Hotel and Hospitality Accounting Services

US Based

Experts Available

Dedicated Team

Financial help customized for small businesses.

FinancePal is your one-stop-shop for all your tax and accounting needs

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

At FinancePal, our expert accountants and bookkeepers are committed to providing the hospitality industry’s best service and results. From timely, effective financial statements to audit defense and more, our team of professionals will help guide your hospitality business to financial success.

Hospitality Industry Accounting and Bookkeeping Services:

- Payroll

- Rent roll

- Financial statement preparation

- Accounts payable & receivable

- Inventory statements

- Balance sheets

- Financial statements compliance audits

- Asset and staff management

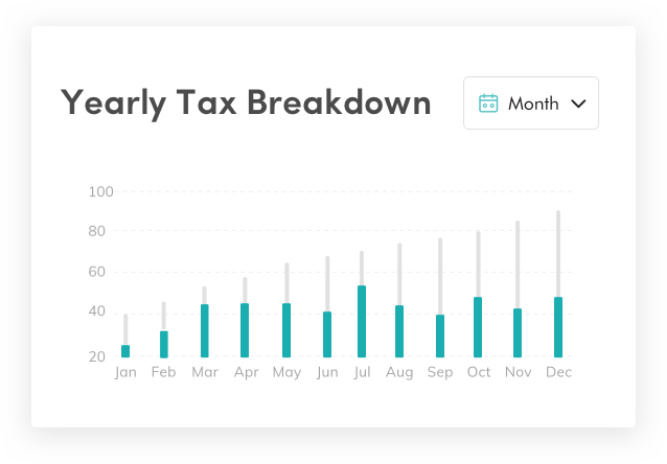

- Tax reconciliation and payment

- Audit defense

- Quarterly Tax Filing

Let us help you grow your hospitality business…

At FinancePal, our experienced hospitality industry accountants know how to maintain compliance with the IRS while adhering to best business practices.

Asset Management

Successful hospitality businesses can maximize each asset’s profitability. To be able to do this, quality real estate accounting is a necessity. Our accountants accurately track the value and performance of each property, providing essential insight to inform business decisions going forward.

The most important asset metrics we track are:

- Cash

- Invoices

- Maintenance and Contractor payments

- Property and Real Estate

- Total net income

Staff Management

If your hotel or hospitality business has employees, they will need to be compensated. This compensation must be meticulously recorded to make payroll filing a breeze. Hospitality staff may be paid in a plethora of ways, including of hourly, salaried, or commission-based compensation. We will impeccably track and report payroll, hours worked, and commissions to make annual payroll tax filing easy.

Audit Defense

Meticulous accounting is imperative to stave off dreaded IRS audits. But even so, the IRS occasionally audits businesses seemingly at random. That is why clear, top-notch accounting will save your hospitality business from heavy fines, penalties, and further inquiries. Our accountants are trained in audit defense and can handle IRS dealings with aplomb.

GAAP-Compliant Hospitality Accounting

FinancePal’s accountants are well versed in GAAP, which stands for Generally Accepted Accounting Principles.

For medium and large-sized hospitality businesses (sales of over $5 million per year), all accounting must follow the Generally Accepted Accounting Principles (GAAP) guidelines to avoid fees, fines, and even criminal charges. GAAP refers to a common set of accounting principles, standards, and procedures issued by the Financial Accounting Standards Board (FASB).

There are ten main principles of GAAP:

- The Principle of Regularity: the adherence to GAAP rules and regulations as a standard. FinancePal’s accountants apply each principle to their work to produce the most honest, consistent, and compliant reporting possible.

- The Principle of Consistency: applying the same standards throughout the reporting process to ensure financial comparability between periods. The accountants at FinancePal’s are professionals and adhere to the same strict standards throughout the accounting cycle.

- The Principle of Sincerity: the provision of an accurate and impartial depiction of a company’s financial situation. At FinancePal, we want nothing more than for your hospitality business to succeed. Accuracy and impartiality are necessary for sound financial statements.

