches. Using a payroll software that’s labor law-complaint will help you calculate overtime correctly, and process both contracted employees, hourly employees, and salaried employees.

If you want to outsource all of your payroll duties, you can use online payroll services, such as those offered by FinancePal. An online payroll service can speed up your payroll process by:

The last option, which is also the most expensive, is hiring a professional service organization to run your payroll. These companies will manage all of your HR needs, from benefits and payroll, down to employee onboarding and providing labor law posters.

Now that you know how to start payroll, it’s time to get started and hire your first employee! Learning how to do payroll as a new business owner is hard work—from obtaining an Employer Identification Number all the way down to choosing how to set up payroll takes a lot of thought and consideration. With this “how-to” guide on setting up payroll, you’ll be able to streamline your business operations so you can keep your employees satisfied with an accurate and timely paycheck.

Don’t want to undertake this admittedly large task on your own? You don’t have to! Speak with an expert at FinancePal to find out how we can help you make setting up and running your payroll as easy as possible.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.