Written by: Nick Charveron Nick

Sales tax and use tax sometimes draw the ire of small business owners, and they’re often the subject of debate about interstate and online commerce. Most consumers are probably aware of what sales tax is (it makes that thing you’re buying more expensive than the listed sales price). But there seems to be less awareness about what use tax is. Even if you’re not a business owner, you should familiarize yourself with use tax because you just might have to report it on your annual tax filing.

Sales tax and use tax are both “transactional taxes.” Here’s the difference: sales tax is applied on the purchase of a good or service, while use tax is applied on the use of a good or service on which no sales tax has already been paid. Sales tax and use tax are mutually exclusive, so they’ll never be placed on a transaction at the same time. It’s either one or the other.

Of course, it gets a little more complicated than that, especially if you’re a business owner. Let’s review the differences between sales tax and use tax in greater detail, and define the situations that require you to pay either:

Sales tax is one of the best ways for state and local governments to acquire funds. After all, consumer spending makes up $14 trillion of the country’s $21 trillion gross domestic product.

A sales tax is a tax that’s placed on the sale of an item or purchasing of a service. The good or service must be taxable—there are lots of products in each state that are tax-exempt. California, for example, prohibits sales tax on grocery food, prescription drugs, medical services, transportation services, and software, among other things. Other states have very similar lists of products that are tax-exempt.

But for most products on sale, there’s a sales tax levied on it by both state and city governments. First comes the state’s sales tax. Then, a city government can impose a sales tax on top of that, although it’s usually limited to a smaller amount. So, if the state places a 4% sales tax on an item, and the city places a 2% sales tax on the same item, you’d be paying a total of 6% in sales tax on the product.

In the United States, 45 states impose sales taxes, as well as the District of Columbia and the territories of Puerto Rico and Guam. The 5 states that do not impose a statewide sales tax are:

Note that Alaska and Montana do allow local sales tax. View this sales tax map to learn the sales tax rate in your state.

A state can impose sales tax on any seller who has established nexus with the state. Nexus is when a seller has established a sufficient economic presence in the state to warrant sales tax obligation—usually, that’s when the seller owns a store within the state or sells a certain amount of goods to people who live in the state.

Every state has their own nexus criteria. In nearly all states, nexus is established when the seller has a physical location within the state—for example, they own a brick-and-mortar store within the state borders.

But even if the seller is located outside the state, nexus can be established through sales. In Massachusetts, for instance, a seller can establish nexus by completing over 100 transactions to buyers who live there. In Ohio, selling over $150,00 worth of taxable goods or services to Ohio residents establishes nexus.

There’s a major debate about the legality of such provisions. We’ll discuss that a little later.

If you own a business in a state that collects sales tax, you must collect sales tax whenever:

What happens when you sell a taxable good or service to a buyer in a different state? In that case, you’d owe seller use tax to that state, but only if you’ve established nexus there. We’ll discuss seller use tax later.

There are different kinds of sales tax systems. States differ on whether or not the sales tax is imposed on the buyer, seller, or on the transaction itself. These rules are important because they determine who’s liable for the tax. If you’re a business owner, it’s important that you understand your sales tax obligation in your state or territory.

In the United States, there are two main types of sales taxes:

A “seller privilege tax” is a sales tax that’s levied on the seller. It’s technically the seller who’s charged sales tax for each item that’s sold, but the seller can charge the buyer with a “sales tax reimbursement.”

Here’s the important thing about seller privilege taxes: sellers are allowed to absorb the tax for the buyer—in other words, the seller pays the sales tax without charging reimbursement to the buyer. Sellers might want to absorb sales tax for a couple of reasons. First, products can be sold at a cheaper price when there’s no sales tax, and that could give the seller an edge over competitors (it should be noted, however, that some states prohibit advertising of sales tax absorption).

Second, the seller might want to absorb sales tax for ethical reasons. In most states, the products that are tax-exempt are usually the ones that are considered “necessities” for life. But many citizens feel as though there are essential products that are being taxed when they shouldn’t be. For example, female hygiene products (notably women’s pads and tampons) are subject to sales taxes in many states. If a seller thinks this is unfair, the seller may choose to absorb the sales tax so the buyer doesn’t have to pay it.