- The Principle of Permanence of Methods: the commitment to using procedures used that are consistent, allowing comparison of the company's financial information.

- The Principle of Non-Compensation: the reporting of both positives and negatives with full transparency and without the expectation of debt compensation.

- The Principle of Prudence: the commitment to using fact-based financial data representation without speculation.

- The Principle of Continuity: the commitment to operating a business while simultaneously valuing assets.

- The Principle of Periodicity: the reporting of revenue during the appropriate accounting period.

- The Principle of Materiality: the commitment to fully disclose all financial data and accounting information in financial reports.

- The Principle of Uberrimae Fidei (utmost good faith): the commitment to honesty in all transactions.

All publicly-traded companies must adhere to GAAP, per the Securities and Exchange Commission (SEC). While not required by law for non-publicly traded companies, it is critical to achieving favorable views from creditors and lenders. Most banks and financial institutions require GAAP-compliant financial statements when issuing business loans.

Accounting Methods in Hospitality

To help serve a wide range of businesses, FinancePal’s professionals are experienced in handling both cash and accrual accounting.

Accrual Method

Most hotels utilize the accrual method of accounting. Small hotels, inns, and bed and breakfasts may use the cash method of accounting, explained later in the next section. In accrual basis accounting, transactions are recorded when money is earned, or an expense is incurred — not when the money is actually exchanged.

Accrual basis accounting can provide a more accurate overall picture of the business’s financial health. This will come in handy when you’re trying to inform financial decisions.

The accrual method accurately tracks inventory and accounts payable and receivable. Additionally, this method is preferred by investors and banks because they can get a better financial overview of your company. If you ever plan on selling your business at any point in the future, the accrual method is necessary for potential buyers to obtain a clear picture of past and future financial health.

The accrual method may fail small businesses, however. When using accrual basis accounting, you could potentially end up with a significant amount of revenue but very little cash on hand. While this is a worst-case scenario and is contingent on payments taking a long time to clear, it can happen — and it can sink small businesses when it does. To counterbalance this potential challenge, you need to be diligent about monitoring your cash flow. FinancePal reviews the cash your business has on hand each week to ensure it is sufficient to help your business avoid that trouble.

Cash Method

Sole proprietorships and small hotel businesses such as bed and breakfasts may use the cash method of accounting. The cash method of accounting records transactions at the time money is spent or received. Cash accounting doesn’t account for credit — the money needs to be on hand (hence the name “cash accounting”). Cash basis accounting gives you a good view of actual cash flow. However, it won’t give you an accurate report of your sales and inventory. It gives you a reliable picture of how much cash you have available and can help you understand your short-term finances. Additionally, the cash method allows you to not pay taxes on income until it is received and on hand.

However, there are some instances in which the cash basis method of accounting comes up short. For example, this method doesn’t have any form of invoicing structure, as there are no accounts receivable or accounts payable to track outstanding bills and payments. Additionally, it can be difficult to project long-term business performance as the cash method can only give a clear picture of the short-term.

In an industry as competitive as the hospitality industry, FinancePal is a trusted provider of accounting and bookkeeping services for hotel businesses. For a free consultation and custom quote, click here.

Who We Work With

We partner with tech-driven industry leaders to bring advanced financial services to businesses like yours. By aligning with these innovators, we’re able to integrate with other business tools and enhance our service offerings. Some of our prestigious partnerships include:

Quickbooks

Hubdoc

QuickBooks Time

ADP

Gusto

Bill.com

Our Services

Accounting & Bookkeeping

Sales Tax Consulting Services

Payroll Services

Entity Formation

Catch-up Bookkeeping

Don't just take our word for it.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Financial help customized for small businesses.

Financepal is your one-stop-shop for all your tax and accounting needs

By entering your phone number and clicking the “Contact Us Today” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.