Written by: Jacob Dayan

As an owner of a nonprofit, you likely started your organization with bright-eyed dreams of making a difference. You might think that running a nonprofit organization is much simpler than a traditional, for-profit business. In some ways, that’s true; you don’t have to deal with income taxes and other responsibilities that a for-profit business may feel pressured by. But, there are still plenty of financial reporting obligations that need to be on your radar.

This helpful guide to accounting for nonprofits will help you make sure you’re on the right track—from figuring out how to handle your day-to-day bookkeeping to producing accurate financial statements. We recommend reading the article in full to get the best start on your accounting practices, but you can also use these links to jump to the section you need:

How Does Accounting for a Nonprofit Organization Differ?

Nonprofit Accounting Best Practices

Nonprofit Fundraising Best Practices

Do Nonprofits Need Accountants?

Take Your Nonprofit Accounting to the Next Level

Nonprofit accounting is the process of recording, tracking, and reporting the financial activities of a nonprofit organization. With a properly maintained accounting system in place, your nonprofit organization will be better able to plan expenses and support your initiatives.

Before we jump into the differences between for-profit and not-for-profit accounting, it should be noted that many of the basic practices and principles apply the same way. If you need more guidance regarding basic accounting tips for beginners, we have a variety of blog posts covering accounting topics or you can speak with a member of our team by calling (888) 988-1886.

In this post, we’ll help you understand the fundamental differences of how accounting is done for nonprofits, so that you can ensure your records are kept correctly

Let’s dive in…

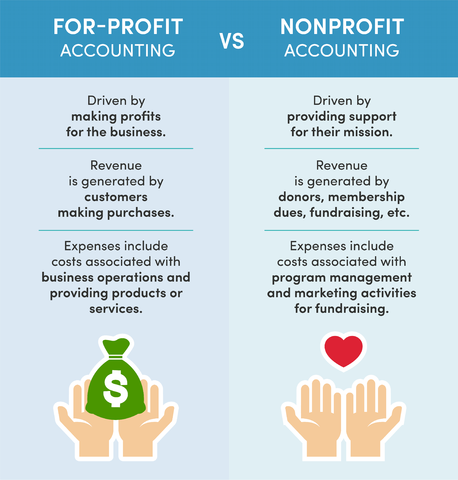

For-profit accounting focuses on profits the business brings in, whereas nonprofit accounting focuses on the ability to financially support the organization’s mission and the management of the money they oversee. As such, there are several key differences that you must be aware of when it comes to nonprofit accounting:

By keeping these differences in mind, you’ll be well equipped to take traditional accounting practices and apply them to your nonprofit accounting processes.

In a traditional for-profit business, revenue refers to the income brought in by the sale of its goods or services, while expenses include the overhead costs of business operations in order to provide those goods or services. These two values still generally represent the same concepts in non-profit accounting, but the revenues and expenses encompass different aspects of the organization’s business activities:

The financial statements required for nonprofits also differ from for-profit businesses. While financial statements serve a slightly different purpose for nonprofit organizations, they are still valuable for the board of directors and donors to review, as well as protection against IRS audits. The following financial statements will be required for your nonprofit:

Your nonprofit will not be required to produce a Statement of Stockholders’ Equity because there is no equity.

The accounting system used by nonprofits must reflect all the money that enters the organization. Since there are many sources of funding that a nonprofit can bring in, it typically leads to complicated accounting processes and bookkeeping. Not to mention, records must be meticulously kept in order to comply with the rules applied to 501(c)3 organizations, which is how the IRS categorizes nonprofits.

Let’s cover some of the most important factors of financial accounting for nonprofit organizations…

As with any organization, one of the first decisions you’ll have to make when it comes to your accounting process is determining whether you’ll use cash or accrual accounting. The biggest difference between these two accounting methods is the timing of recording transactions.

If you use accrual-basis accounting, transactions will be recorded when the exchange is initiated, whereas, in cash-basis accounting, transactions are recorded when money is paid or received.

Typically, smaller nonprofits that are just starting out can get by with cash-basis accounting. However, accrual-basis accounting is typically recommended for bigger, more established organizations. This is because there is a greater need for detailed categorization and a better view of the big picture—which will be essential for planning the use of your funds.

Read our dedicated blog post for more information on cash vs. accrual accounting.

Handling donor funds is one of the most prominent challenges you’ll face when running a nonprofit. One of the reasons this is the case is because donors have the option to restrict their contributions, meaning they have a say in what they’re used for—and this is where things can get complicated.

Generally, funds are donated in an unrestricted manner, meaning they can be used for whatever the organization needs, whether that may be financial support for a certain program or coverage of management costs. However, if a donor does impose restrictions on the funds they provide, they must be accounted for properly.

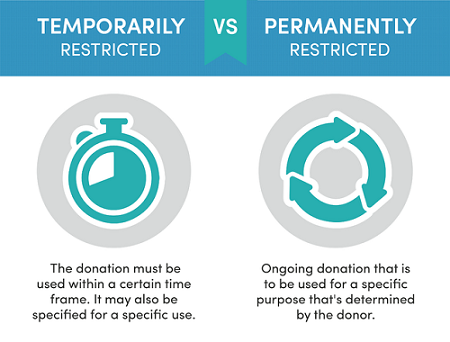

In order to account for the different types of restricted contributions, net assets must be classified as either temporarily restricted or permanently restricted.

