Written by: Jacob Dayan

While there may be a recent focus on the marginal tax rate in light of proposed progressive tax reform, it has always been a hot-button topic within the halls of Congress. Proponents of a higher marginal tax argue that it can increase lower-income taxpayers’ spending power by easing their tax burden. Meanwhile, opponents worry that shifting the tax burden to high-earners and large businesses will tighten profit margins. However, the nitty-gritty is for economists with Ph.D. ‘s to debate; most taxpayers are only concerned with what it is and how much they need to pay.

This article breaks down the marginal tax rate, how it is calculated, and how it differs from other taxes.

Put simply, the marginal tax rate is tax paid on every additional dollar of income over a set threshold. It is an example of progressive taxation, meaning the tax rate increases as income increases.

To assess marginal tax, the IRS divides taxpayers into tax brackets based on taxable income. Taxpayers whose income falls within a certain bracket must pay the tax rate set for that specific bracket as income is earned.

To visualize this, imagine a kitchen measuring cup demarcated by fluid ounce. Now imagine each space between the demarcations as a tax bracket. To represent a lower-income taxpayer, fill the measuring cup with a small amount of water so that the level rests between one and two fluid ounces. The lower-income taxpayer is taxed a low rate for the water until the first fluid ounce and a slightly higher rate for the water between the first and second fluid ounce.

To represent a higher-income taxpayer, fill the measuring cup so that the water level rests between the five and six fluid ounce mark. For the first two fluid ounces, this taxpayer pays the same rate as the lower-income taxpayer. But the tax rate gets progressively higher for fluid ounces three, four, and five.

With a new presidential administration, this could very easily change. But as of January 2021, there are seven brackets.

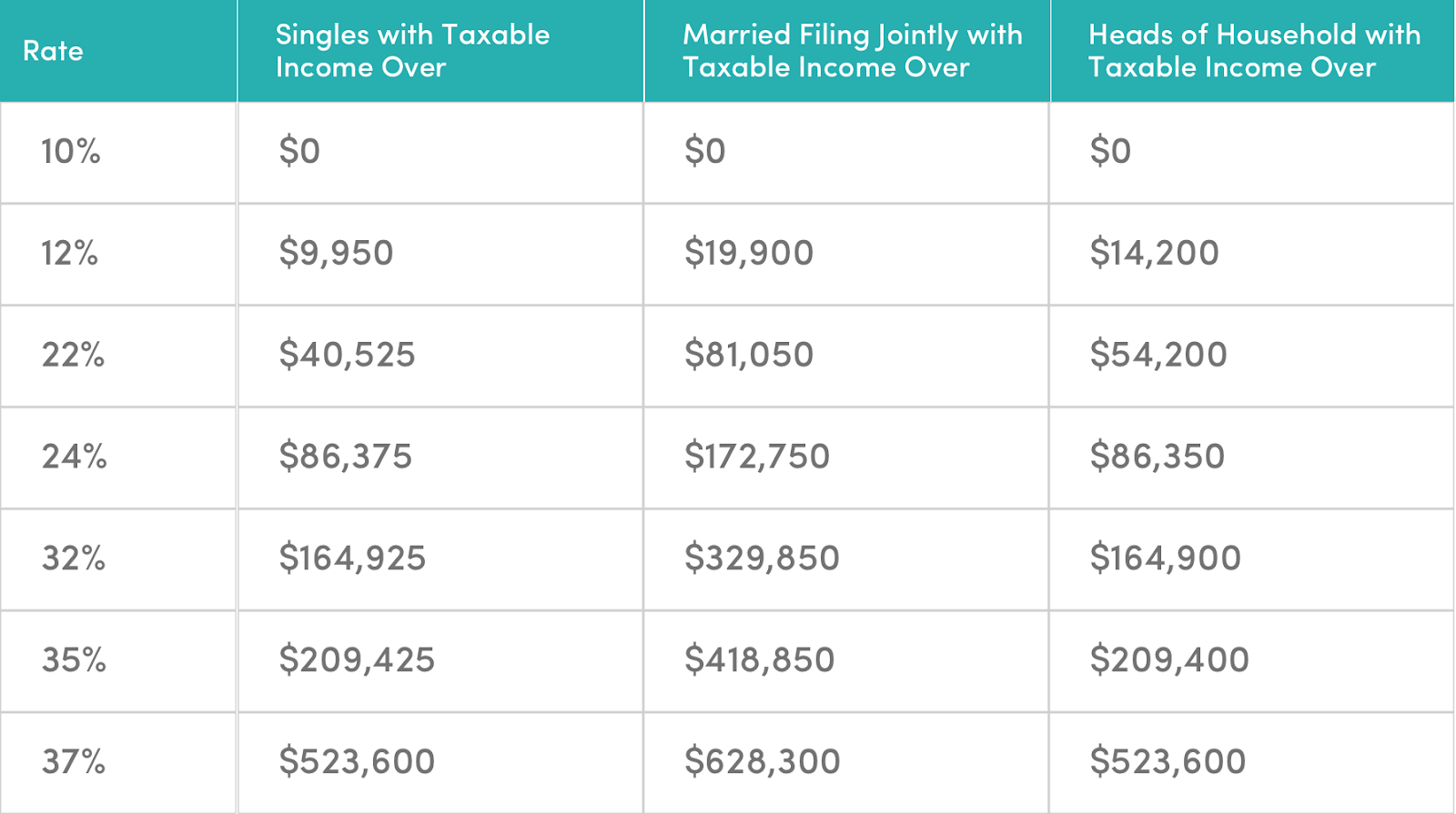

Since 2018 — when former President Trump signed the Tax Cuts and Jobs Act (TCJA) — the tax rates for each bracket are 10%, 12%, 22%, 24%, 32%, 35%, and 37%, respectively. Prior to the TCJA, the rates stood at 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%.

The following is a table showing the marginal tax rate for singles, married joint filers, and heads of household, broken down into the seven brackets:

For the sake of explanation, let’s take a single-filing taxpayer with a taxable income of $90,000. He is taxed a rate of 10% for income between $0 and $9,950. Since he makes more than $9,950, he is charged the maximum amount for that bracket, or $995.50.

His income surpasses the 12% bracket, so he is taxed the maximum amount for that bracket. Because you can’t get taxed twice, he owes 12% of ($19,900 – $9,950). This amount stands at $3,669.00. Factoring in the amount he owes for the 10% bracket; he now owes $4,664.50.

His income surpasses the 22% bracket as well, so he owes the maximum amount: 22% of ($81,050 – $40,525) = $10,087.00. Added to the previous amounts, he owes $14,751.50.

Because he makes less than $172,000 per year, he does not owe the maximum amount for the 24% bracket. Rather, he just owes 24% of income owed over the $86,375 threshold. 24% of ($90,000 – $86,375) is $870.00. When added to the totals for the previous brackets, he owes a grand total of $15,621.50

The widely-recognized alternative to marginal tax is flat tax. Some states assess income tax using a flat tax rate. Flat tax is much simpler; everyone is charged the same tax rate regardless of income. In addition to some U.S. states, flat tax is often used in developing nations.

Related Reading: Bookkeeping for Small Businesses

Many small businesses fall under partnerships, sole proprietorships, and LLCs — all of which do not pay a business tax. Instead, owners of these types of businesses file their taxes on their personal tax return. Because of this, you will pay marginal tax on some of your business income. To help lower your tax burden by finding deductible business expenses, you can work with a dedicated small business accountant.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.