Of course, sellers aren’t required to absorb the tax. Most sellers, in fact, charge reimbursement to the buyer.

As of 2019, states that levy seller privilege taxes include:

But here’s where it gets complicated. Some states place tax liability on the seller, but they also have laws that prohibit tax absorption. Of the jurisdictions listed above, these ones prevent sellers from absorbing sales tax:

When it comes to taxes, things are rarely as simple as they seem.

The vast majority of states use a “consumer sales tax.” A consumer sales tax is a sales tax that’s levied upon the buyer and not the seller. The state imposes the tax on the buyer, but it basically uses the seller as an agent to collect the tax and remit it to the government. The seller is not allowed to absorb the tax for the buyer or interfere with it in any way.

An excise tax is placed on certain goods as soon as they’re manufactured, and not when they’re sold. For example, California imposes excise taxes on alcoholic beverages, cannabis, and tobacco products, among other things. It’s worth noting that the retailer of the product typically factors excise tax into the purchase price—which could mean a pack of cigarettes in New York costs the consumer much more than it would in Mississippi, due to higher excise taxes.

Before your business begins selling items, you need to obtain a sales tax permit from the state your business is operating in. Each state has a different permit, with different stipulations on how often you must remit sales tax. In California, for example, you may have to remit (report) sales tax monthly, quarterly, semi-annually, or annually—it all depends on how much sales tax your business is collecting each month.

You may also have to collect local sales tax if your business is located within a local tax district (a city government that charges sales taxes).

It’s mandatory that you collect sales tax on taxable transactions. If you don’t collect sales tax, you could lose your sales tax permit in whichever state you’re selling in, and you won’t legally be able to make sales there.

For not collecting and remitting sales tax, you could also be subject to financial penalties from the state you’re operating in. Typically, states charge interest and/or fees for late filings and underpayments, and these can significantly add up in cost. Pennsylvania’s sales tax penalties, for example, include 6% interest on late due taxes.

If you’re confused about how or when to collect sales tax in your state, consider looking into sales tax consulting services. Tax experts will have a very thorough understanding of your sales tax obligations in your state, and they’ll help you determine which products or services your business offers that you’ll need to collect sales tax on, and they’ll advise you on how to remit those taxes to the proper tax jurisdiction.

