Written by: Nick Charveron Nick

As a small business owner, you have an endless to-do list. The majority of the time you’re probably focused on the day-to-day concerns of running your business, but you can’t forget about the big picture, which unfortunately includes paying taxes. The taxes you owe and the small business tax deductions you qualify for can drastically impact your business’s financial well-being.

Filing your taxes properly is of the utmost importance. Inaccurate or fraudulent tax reporting could mean a 20% inaccuracy fee or even a 75% tax fraud penalty. However, there are resources to help you protect your business by making sure you’re in compliance.

Working with FinancePal can simplify the process, relieve the burden that filing taxes places on your limited resources, and give you peace of mind. With all-in-one accounting and tax preparation services , you can leave your finances to us while you focus on running your business.

If you prefer to stay in the loop or want to file your taxes on your own, you will need to be well-versed in the small business tax rates and deductions that apply to you in 2019. That’s what we’re here for. We’ve compiled an extensive list of the taxes, deductions, deadlines, and processes you need to know about to handle your small business taxes with finesse.

Reading through our guide to small business taxes and deductions can help you prepare for the 2019 tax season. But if you’re short on time, you can use the jump links below to skip to the section that addresses a specific question you might have:

Your Business Structure Matters

How Much Can a Small Business Make Before Paying Taxes?

Small Business Taxes You’re Responsible For

Can a Small Business Get a Tax Refund?

Filing Your Small Business Taxes

Paying Your Small Business Taxes

The business structure you have chosen for your small business will impact how much you owe in taxes.

In a sole proprietorship, your personal and business liabilities and assets are not separated for tax-filing purposes. This means you are personally liable for all business activities. Typically, new businesses will start out as sole proprietorships because they are the simplest, then enter one of the following business structures as they expand and need to raise capital.

If you have not formally established your business structure, you will automatically be classified as a sole proprietorship.

A partnership is a simplified business structure that can be used for businesses run by two or more people. Typically, business owners choose to enter a general partnership (GP) because each owner holds equal responsibility.

A limited liability partnership (LLP) is similar to a GP in that all partners are partially responsible for the business and are protected against business debts and actions of the other partners. No partner holds total responsibility.

The other type of partnership, known as a limited partnership (LP) assigns unlimited liability to one partner, who assumes the responsibility of paying self-employment taxes and the most control over the company. The other partner(s) will have limited liability and limited control over business activities.

In an LP, profits will need to be claimed on personal income taxes.

A limited liability company (LLC) is a middle ground between a partnership and a corporation and offers several advantages:

Members of an LLC have to pay self-employment taxes for Medicare and Social Security.

If your business is structured as a corporation (C Corp), the entity and its activities are separate from shareholders. This provides protection from liability but requires corporations to pay income tax on their profits, usually at a higher rate.

Typically, a corporate structure is recommended for larger scale, higher-risk businesses.

In an S corporation (S Corp), some profits and losses can be listed on yours and other business owners’ personal income taxes. This allows for lower taxation. Not all states allow this though and there are many other restrictions that apply to S Corps, such as having a maximum of 100 shareholders.

S Corps must follow strict filing guidelines and register their status with the Internal Revenue Service (IRS).

For tax purposes, an international business is one that is either foreign and conducts business activities within the U.S. or vice-versa. International businesses are required to operate within the Foreign Account Tax Compliance Act (FATCA). Reporting requirements will vary from country to country.

You can find further details about ownership and the tax requirements of your business at IRS.gov .

You must start paying taxes if the net income (profits minus expenses) from your small business exceeds $400. As soon as you begin operating your business, you should make sure to keep track of all of your expenses and profits to make sure you are able to accurately determine if, and how much you owe.

You are responsible for paying both federal and state taxes for your small business’s operations. Small business tax rates can vary from state to state, so it is important to check with your state’s Department of Revenue . Small business taxes you’ll be responsible for include:

Like personal income taxes, some small businesses pay taxes on the net income (after expenses have been subtracted) they have earned throughout the year. How this is done depends on the structure of your business.

