Written by: Jacob Dayan

As a small business owner, one of the many important financial decisions you’ll make is whether to use cash vs. accrual basis accounting. For many business owners, this can be a roadblock when getting started. Whether you’re unaware of what the difference between these two accounting methods even is or just need more background on how they work, we have you covered.

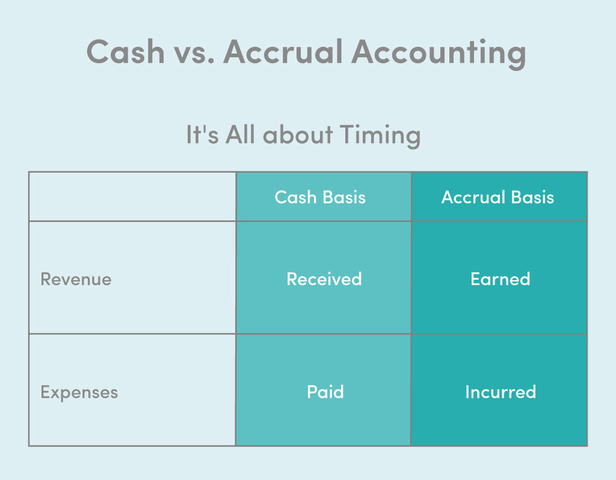

Put simply, the difference between accrual vs. cash basis accounting comes down to the timing of transaction recording. In accrual basis accounting, transactions are recorded as soon as an exchange is initiated. However, in cash basis accounting, transactions aren’t recorded until money is sent or received.

While making accounting decisions with little to no financial experience might seem overwhelming, we’ve created this guide on cash vs. accrual accounting for small business owners to simplify the choice.

If you’re unfamiliar with these concepts, we highly recommend taking a deep dive into this article. But, if you’re short on time and have a specific question you need answered, use these links to navigate to the section you need:

What’s the Difference Between Cash Basis and Accrual Basis Accounting?

Should Small Businesses Use Cash or Accrual Accounting?

Which Accounting Method Is Better, Cash or Accrual?

Can You Switch from Cash to Accrual?

How Can FinancePal Help Your Business with Accounting?

Move Forward with the Right Accounting Method for Your Business

The difference between cash basis and accrual basis accounting is when transactions are recorded:

When choosing an accounting method for your business, you will need to carefully consider the pros and cons of accrual vs. cash basis accounting, which we’ll cover shortly.

But first, let’s go through a quick example comparing how the same transaction would be recording using the two different methods:

Say your business was contracted for a job on February 1st, in which the client is quoted $5,000. Of that $5,000, $3,500 is the cost of labor and materials to complete the job. Based on that, your business’s profit will be $1,500. The client pays for the work on March 1st.

But what does it mean to “record a transaction”? Since this is a core concept for understanding how these two methods of accounting work, we should take a moment to explain.

An accounting transaction is any business activity that has a financial impact on your operations. Every transaction is recorded as part of the accounting cycle in order to keep track of your business’s financial standing.

Typically, a bookkeeper will be responsible for analyzing and recording transactions, as well as all the other steps necessary to manage your books. Bookkeeping is an essential function of your business in order to generate financial statements for each period.

Note: If you need to back up even further and figure out the difference between bookkeeping vs. accounting, we have a guide for that. As the small business financial experts, we’re here to make it easy on you.

Now, let’s break down each of these accounting methods into more detail…

In cash basis accounting, transactions are recorded when money is spent or received. This means that when using cash basis accounting, money paid is only recorded when it leaves your bank account and money received for goods or services is only recorded once it is in your bank account.

In other words, cash basis accounting records transactions when money officially changes hands.

Cash basis accounting is usually used for managing personal finances. For instance, it’s the method you’d use to balance your checkbook.

To drive this concept home, let’s take a look at some real-world examples:

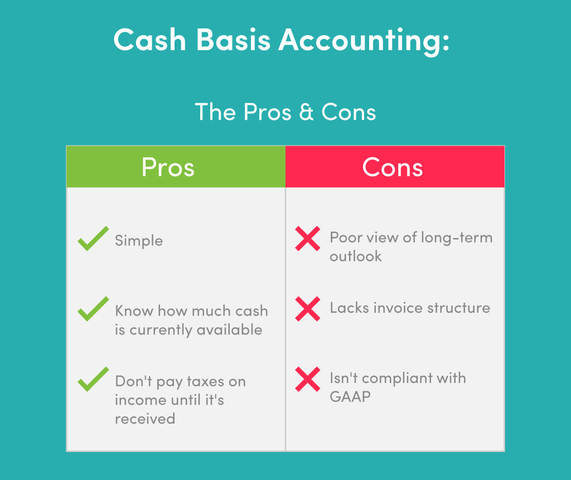

The benefits of using cash accrual accounting include:

Another way that cash basis accounting can benefit small business owners is on their tax bill. To lower your current year’s tax payments, you could request that clients hold off on making payments until the beginning of the year.

However, there are also disadvantages to the cash accrual method:

With cash basis accounting you’ll have a good view of actual cash flow, but you won’t have an accurate report of your sales and inventory. This means more time digging into the numbers when you need a sharper picture of the details. This is because you’ve recorded purchases made using credit (the money has not yet come out of the account) or because you’ve extended credit to your customers that has not yet been paid for.

In accrual basis accounting, transactions are recorded when money is earned or an expense is incurred — not when the money is actually exchanged. Another way to think about it is that transactions are recorded as soon as there is a legal obligation to pay.

