Written by: Jacob Dayan

So, you’ve earned a coveted government contract and now you find out that you have to file something called certified payroll. You likely have a lot of questions, primarily “what is certified payroll?” and “how do I report certified payroll?” Don’t worry—we’re here to provide the answers you need.

Certified payroll is a subcategory of a contractor’s payroll responsibilities. Certified payroll must be filed by companies, typically contractors, who are working on government-contracted projects. While it might sound like your general payroll process, it’s actually a bit more complicated as there are specific wages that need to be paid and a weekly form submittal process you need to adhere to.

But don’t worry, you can use this guide to better understand your certified payroll obligations. That way, you can ensure that you remain in compliance, pay your workers fair wages, and set yourself up for success when dealing with future government-funded projects. If you’re just now being introduced to the concept of certified payroll, read this guide from start to finish; or go straight to specific questions you have by using the links below:

Certified payroll is a weekly payroll report that a company must submit for federally funded (or assisted) projects, such as government-contracted work and public works projects that are over $2,000. Employers are required to submit certified payroll on behalf of all employees who work on these types of projects. A certified payroll report includes:

Certified payroll is one aspect of construction accounting that can be especially confusing for small business owners. To help you gain a better understanding of this concept, we’ll dive deeper into the basics of certified payroll.

Certified payroll is required as a means of providing government entities with a detailed breakdown of the work completed and pay provided to employees. This is done to ensure that contractors are paying their employees the local prevailing wage.

The prevailing wage was instituted to protect workers by ensuring they are being compensated fairly and at a rate similar to what they would be paid for similar work. A variety of factors determine the prevailing wage, with the two most important being location (specifically, the county where the work is being completed) and type of work (pay should be comparable to that of similar jobs). As such, the prevailing wage often varies from county to county.

Davis-Bacon Act and Related Acts established labor fairness legislation, which included the prevailing wage system and certified payroll. Prevailing wage is the hourly pay rate that is used to complete certified payroll.

Certified payroll is calculated based on the prevailing wage, which is considered the standard rate for a government contract in that county. To determine the prevailing wage, the following factors (based on local norms) are considered:

Once you have calculated the proper wages, you will need to subtract any deductions, such as union deductions and state and federal taxes, which will give you the net pay for that employee. Repeat this process for each employee when completing certified payroll for that week of the project (reminder: certified payroll is reported on a weekly basis).

Setting up payroll is a common challenge for small businesses, and this process only becomes more complex if you have to figure certified payroll on top of that. Don’t fret if you feel in over your head—we’ll break down how to report certified payroll, so you can complete this essential process and make sure you’re in compliance when working on government projects.

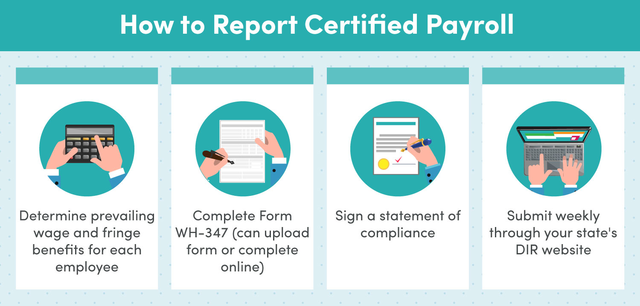

Here are some guidelines to follow when reporting certified payroll:

In addition to these specific DIR certified payroll details, you’ll need to include basic payroll information like workers’ social security numbers, contractor name (your company’s details), and payroll period.

