Written by: nablasol

GAAP and IFRS are two different sets of accounting and reporting principles that apply to businesses. Learn more about the differences between GAAP vs. IFRS and how each works.

Ubiquitous in the worlds of business and finance, GAAP is an acronym for Generally Accepted Accounting Principles. GAAP refers to a common set of accounting standards, principles, and procedures issued by the Financial Accounting Standards Board (FASB). An external audit usually determines GAAP compliance.

GAAP is sometimes qualified as the U.S. Generally Accepted Accounting Principles in international dealings since it sees primary use within the United States. While businesses with under $5 million in yearly revenue are not required to follow GAAP, many do. However, those that do bring in $5 million or more per year must follow the GAAP guidelines to avoid possible fees, fines, and even criminal charges.

Regardless of revenue, the Securities and Exchange Commission (SEC) mandates that all publicly-traded companies adhere to GAAP. While not required by law for non-publicly traded companies bringing in less than $5 million annually, GAAP compliance is still critical for cultivating a favorable perception from creditors and lenders. Most banks and financial institutions require GAAP-compliant financial statements when issuing business loans.

GAAP is comprised of ten core tenets or principles. While GAAP may apply differently depending on whether a business uses cash vs. accrual accounting, the general principles remain the same. These principles are:

IFRS, which stands for International Financial Reporting Standards, are principle-based reporting guidelines primarily utilized outside of the United States — in fact, more than 144 nations have committed to using IFRS. The IFRS are administered by the IASB or International Accounting Standards Board.

With business dealings being notoriously opaque in the past, IFRS was explicitly designed to prioritize transparency for the sake of lenders and investors alike. The IFRS contains detailed instructions for record-keeping and financial reporting alongside guidelines for universal accounting practices.

IFRS contains guidelines for creating five mandatory financial statements:

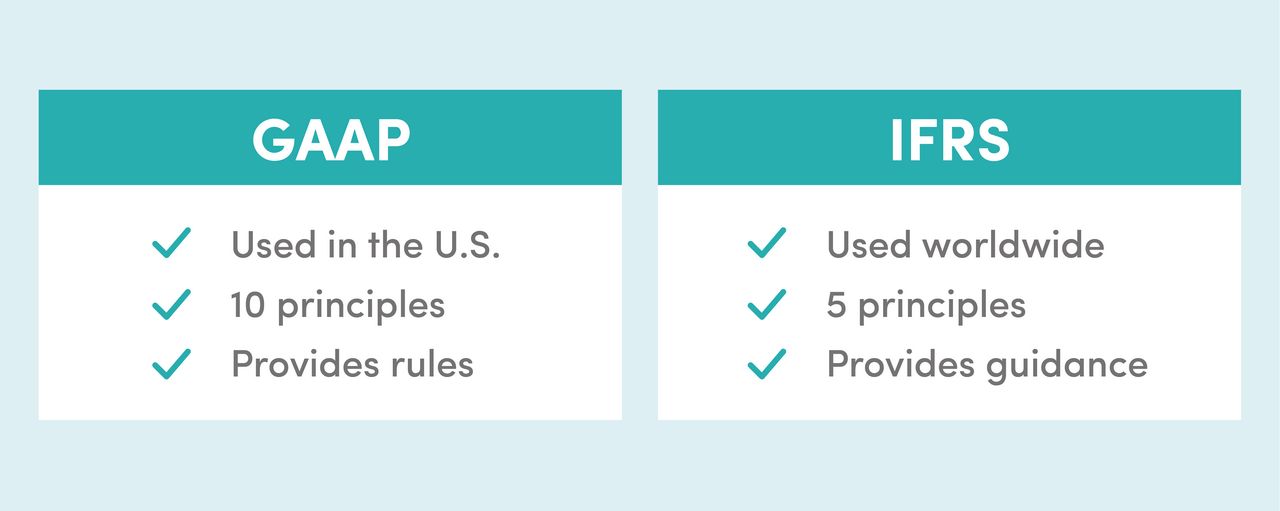

As previously mentioned, the most notable difference between the two standards is their scope; while GAAP is primarily prevalent only in the United States, IFRS is used worldwide. This may change in the future — the SEC has been coaxing an American shift to the IFRS for some time now — but many American businesses do not see this transition as a priority.

Another significant difference is that while GAAP seeks to enforce rules, IFRS is guided by principles. This becomes apparent in each standard’s language — while GAAP is rather particular, IFRS provides a more general overview of its tenets. As a result, IFRS does allow some room for interpretation. However, many experts consider IFRS to be more effective and representative of applicable business reporting, likely due to its inherent logic.

Another primary difference is IFRS’s treatment of “intangible assets” — assets that, while not physical in nature, help a business’s bottom line. Common examples of intangible assets are concepts like brand recognition, brand goodwill, and intellectual property. Whereas GAAP does not provide guidelines for reporting intangible assets, IFRS very much does.

When running a small business, a highly competent financial team can provide essential business insights, find crucial tax savings, and allow business owners to spend less time stressing the financials and more time serving customers. Sign up to get a custom quote today for FinancePal’s professional financial services.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.