Tax Preparation Services for Small Businesses

US Based

Experts Available

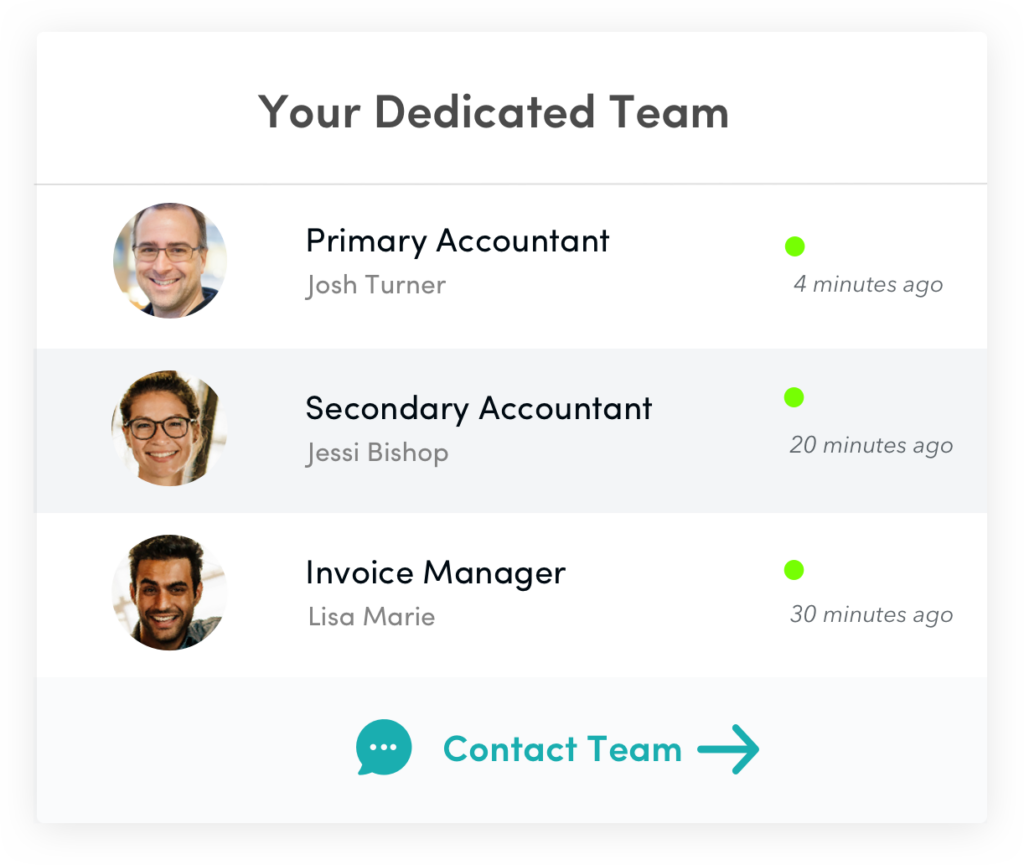

Dedicated Team

Financial help customized for small businesses.

FinancePal is your one-stop-shop for all your tax and accounting needs

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

Our Experts Have It Covered

We’ll evaluate your tax liability based on where you operate and your business structure

Our experts will maximize your tax deductions and credits to help you save money

We’ll file your small business taxes on your behalf, correctly and on-time

By employing our small business tax services, you’ll never have to worry about keeping track of ever-changing tax laws or missing important due dates.

Small Business Tax Preparation Made Easy

- Seasoned tax professionals and tax attorneys who are based in the U.S. and available to assist you at all times

- A dedicated team who knows your business inside and out to ensure they best serve your business’s needs

- A la carte tax services or comprehensive financial services such as virtual bookkeeping, accounting, and payroll