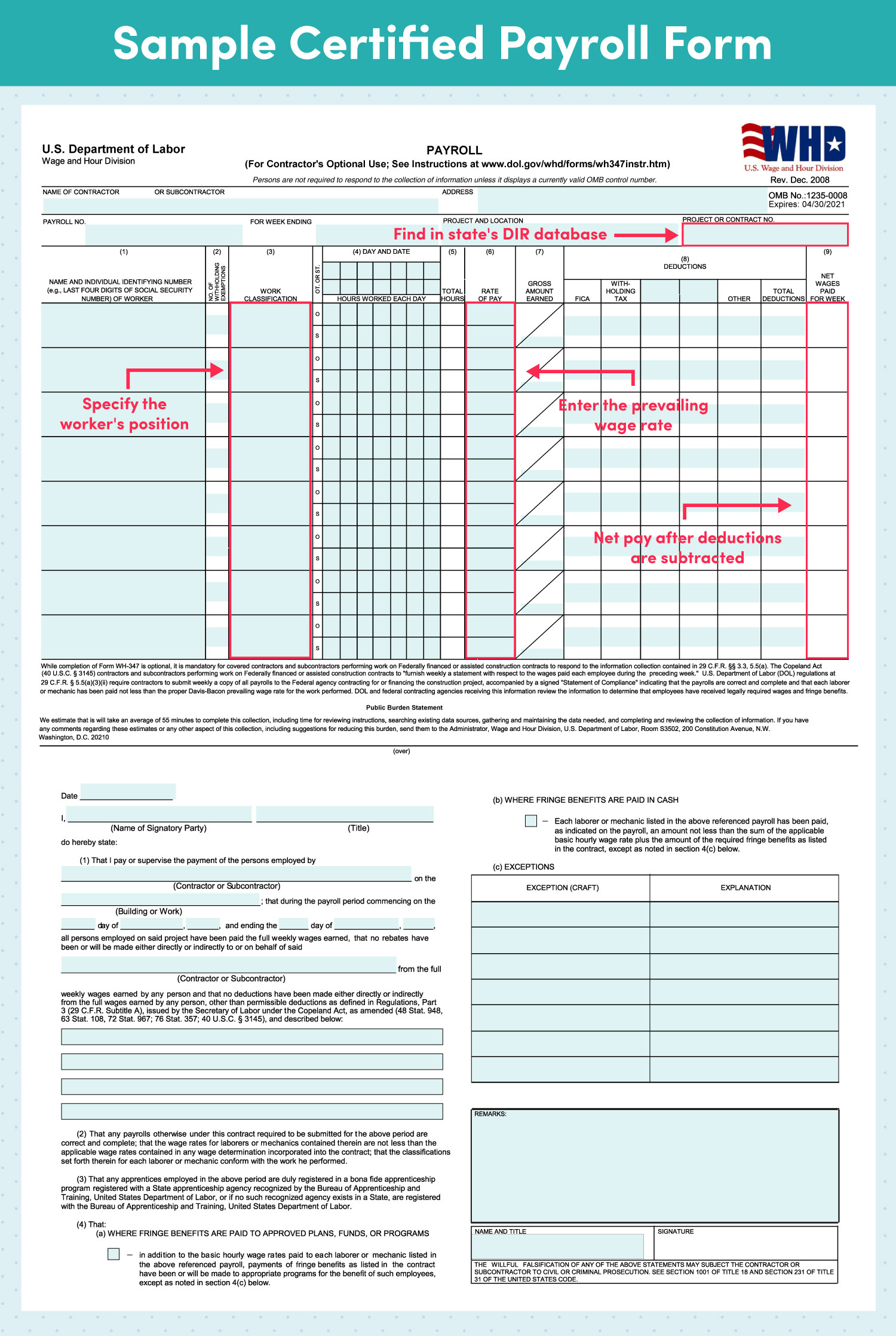

Here is an example of what the certified payroll report, known as Form WH-347:

As you can see, once you have a grasp of the basic components of certified payroll, it’s fairly straightforward to complete the form for each of the employees who are working on the project.

You will need to submit certified payroll reports to the Labor Commissioner using the DIR’s (Department of Industrial Relations) online system. You can either upload the completed WH-347 form or you can fill it out digitally and submit it through their system.

You will need to hold onto certified payroll records for three years. For more guidance on retaining certified payroll records for federal projects, refer to the code for Contractor Records Retention.

When working on government-related projects, employees may be paid in wages or a combination of wages and fringe benefits. Fringe benefits include anything provided in addition to basic compensation (the prevailing wage workers are paid by the hour).

Fringe benefits can be perks such as healthcare, paid time off, and other traditional workplace benefits, or they can be paid in cash. For construction contracts, this is typically the case. When paying cash fringe benefits, this additional hourly pay is a percentage of the prevailing wage.

In order to calculate fringe benefits, you need to first determine the prevailing wage for the project. Once you have that, you will need to provide workers with a basic hourly wage plus fringe benefits that add up to the required prevailing wage for their position and the county the project is being completed in.

So, together, the cash wages you pay your workers plus fringe benefits provided must add up to the prevailing wage on an hourly basis.

Fringe benefits must be paid on all hours of work.

Apprentices or trainees may be exempt from certified payroll and prevailing wage requirements if they are participating in an apprenticeship program registered with the Department of Labor or with a state apprenticeship agency recognized by the Department of Labor.

Additionally, salaried employees who serve in executive, administrative, or professional positions may also be exempt from certified payroll.

Yes, however, it works a little differently than with your direct employees. This is because each contractor and subcontractor is responsible for submitting their certified payroll records directly to the Labor Commissioner. To comply with this requirement, the subcontractor will complete a certified payroll report and provide it to you. This should then be included with your company’s certified payroll reports in order to properly account for their wages related to the project.

If you’re still feeling confused or overwhelmed, you’re not alone. Even payroll professionals have to earn a specific accreditation to become a Certified Payroll Professional.

Incorrectly processing certified payroll can lead to hefty fines. In fact, if you are found to be purposefully violating the Davis Bacon Act by not paying prevailing wages and submitting certified payroll, your company may face:

We understand that protecting your business’s viability is your top priority (and not to mention every dollar counts for a small construction business), so here are a few reminders to help you avoid making mistakes on certified payroll and remain in compliance:

Keep in mind that if you make mistakes on your certified payroll, you cannot make changes. However, you can submit a new record with the correct information, which will take precedence. Note that you only need to submit updated records for the affected employees; the report for the other employees will stand.

Need more help? You may benefit from our payroll services for small businesses.

Adding any new process to your workflow can be stress-inducing, but growing your business with government-contracted projects is an exciting opportunity. Don’t let the learning curve deter you from taking on these lucrative projects for your firm. Instead, master the process, or get help with your construction payroll and accounting.

FinancePal has helped many contractors just like you streamline workflows, improve their finances, and take their business to the next level. Our financial services are completely customized to your business, so you only pay for what you need. Simplify your payroll and construction finances, get started today!

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.