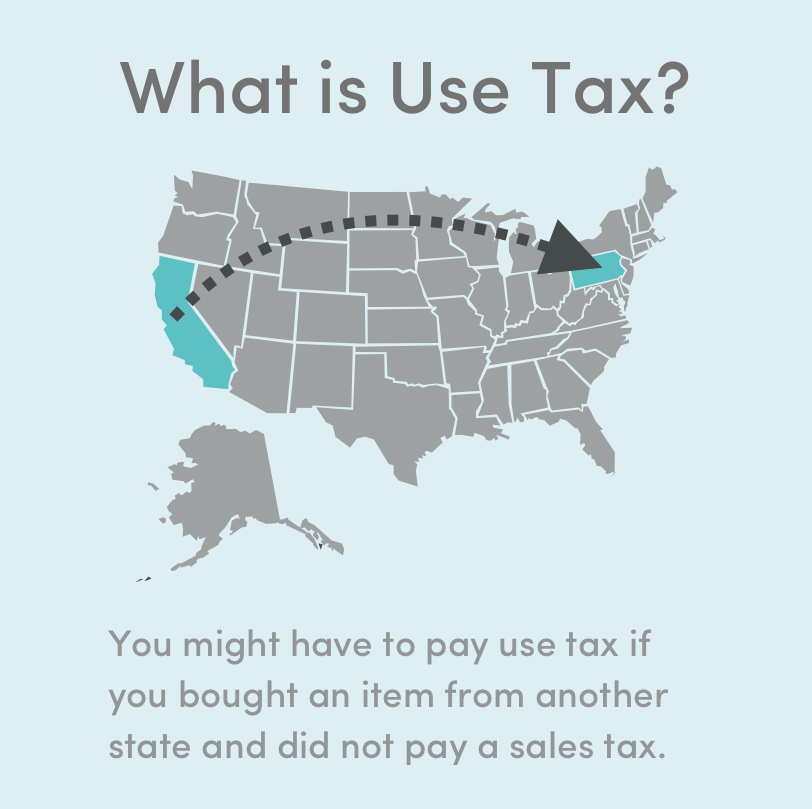

Use tax is a tax on the storage, use, or consumption of a taxable item or service on which no sales tax has already been paid. Use tax can also be applied on any item or service that was not purchased but used in a taxable manner. In most states, the use tax is set at the same rate as the sales tax.

Use taxes are “self-assessed.” That means it’s the responsibility of the buyer or seller to know when they owe use tax on a transaction, and they must report the use tax to their tax jurisdiction and remit the funds.

You may be obligated to pay use tax when:

Here are some examples of situations in which you’d have to pay use tax.

1. Buying Outside Your Tax Jurisdiction

When you purchase a good or service from an area outside of your tax jurisdiction, you might have to pay use tax to your state.

Scenario 1:

Let’s say that you live in California and you buy a piece of furniture from a company in New Hampshire. You don’t have to pay sales tax on the furniture because there’s no sales tax in New Hampshire. But California does charge sales tax on furniture. That means you’ll have to report the item on your annual tax filing and pay use tax on it.

Scenario 2:

You live in Maryland, and you’re looking to hire a contractor to remodel your kitchen. You decide to hire a company in Delaware. They travel to Maryland and remodel your kitchen, and you don’t have to pay sales tax for their service because Delaware doesn’t collect sales tax. However, this is a taxable service in Maryland, and so you’re required to report the transaction and pay Maryland’s use tax on it.

Scenario 3:

You live in California, and you purchase software from a company in Montana. You don’t have to pay sales tax on the software because Montana doesn’t collect sales tax. You also don’t have to pay use tax in California, because software is tax-exempt in California.

2. Using Taxable Goods

If there’s an item you haven’t paid sales tax on, you may have to pay use tax if you use the item in a taxable way.

Scenario 1:

You own a business in California that sells computers. You have lots of computers in stock that you haven’t paid sales tax on because you haven’t sold them yet. You decide to use one of these computers in the back office, in which case you’d have to pay California use tax on it. Since you’re basically using the computer like you’ve bought it, you owe use tax because the item was transferred to your possession and you didn’t pay any sales tax.

As we discussed earlier, you collect sales tax when you sell a taxable good or service in your state, or if you’re delivering that good or service to someone in your state. But if you’re selling to someone who lives in a different state, you may be obligated to pay seller use tax, instead.

Think of seller use tax as a sales tax on interstate commerce. Whether you pay sales tax or seller use tax depends on the kind of nexus you have with the state you’re selling to:

Nowadays, seller use tax is applied mostly to online sales.

Each state has different requirements on when and how you report use tax and remit the funds to the proper tax jurisdiction. Typically, the way you’ll remit use tax is similar to how you’ll remit sales tax.

Use tax is notoriously difficult to enforce. The tax must be self-assessed by consumers, and many people aren’t even aware that use tax exists or they choose not to report it. Without the buyer or seller reporting their use tax obligation, there’s little way for the state to know that use tax hasn’t been paid on an applicable transaction.

Does that mean you should avoid reporting use tax? Absolutely not, and doubly so if you’re a small business owner. An audit could reveal the instances in which you didn’t pay use tax, and this could result in legal trouble and severe tax penalties. Remember, you could be randomly selected for IRS audit, so it’s important to protect yourself and your business by always being transparent about your use tax obligation.

If your business sells to multiple states, you could be subject to financial penalties from each state you do business in. That could result in huge penalty fees and interest rates that could be catastrophic for a small business.

In 2018, Americans spent over $504 billion online . Online commerce has become a huge part of the American economy. For the states, what’s difficult about e-commerce is that many transactions take place between a buyer and seller in different states.