Partnerships are the exception and do not pay income taxes as an entity. Instead, if you are part of a partnership, you must file an annual information return. Then, each partner will include their share of the income or losses on their personal income tax return.

Keep reading to see which forms you need to file to account for your business’ income taxes.

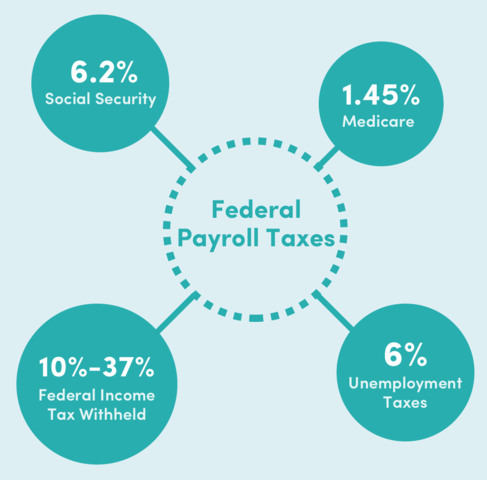

If you have employees, you are responsible for paying payroll taxes, which include:

Unlike most taxes, the IRS requires small business owners to make deposited payments for these taxes at least once a month. Failure to comply with your business’s set pay schedule can result in hefty fines. If you’re a newer business, this can be especially detrimental. As such, staying current on small business tax rates and their deadlines is imperative.

If you’re self-employed, or a sole proprietorship, you will need to pay these taxes to contribute to your social security and Medicare benefits.

Your business may be required to pay excise taxes on certain activities, sales, or payments. For instance, if your business uses truck tractors on public highways or you sell lottery tickets, you may be required to pay excise taxes.

Take care when considering whether you owe excise taxes. There are varying rules and forms that must be filed depending on which, if any, excise taxes apply to your business.

Your business may be obligated to collect and pay sales taxes for the goods or services you provide. In addition to federal sales taxes, you may also be required to pay state sales taxes, which can differ depending on which county or city you operate in. In fact, only a few states do not impose their own sales taxes.

Certain goods or services may be exempt from sales taxes, but it is important to thoroughly research federal and state exemptions before making any assumptions.

If your business owns real property, fixed land and buildings, you’ll have to pay property taxes. Taxes are paid on the assessed value, not the fair market value. The assessed value is determined by the local taxing authority which will provide you with documentation and a tax bill based on their calculation. The amount you pay in property taxes largely depends on where your real estate is located.

Understanding and calculating all the taxes that apply to your business can be difficult. Protect your business by working with FinancePal. Our team members know the ins and outs of small business tax filing and can help you make sure everything you owe is accounted for.

Deductions are a form of tax incentive that directly reduces your business’s taxable income, lowering your tax bill. Small businesses might be able to claim deductions for business expenses that are “ordinary and necessary” . This means that the expense must be one that is common, helpful, and appropriate for businesses within your industry. For example, if you’re a rideshare driver for a company like Uber or Lyft, some deductible ordinary and necessary expenses may include water bottles, snacks, and tissues for passengers.

The Tax Cuts and Jobs Act is a major tax reform initiative that allows certain businesses to deduct up to 20% of their qualified business income. This deduction is only applicable to sole proprietorships, partnerships, and S corporations and is complex in regards to the specific qualifications a business must meet. Taking advantage of this and other small business tax deductions can be very beneficial but due to the nature of deductions and their many restrictions, it is highly recommended that you work with a professional at FinancePal.

There are several costs that are tied to business operations that you can deduct:

As a small business owner, it will benefit you to ensure that you are writing off all applicable business expenses in order to save the most money.

Business operation costs aren’t the only deductibles you can take advantage of. Other common small business tax deductions include:

The most important thing to remember if you’re planning on claiming small business tax write-offs is to make sure that you have the necessary documentation to back it up.

Not every expense is fully deductible, but you may be able to partially deduct other expenses. For example:

Whenever writing off something outside your primary business operations, make sure you are aware of any guidelines that may apply to that specific expense.

