Written by: Nick Charveron Nick

Understanding the financial position of your business is an essential task for any small business owner. This includes keeping tabs on the status of your cash flow, which is how money moves in and out of your business. You always want a positive cash flow, meaning incoming cash flow (revenue and income) is greater than your outgoing cash flow (expenses).

Maintaining a positive cash flow is critical to your company’s long term success, as is securing investors, accurately forecasting and setting benchmarks, and being able to sustain growth. However, many small business owners cite cash flow management as one of their biggest challenges. This is due to a variety of factors, ranging from not being familiar with accounting and bookkeeping to simply not having the time to dedicate to the task.

To learn more about the importance of steady cash flow and how to effectively manage it, read our complete guide to small business cash flow. You can also use these shortcuts to get help with specific aspects:

Cash flow is how money moves through your business via incoming or outgoing cash. Before we get any further into the intricacies of small business cash flow, let’s quickly define what we mean by “cash”, so that you have a clear understanding of which assets are included:

Cash is all of the available cash your business has as well as any cash equivalents, or assets that can be quickly converted into cash. Cash is referred to as either ingoing or outgoing.

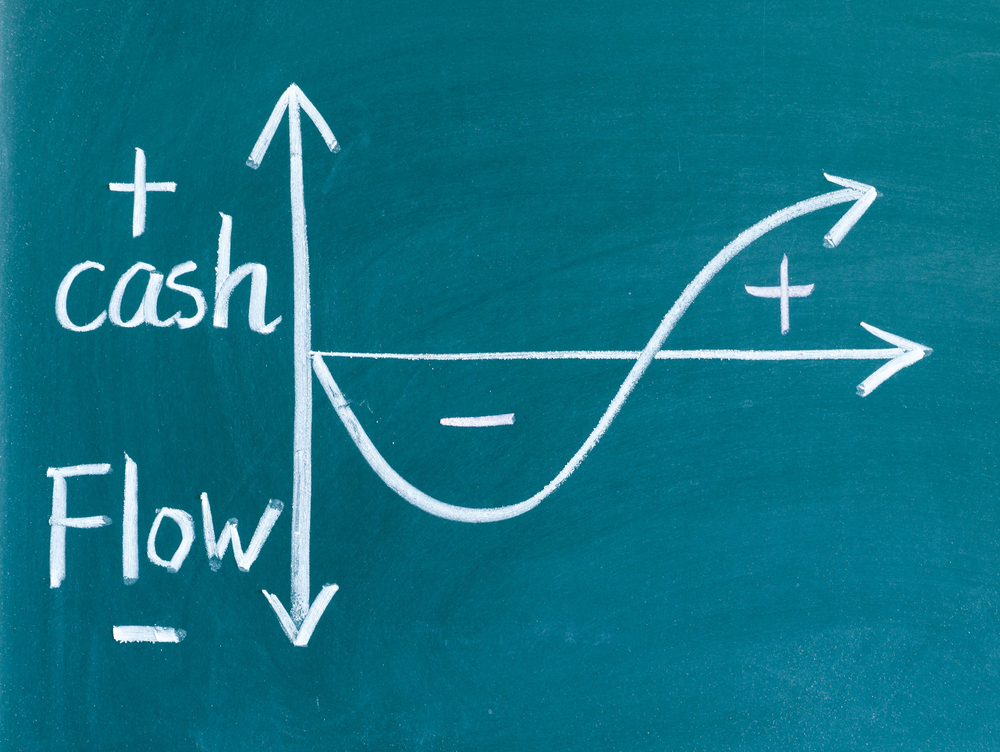

Your small business’s cash flow can either be positive or negative. What exactly does that mean?

The status of cash flow can be determined as follows:

As such, accurate bookkeeping, and in turn, precise financial reporting, play a critical role in having an understanding of cash flow.

Small business cash flow management can be complicated, especially for those just starting out. However, one of your main business objectives should be generating a positive cash flow because it is more or less the fuel that allows your business to continue operating.

Having a positive cash flow means that your business will be better prepared for times of economic distress, such as another recession. Small business cash flow management is critical to any entity’s success because it allows you to:

Additionally, healthy cash flow is important to investors. It is one of the factors they will consider when determining whether your company is a solid investment. Being able to secure investors will be critical to growing your business so you want to make sure your finances are in order.

If you’re not confident in your ability to keep track of your outgoing and incoming cash, that’s okay. FinancePal specializes in small business bookkeeping so you don’t have to. We’ll even provide you with financial statements for review so you always know where your business stands.

Experiencing cash flow problems at any point in your business’s operation can be more detrimental to its overall financial health than seeing losses month after month. In fact, according to a study by U.S. Bank, poor management of cash flow causes 82% of small businesses to fail.