State governments have responded by expanding their definitions of what constitutes nexus. In the past, businesses needed to have a physical presence in a state to establish nexus, but most modern nexus rules enable businesses to establish nexus via e-commerce. This makes it easier for states to claim taxes on out-of-state transactions.

But enforcement is a different matter, especially where use tax is concerned. As mentioned earlier, many consumers don’t remit use tax and they’re not even aware that use tax exists. According to a study by the Minnesota government, only 1.6 percent of its taxpayers reported use tax in 2009, and in the same year only New York and California reported use tax over revenues of over $5 million.

Because states haven’t been able to collect a lot of revenue from use tax, they’ve instead tried to pass laws that enable them to collect sales tax from out-of-state sellers. The law has taken the side of the state governments. In a 2018 Supreme Court case, South Dakota v. Wayfair, Inc. , the court ruled that states can collect sales tax from out-of-state vendors that are selling to their citizens. It was a landmark ruling for e-commerce, and it immediately caused many states to pass expanded nexus laws.

Some larger corporations, like Amazon, have willingly chosen to collect sales tax on all applicable transactions. But it’s harder for small businesses.

The states have tried to be fair to small businesses by stipulating that nexus may only be established through a high number of transactions or sales revenue. But if your business engages in online retail, you may now find it incredibly difficult and tedious to report sales tax. Each state has different nexus rules and sales tax rates, so calculating what you owe to each state—and whether you owe anything at all—may be a major challenge if you’re limited on labor.

That’s why it’s important to have meticulous bookkeeping and accounting practices at your company (read our article on accounting for small businesses to learn some great accounting methods). By keeping detailed records of your transactions, it’ll be easier to figure out if you’ve made enough transactions/revenue in a particular state to have established nexus and be liable for sales tax. It’s not a bad idea to use a digital accounting service, like FinancePal , to help you keep extremely accurate records.

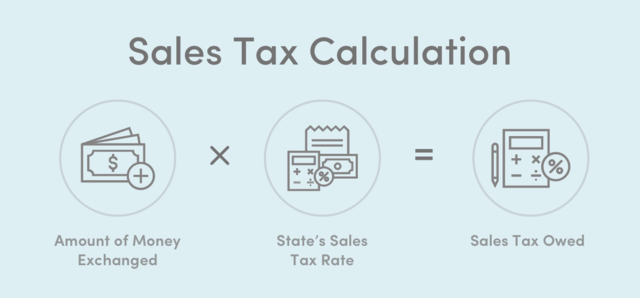

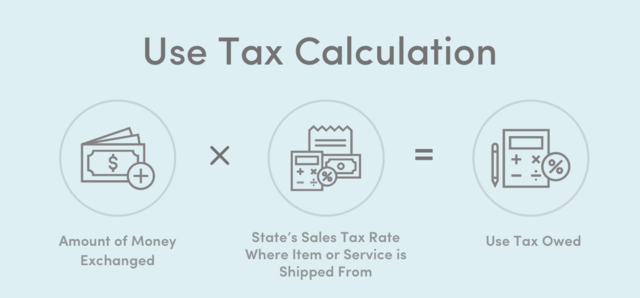

It’s relatively easy to calculate how much sales and use tax you owe on a taxable transaction. Here are the equations:

“Amount of Money Transferred” means however much money you pay or collect on a transaction.

If there’s one thing you probably learned from this article, it’s that taxes are complicated. Unfortunately, collecting sales and use tax is bound to become more complicated for small businesses as states expand nexus in the post- Wayfair era.

If you’re confused about when you’re obligated to collect and report sales and use taxes, or if you need assistance managing the overwhelming amount of financial and legal details you need for interstate sales, we highly recommend using a tax consulting service or digital bookkeeping program. FinancePal offers these services to small businesses at budget-friendly prices. We’ll make sure your business won’t find itself in legal trouble with any of the states you do business in, and that you’re always remitting taxes to the proper jurisdiction.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Average Cost of Tax Prep for Small Businesses & Other Tax Facts

Contabilidad para pequeñas empresas: 10 consejos que debes conocer

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.