Personal expenses cannot be deducted as business expenses but in some cases, if you use something both personally and for your business, you may be able to write off a portion of the cost. The IRS also has strict guidelines as to which business expenses, and how much of each cost, you can write off. Keep in mind, you are not able to deduct expenses that are considered “lavish or extravagant”.

As of 2018 , you cannot claim deductions for:

It is also important to note that expenses that were calculated toward your cost of goods sold cannot be included in your itemized deductions. For the most up-to-date details on deductions and restrictions, refer to the Publication 535 by the IRS.

Technically, the only type of small business eligible to get a “tax refund” is a C Corp. This is because the business’s profits are taxed and paid separately from shareholders. In actuality, it isn’t the same type of refund you would receive on your personal income taxes. Instead, corporations accrue a rebate or deficit that can be applied to future tax payments.

However, small business tax write-offs can add up to get you a refund on your personal income taxes.

Depending on the type of business you operate, you may have different tax forms and filing deadlines.

For your federal income taxes, you should file based on your business structure:

Form 940 should be used for federal unemployment and Form 941 for quarterly employment taxes (Social Security and Medicare).

Corporations, sole proprietorships, and single-member LLCs adhere to the April 15th deadline. If you operate a partnership or an S corporation, you will need to file your taxes by March 15th instead. Since this is an entire month earlier than you’re used to, it can be easy to forget.

If crunching numbers, tracking down forms, and double-checking every detail makes you nervous, our team members can help you. FinancePal’s experts are well-versed in small business tax preparation and can provide you with the reassurance you need to make the best decisions for your business.

The first time you pay taxes for your small business, you will need to establish the tax year that you will operate under, even if you were not in operation for the full year. Often, business owners choose to follow the calendar year for simplicity but certain accounting needs might interfere. If necessary, you can change your tax year by filing Form 1128.

As a small business owner, you’ll need to make a multitude of tax payments throughout the month and year. Business owners are required to make estimated tax payments four times per year. You’ll also need to make frequent deposits for employment taxes.

Small businesses are expected to deposit employment taxes from the following:

If your tax liability was $50,000 or less, you’ll follow a monthly deposit schedule. If it was greater than $50,000, you’ll make semi-weekly (two times per week) deposits. FUTA taxes are only paid quarterly though. You will need to make your payments through the Electronic Federal Tax Payment System ® (EFTPS).

As you can see, you have to make these payments frequently, which adds another item to your ever-growing to-do list. The IRS provides access to a calendar but it can still be pretty overwhelming. If you pay late, you’re subject to a penalty of up to 15%. If you have a lot of employees, that can be a pretty big hit to your finances that month.

The experts at FinancePal can help you ensure that your employment taxes are paid in a timely manner so you don’t have to pay fees and you can worry about one less responsibility.

You will only need to make quarterly payments if your business will owe $1,000 or more in income taxes. However, if your business is classified as a C or S Corp, you’ll need to make estimated payments if you’re expected to owe $500 or more in taxes.

Quarterly estimated taxes are due:

To calculate your estimated tax payment, use Form 1040-ES or get assistance from one of the pros at FinancePal. If you do it yourself, make sure you verify the most current small business tax rates for correct payment estimates.

The average cost of tax preparation for small businesses for Form 1040 was approximately $273 in 2017 . But again, the structure of your business will impact the cost of filing because additional forms may be required. Additionally, the cost may vary due to where you live, the industry your business operates in, and other important factors.

According to a 2017 survey by the National Society of Accountants, the average costs for small business tax preparation were as follows:

As you can see, paying to have your small business taxes filed on your behalf is a small cost in the grand scheme of business operations, but provides significant benefits.

Simplify your finances and your taxes with FinancePal . We’ve helped many small businesses like yours file their taxes on-time, correctly, and ethically. Our dedicated financial team will know all the important details about your business’s finances to provide personalized guidance and accurate tax filing on your behalf. Like your employees and partners rely on you to make good business decisions, you can rely on us to serve your best interests while ensuring that you remain in good standing with the IRS so your business can thrive.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.