Our Small Business Tax Services Include

Tax Consulting

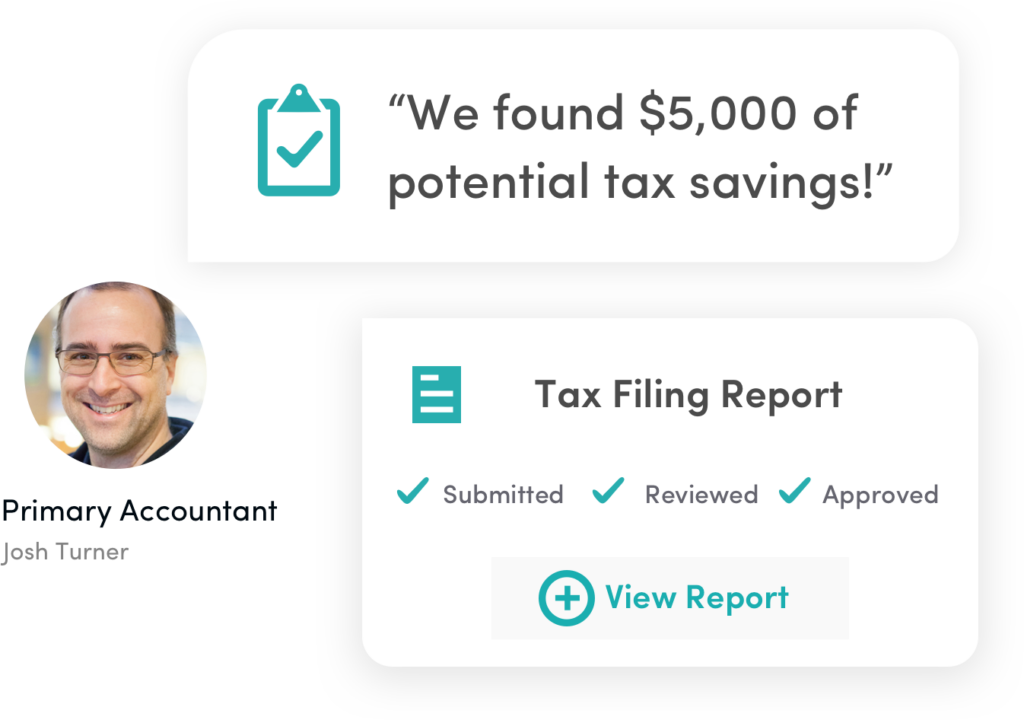

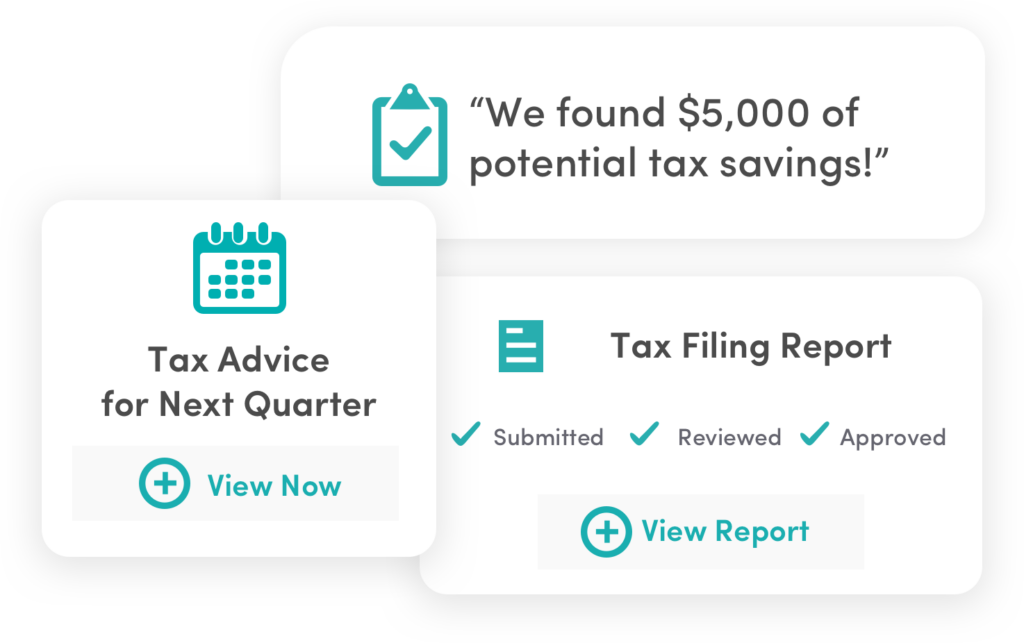

Optimized Tax Savings

Tax Filing

With FinancePal, you can take tax prep off your plate and focus on running your business.

Small Business Tax Preparation Process

With our small business tax services, you have better peace of mind.

Here’s what you can expect from our team:

Consultation

You’ll speak with one of our tax experts to determine where your business is in the tax preparation process and how we can best assist you.

Automated Tracking

You will gain access to our online tools that can track essential tax-related information like sales taxes collected, expenses, etc.

Gathering Documentation

We will collect all documentation necessary for filing. If you’re already using our accounting services, we’ll already have access to much of the information we need.

Tax Filing

Once we have all the information we need about your business, we’ll file on your behalf—ensuring they’re filed correctly and on-time.

Protect your small business

The risks associated with incorrect or late filing simply aren’t worth it when you have an easy, affordable solution at your fingertips. Use FinancePal’s small business tax services to protect you and your business from fines, IRS auditing, or worse. Our tax professionals stay on top of the latest developments in tax law and keep your business in compliance— so you don’t have to.

Benefits of Professional Tax Prep

- Correctly filed taxes

- On-time filing and payment

- Affordable tax assistance

- Cutting-edge financial tools

- Sound tax advice

- Maximum tax savings

- Exceptional customer service

- Better use of your time

- Peace of mind

Our team of tax professionals looks forward to helping you with your small business tax preparation for the easiest tax filing of your career.

Tax Prep You Can Afford

Getting help with your taxes might seem like an unnecessary expense, especially if your business is just taking off, but we assure you, it’s not. We offer affordable small business tax preparation, with pricing catered to your needs. Our tax services are based on the level of help you need, so you’re not paying for services that provide no value. Reliable, professional help at a reasonable price—that’s a worthwhile investment if you ask us.

Services We Offer

Need help with more than just your taxes? Don’t sweat it.

We’re a one-stop shop for your small business’s financial needs:

Accounting

Bookkeeping

Tax Preparation

Payroll

Catch-up Bookkeeping

Frequently Asked Questions

1. You’ll need to determine when your taxes and payments are due.

2. Get your tax information in order. Before filing taxes—whether you do it yourself or have a tax professional do it for you—you should gather all the supporting documentation you’ll need to fill out the required tax forms.

3. Once you’ve filled out your tax forms, you’ll need to submit them to the IRS for federal taxes and your state’s regulatory body for state taxes.

Throughout the year, you’ll also need to make sure you pay your estimated quarterly taxes. If all of this sounds like a foreign language to you, our tax professionals can help you understand and make sure your business is in compliance.

Depending on your business entity, more information may be needed. During your consultation, a member of our team can help you determine what’s needed to file your taxes.

Don't just take our word for it.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Financial help customized for small businesses.

Financepal is your one-stop-shop for all your tax and accounting needs