So what factors affect your business’s cash flow? There are many, but several of the most important include:

A lot of small businesses run into cash flow issues when these factors stack up because they are trying to grow too quickly. Without proper financial planning, these aspects of your business can get out of hand.

Here are some of the most common small business cash flow problems:

While cash flows are unique to each business, it is important to understand the basics and how to analyze your small business’s cash flow to improve your business’s cash flow management.

Just because you’re profitable doesn’t mean your business is not in danger of cash flow problems. Even if you are seeing profits month-over-month on your sales, you have to wait until you actually have that income in cash for it to reflect as actual cash flow.

This brings us back to the concept of accounts receivable. If the majority of your profits are attributed to still unpaid invoices, you can’t count it toward your cash flow.

Depending on the type of business you run, and even your location, your cash flow may be subject to seasonality. You should factor in seasonality when trying to optimize your cash flow if:

You will need to keep these factors in mind when managing how you handle hiring, spending, operating hours, and more. Some seasonal businesses find it beneficial to only operate certain times of the year or find opportunities to expand their offerings so they are less affected by seasonality.

To gain insight into the cash flow of your business, you need to analyze the factors that impact it. By reviewing each of these factors, you’ll be able to determine areas that are negatively impacting your business and focus your energy on improving your cash flow management by tackling those issues.

A quick way to identify a cash flow problem is to compare the upcoming expenditures you have against the total sales that will be closed out and paid for by customers. A cash flow problem will be obvious if you will owe more than you’ll have coming in. For a more in-depth analysis, you will need a statement of cash flows that will show all of your business’s transactions.

With a detailed layout of your expenses and income, you will be able to improve your small business’s cash flow management by identifying which periods may be a stretch and prepare ahead of time. You should set aside cash for slow periods or seasons where you will not be bringing in sufficient income to meet the demands of expenses.

The statement of cash flows divides cash activities into three categories:

By evaluating these three categories, you will have a better understanding of your business’s cash flow. It’s important to note that a positive sum means that there was an overall increase in cash, while a sum in parentheses denotes a decrease in cash.

Near the bottom of the statement of cash flows, you will find the overall increase or decrease of all three of these activities combined, labeled as the net increase/decrease in cash and cash equivalents. This line item will show the overall change in your small business’s cash flow during the period.

It’s important to keep two things in mind when using your statement of cash flows to make predictions and decisions about your business:

That being said, it is a useful tool you can use to help you determine whether you have the cash on hand to pay your expenses.

Cash flow issues in business aren’t necessarily tied to businesses of certain sizes, but smaller businesses can lack the resources for adequate financial management, especially in the first few years. As such, many small businesses are affected more drastically.

However, you can prevent your business from becoming a statistic by taking action to address cash flow problems—or even avoid them completely—with these top five small business cash flow management tips:

Implementing all five of these initiatives can help you turn your cash flow around.

If you’ve found that your cash flow situation does not look like it is going to turn around quickly, you may want to consider financing options. Securing financing can help you turn your cash flow positive almost immediately.

There are many different types of small business loans; if you are considering a loan to help with cash flow issues, shop around for the best loan terms you can find. You’d be surprised what a big difference lower interest rates can make.

However, it is important to keep in mind that you will have to pay off the loan or credit, plus interest. While financing isn’t the ideal way to resolve cash flow issues in your business, it may be your only option to keep your business afloat.

Even once you’ve corrected course and achieved positive cash flow, you shouldn’t let it fall off your radar. In order to maintain a healthy cash flow, you should:

The key to good business cash flow management is taking a proactive approach. That way, you can protect your company’s livelihood instead of scrambling to find a way to restore it.

Managing the day-to-day aspects of your business on top of finances and taxes can be draining and lead to mistakes you simply cannot afford. If managing your small business cash flow seems like too much to handle, let the experts at FinancePal take over these responsibilities.

In general, there are few rules that every business owner should keep in mind to help maintain healthy cash flow:

Growing your business takes sufficient available cash. As such, maintaining a healthy cash flow should be one of your top objectives.

Knowing when to seek professional help for your business finances can be the difference between success and failure. If the growing demands of your business have made it difficult to keep up with your bookkeeping, or you do not want to be responsible for this aspect of your business, you’d likely benefit from professional small business bookkeeping services.

Using FinancePal, you can streamline your accounting and bookkeeping and enjoy the peace of mind that we will be monitoring your business’s financial position in extensive detail. Our experts can keep an eye on your cash flow and help you take a more proactive approach to small business cash flow management.

In addition to helping you maintain healthy cash flow, we can assist you with other important aspects of your business’s finances, including how to set up payroll and handling your freelance taxes. Whatever your needs, your dedicated financial team will be one of your biggest resources to ensure that your business thrives.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

¿Qué hacen los contadores especializados en el manejo de libros contables?

Presentación de la declaración de los impuestos de los contratistas independientes

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.