Written by: Jacob Dayan

Many Americans are not familiar with the differences between payroll taxes and income taxes. When most employees get their paycheck, they acknowledge their tax deductions, but knowing exactly how much goes where is not critical. However, for business owners, it is crucial to get very familiar with payroll and payroll tax — and how they differ from income tax.

FURTHER READING: Small Business Taxes

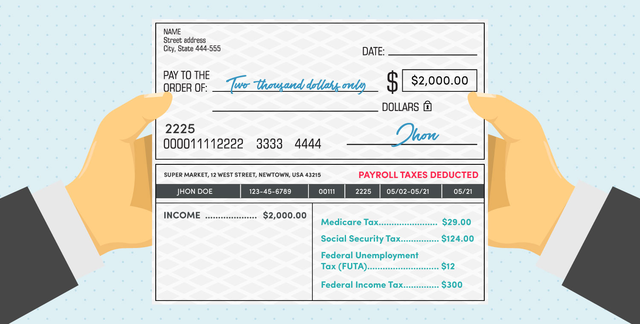

Simply put, a payroll tax is a tax that an employer withholds from an employee’s salary, wage, or tips. The employer then remits the amount withheld to the government on their employees’ behalf.

In the United States, there are four main types of payroll tax:

Payroll taxes paid into Medicare are diverted into two separate trust funds. The first fund is known as the Hospital Insurance Trust Fund. The second fund is the Supplementary Medical Insurance Trust Fund,

Before learning each trust fund does, it is important to recognize that Medicare is divided into four different parts, each one helping with different types of medical costs. These parts are known as A, B, C, or D.

– Medicare Part A helps pay for hospital care, skilled nursing inpatient care, and, in some cases, home care.

– Medicare Part B helps pay for medical service costs, such as laboratory tests and screenings, outpatient care, x-rays, ambulance service, and more.

– Medicare Part C helps pay for hospital, facility, and medical costs, but wage taxes are not paid into Part C. Part C plans are only available through private insurance companies.

– Medicare Part D helps pay for prescription drugs.

The Hospital Insurance Trust Fund pays for Medicare Part A and the associated administration fees. The Supplementary Medical Insurance Trust Fund assists in paying for Medicare Parts B and D and other Medicare program administration costs.

Social Security was signed into law in 1935 to provide a safety net for retirees and the disabled. The Social Security Act of 1935 used to be an exemption for high-income earners, but this exemption has been replaced by a cap that rises and falls relative to wages. This cap is referred to as the Wage Base Limit.

Much like with Medicare, all funds paid into Social Security are diverted into two different trust funds. The first is the Old-Age and Survivors Insurance Trust Fund (OASI), which pays retirement and survivor benefits. The second Social Security fund is the Disability Insurance Trust Fund, which covers disability benefits. These funds are managed by the Secretary of the Treasury, the Secretary of Labor, the Secretary of Health and Human Services, the Commissioner of Social Security, and two public trustees.

The Federal Unemployment Tax Act (FUTA) imposes a federal employer tax used to help fund state workforce agencies. FUTA covers a share of the cost of administering unemployment insurance and job service programs. It also provides a fund from which states may borrow from, if necessary, to provide unemployment benefits.

Employers pay federal unemployment tax — the IRS explicitly states that employers may not deduct this cost from their employees.

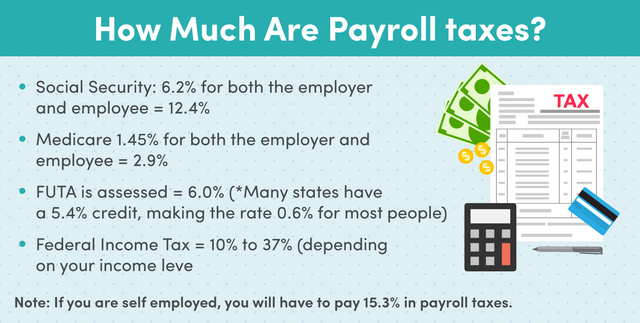

Federal Income Tax is a progressive tax assessed on an employee’s wages, salary, or tips. Most employers deduct federal income tax payments.