Setting these up in your accounting system can be tricky if you’re inexperienced, so you’ll need to proceed cautiously when recording these donations.

Bookkeeping and accounting are not the same thing, but they are related. To have proper accounting, you need correct bookkeeping. Bookkeeping entails your day-to-day recording of transactions and maintenance of up-to-date financial information so that you can create accurate financial statements.

As a nonprofit, there are some special bookkeeping considerations you should be aware of:

For a better understanding of the differences between accounting and bookkeeping, check out our blog post on the topic.

Determining how to use your funds can be difficult, especially when you’re first starting out. This is further complicated by the fact that you’re expected to break down your expenses into three overarching classifications:

While it might take some time to calibrate your nonprofit’s operations, things should settle once you’re more established. Each organization is unique and these percentages may not always be spot on, but they should be relatively close. That said, programs and services should always make up the bulk of your organization’s spending, since that is the purpose of a nonprofit.

In order to ensure that you’re able to accurately track your expenses, you should:

Making this a priority will provide you with a better view of the progress your nonprofit is actually making, and provide your donors with peace of mind.

Most likely, your nonprofit organization will rely on both volunteers and employees (at least for a few key roles). So, how does compensation and payroll work in these circumstances? While some positions inherently call for larger salaries, the pay grade is typically a bit more modest than it is in the for-profit sector. One thing’s for sure: it certainly can’t be excessive—the IRS may even penalize organizations that provide excessively high salaries.

Aside from the complex decisions regarding when and who to hire, you are also responsible for processing payroll for any paid employees—something that might be more difficult than expected for someone who’s inexperienced.

So, what do you do to make sure your payroll is processed correctly and on time? While there are payroll software solutions, most still require you to handle the bulk of the work. Instead, consider FinancePal’s online payroll services that provide you with peace of mind knowing that your organization’s payroll obligations are being met.

Accounting and taxes are closely related. That’s why understanding your nonprofit’s tax obligations is important.

For help with your nonprofit taxes, speak with one of our knowledgeable tax professionals at (888) 988-1886.

As the head of a nonprofit, you are obligated to act responsibly and manage the provided funds with care. That means you must comply with legal requirements, ensure financial responsibility within your organization, and maintain practices that are worthy of the public’s trust.

To help ensure that the accounting for your nonprofit organization meets industry best standards, there are several things you can do:

These practices can help you prevent fraud within your organization and set your nonprofit up for success in the long run. Having these guidelines in place will become especially important as your organization grows.

Fundraising is a critical component of any successful nonprofit organization. However, it isn’t just about securing the funding to support your programs. Your fiscal liability starts when you are awarded the funding and there are a lot of obligations and expectations that come along with that responsibility.

Collecting and disbursing the funds provided to your organization should be done in a manner that supports your mission. In order to ensure that you’re collecting, using, and reporting funds correctly, these are some of the best practices you should follow:

Donors put their trust in you to use their funds toward supporting the organization’s mission, and having these practices in place will help you earn their confidence, as well as protect the organization should disagreements arise.

Not-for-profit accounting can be complicated, especially if your nonprofit has a lot of different programs to keep track of. Even if your nonprofit is in the beginning stages, your finances can quickly become complex as your organization grows. And, if you’re not experienced in accounting, keeping everything in order can be stressful and time-consuming—not to mention the risk it creates for IRS penalties due to inaccurate reporting.

But what if you’re using accounting software to handle everything? Basic accounting software might meet your needs in the beginning when you only have a few funding sources. However, once you begin to bring in more funding from many different sources, you’ll likely need a more sophisticated accounting system in place.

While you might think that you can forgo hiring an accountant because you’re not running a for-profit business, you should reconsider. Having an accountant, or better yet, a dedicated financial team can help your organization ensure that its financials are always in order and that funds are being used as effectively as possible.

If you are going to get professional help, you should look into accounting services tailored to the needs of nonprofit organizations. That way, you can rest assured that your accounting is being conducted in accordance with applicable regulations and best practices.

Here are a few key factors to keep in mind when you’re looking for accounting help for your nonprofit:

You may also want to weigh the benefits of comprehensive nonprofit accounting services, meaning they provide bookkeeping, payroll, and even tax assistance. That way, you can bundle all of these services, potentially saving you money on management expenses as well as streamlining communication and financial processes.

So how do you find an accounting solution that meets all your needs and fits into your budget? At FinancePal, our pricing and services are tailored to your needs, but there are also many other advantages to using FinancePal for your nonprofit accounting.

As we mentioned, accurately maintained financial recording and reporting is critical to the long-term success of your nonprofit. With FinancePal, you can expect nonprofit accounting and bookkeeping services designed to make managing your finances easier. With our bookkeeping and accounting services, you’ll benefit from:

And most importantly, it will give you more time to push your organization’s mission forward instead of crunching numbers.

From the granular financial details to big-picture takeaways, accounting is an important aspect of accomplishing your nonprofit’s goals. Refining these processes as your organization grows and ensuring the utmost accuracy, timeliness, and transparency is the key to successful nonprofit accounting.

Figuring out how to navigate these processes and other financial obligations might seem like an impossible feat when you’re starting out. However, you don’t have to take on this burden alone. By using the information and resources in this guide and getting help from FinancePal, you’ll be in the best position to take your organization to the next level.

Let’s work together to make your nonprofit’s mission possible, starting with a strong financial foundation.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.