Basically, transactions are recorded based on the assumption that they will get paid.

When using accrual basis accounting, accounts receivable and accounts payable are used to record these transactions.

For clarity, let’s take a look at a few real-world examples:

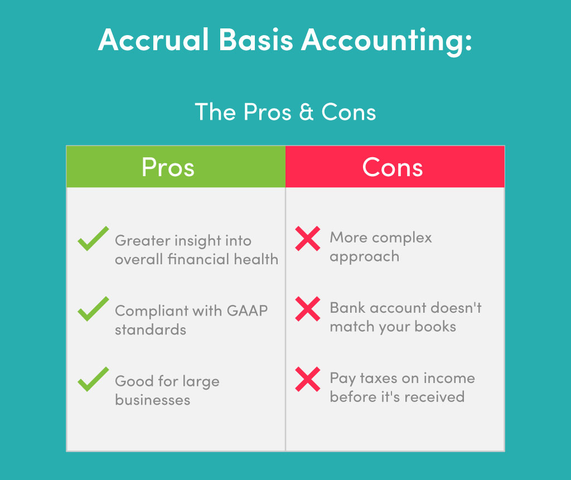

Accrual basis accounting has its own advantages:

Because they are able to get better financial overview of your company, investors typically prefer this method.

Like cash basis accounting, there are also disadvantages to this method.

The disadvantages of accrual basis accounting include:

When using accrual basis accounting, you could end up with a significant amount of revenue but very little cash on hand if clients take a long time to pay you.

To counterbalance this potential challenge, you want to be more diligent about monitoring your cash flow. Reviewing the cash you have on hand on a weekly basis should be sufficient to help you avoid that trouble, though.

Note: For other tips on how to properly manage cash flow, or correct course, read our comprehensive guide to small business cash flow.

Cash vs. accrual accounting have pretty significant differences. With their clearly defined advantages and disadvantages, it should be fairly easy to determine which is better suited for your business.

Trying to decide between cash vs. accrual for your small business accounting? Typically, smaller businesses use cash basis accounting, and larger businesses prefer accrual basis. Here are some further factors to consider when trying to choose between cash vs. accrual:

However, every business is different. What might be right for one small business doesn’t necessarily mean it’s the right solution for yours. Certain businesses have very simple finances which might be well-suited for the cash basis accounting method.

At the end of the day, accrual accounting will demand more from business owners. The more transactions you need to keep up with, the more time it will demand from your already busy schedule. This is why it is typically recommended that you work with an accountant once your business begins to grow.

It’s important to know that if, or when, your business reaches $5 million in annual revenue, you will be required to use the accrual method. If you’ve reported revenue below $5 million for the last three years, you’re okay to use cash basis accounting if you want to.

This requirement is based on the Generally Accepted Accounting Principles (GAAP) set forth by the Financial Accounting Standards Board (FASB). These standards dictate how financial statements are prepared and presented.

Generally speaking, accrual vs. cash basis accounting doesn’t come down to which is necessarily better in an overarching sense, but on a case-by-case basis. For example, even the Congressional Budget Office must decide between which of these accounting methods is the best for different aspects of their budget. During the federal budgeting process, this is done depending on the specific program, not as a blanketed approach.

In some cases, some business owners choose to use a hybrid approach for their accounting. This is possible by using accrual basis accounting for inventory-related transactions and the cash basis accounting for revenue- and expense-related transactions.

If you are going to take the hybrid approach, it’s likely that you’ll need professional help as your books become more complicated. Making sure that every transaction is recorded correctly is essential to your business’s financial health.

So, when it comes down to it, determining whether cash basis or accrual basis accounting is better depends on your business’s unique circumstances.

Yes, you can. You might decide to switch from cash to accrual accounting if:

However, it’s important to note that you’re required to use the same accounting method for an entire tax year. So, if you’re looking to switch from cash to accrual, you’ll need to plan accordingly.

You can also switch your books from accrual to cash basis accounting. This might be the case if the accrual method turns out to be overly complicated for your business’s purposes.

Note: If you do hit the profit threshold, this is where accurate financial statements and forecasting will become especially important. If you believe you’ll hit this revenue in the coming year, you’ll need to start a plan to switch over your accounting method.

Whether switching accounting methods is difficult depends on your experience and understanding of bookkeeping and accounting.

To make it easier on you, we’ve laid out the general process for switching accounting methods below:

A few steps are required to make this transition:

Looks like a lot, doesn’t it? Luckily, you don’t have to figure it all out on your own. In fact, FinancePal can handle your business’s accounting for you.

Find out why so many small businesses choose FinancePal to handle their bookkeeping, accounting, and more…

Working with FinancePal means that you have a team of experts helping you tackle your business’s accounting. Here’s how you can benefit from turning over your accounting to FinancePal:

As you can see, our mission is to make managing your business’s finances as simple as possible. By using FinancePal, you’ll save time that can be invested in other critical aspects of running and growing your business. This can prove invaluable, especially in the early years of your business.

Our goal is to make high-quality financial assistance accessible to small business owners on all budgets. While your first instinct might be that you can’t afford to hire help with accounting, FinancePal has a tiered pricing system starting at just $99 per month.

In addition to small business accounting, FinancePal provides entity formation, payroll solutions, sales and use tax consulting, and bookkeeping services for small businesses. We’re your one-stop-shop for small business financial management — and we make it simple.

Still unsure whether you should use cash or accrual accounting for your small business? Why spend time worrying when your business could be backed by FinancePal? Our experts can help you figure out how to move forward with your small business accounting.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.