Medicare and Social Security contributions constitute the Federal Insurance Contributions Act (FICA). Employees pay Social Security and Medicare taxes through payroll deductions.

The employee pays a 6.2 percent tax for Social Security expenses and 1.45 percent for Medicare. The employer must match the deduction and send the total amount to the IRS. Self-employed individuals pay 15.3 percent of their wages, which includes both the employer and employee portion of the tax

For the employer and the employee, the current tax rate for social security are both 6.2%. These add up to a total of 12.4%. The current rates for Medicare are 1.45% for both the employer and employee, adding up to 2.9% total. The rates are equal because, by law, employers must match FICA contributions.

If you are a sole-proprietor or otherwise run a business without employees, you must pay the self-employment income tax. This tax is assessed at a rate of 15.3% — equal to the sum of the employer’s share of Social Security and Medicare.

According to the IRS, Additional Medicare Tax applies to an individual’s Medicare wages that exceed a threshold amount based on the taxpayer’s filing status. Employers are responsible for withholding the 0.9% Additional Medicare Tax on wages for an individual making over $200,000 per year, without regard to filing status. An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages over $200,000 to an employee and continue to withhold it each pay period until the end of the calendar year. Unlike with Social Security or base-level Medicare, there is no obligation for the employer to match employee contributions to Additional Medicare Tax.

The Wage Base Limit is the aforementioned income cap on Social Security; the wage base limit is the maximum wage that’s subject to the tax for that year. The base is $137,700 for all earnings in 2020.

There’s no wage base limit for Medicare tax as all covered wages are subject to Medicare tax.

The total rate at which FUTA is assessed is 6.0%. However, most states have a 5.4% credit. This knocks the rate down to 0.6%.

There are two tax withholding table methods to determine how much to withhold for federal income tax: percentage and wage bracket. Use the information on the employee’s Form W-4 as well as their weekly wages and frequency to figure out their federal income tax deduction.

Many people do not fully understand the difference between payroll taxes and income taxes. However, it is essential for employers to familiarize themselves with the similarities and differences.

For starters, unlike payroll tax, federal income tax is not assessed at a singular flat rate. Instead, it is assessed on a progressive tax rate. An employee’s wages and pay frequency impact their federal income tax amount. This amount is based on an employee’s Form W-4 information, such as filing status, dependents, and additional withholding requests. When you first hire a new employee, they need to fill out Form W-4, Employee’s Withholding Certificate.

The main difference between federal income tax and payroll tax is that federal income tax that goes to the government’s general fund for public services like defense, education, postal service, and transportation. FICA taxes fund only Social Security and Medicare program.

State income tax works similarly to federal income tax. If there is state income tax, you will give your employee a state income tax withholding form. State income tax can either be a flat or progressive rate.

In addition to federal payroll tax, employers are also responsible for remitting state payroll and income tax on behalf of their employees.

Beneath the federal level, payroll tax rules differ from state to state. To help taxpayers access information relevant to their states, the Federation of Tax Administrators published a list of each state’s taxing authority.

On the surface, it appears that the employee and the employer split the bill for payroll tax. There are arguments to be made about how much each party really contributes due to tax incidence being affected more by markets than laws. Some argue the economic concept of relative price elasticities places the burden on the employee more than the employer. But if you are running a business, these bells and whistles do not matter. It is your responsibility as an employer to have your payroll set up properly and in order — unless you outsource to a third-party, like many businesses choose to do.

Having your payroll in order is imperative for any business owner. However, it can also be tedious, complicated, and time-consuming — especially for smaller businesses. Additionally, the IRS can be unforgiving when it comes to mistakes — filing your payroll taxes just one day past the deadline incurs a 2% penalty. These penalties can add up too — to a hefty 15%.

Thankfully, outsourcing payroll to an outside firm is a fairly simple and rewarding process that allows business owners to spend less time worrying over books and more time running their business. Every day, more people are making the switch to outsourced small business payroll services.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.