Written by: Jacob Dayan

It’s a saying almost as old as recorded history: never borrow more than you can payback. Since the days of ancient Mesopotamia, businesses have been borrowing money to bolster operations with the intent of resolving the debt with the ensuing cash flow. In modern times, companies can determine how their cash flow compares to their debt using a metric called debt service coverage ratio, or DSCR. This article examines the debt service coverage ratio, what it means, how to calculate it, and why it’s essential.

In personal, government, and corporate finance, the debt service coverage ratio is a metric that can be used to determine whether a debtor has enough capital to pay off a creditor. In the business world, the debt service coverage ratio measures how much of a company’s available cash flow can be used to cover its current debt obligations. The debt service coverage ratio is an essential tool for investors, who can use this metric to determine whether a business can settle its debts using cash flow.

Whether in the context of personal finance, government operations, or corporate finance, the debt service coverage ratio reflects the ability to pay off debt obligations using a specific amount of income.

Before approving a loan, lenders will typically assess a borrower’s debt service coverage ratio. The minimum debt service coverage ratio a lender will demand will vary based on the prevailing economic conditions. In a growing economy where credit is more readily available, lenders may, in turn, be more lenient with their minimums. It is important to note that a glut of less-qualified borrowers can affect macroeconomic stability. This happened in the run-up to the 2008 financial crisis.

If a debt service coverage ratio is less than 1, it indicates negative cash flow — and that the borrower will be unable to cover or pay current debts without falling back on outside help or taking on more debt.

Let’s take an example: a small business has a debt service coverage ratio of 0.98, which means that, at current net operating income, the borrower will only be able to cover 98% of their debt obligation annually. In this scenario, this would mean that the business owner would need to invest personal funds every month to keep their business above water — or worse, take on more debt. Most lenders take a rather negative view on a negative cash flow; however, if the business has enough resources or backing, they may relent and provide additional support.

Suppose the debt service coverage ratio is too close to 1. In that case, it means that the business is in a precarious position — any decline in cash flow for any reason could cause the company to lose the ability to service its obligations. In some cases, lenders can require a borrower to maintain a minimum debt service coverage ratio for the duration of the loan. In fact, some loan agreements contain a provision that considers falling below the agreed-upon debt service coverage ratio a default.

If a company maintains a debt service coverage ratio greater than 1, it means that the business has enough cash flow to pay its current debt obligations. This is an ideal scenario for lenders and businesses alike.

The debt service coverage ratio is a ubiquitous metric, often referenced by companies and banks when negotiating loan contracts. For example, a company seeking to obtain a line of credit might be obligated to keep its debt service coverage ratio above 1.2. If the DSCR falls below this mark, the lender may consider the loan to be in default. In addition to serving as a crucial risk-management metric for banks, debt service coverage ratios can also provide insights to analysts and investors regarding a business’s financial health.

What is considered a good debt service coverage ratio varies based on a company’s sector, competitors, and development stage. For instance, a smaller company in its nascence might face lower expectations in regards to debt service coverage ratio expectations compared to a mature, well-established business. However, a good rule of thumb is that a debt service coverage ratio above 1.25 is considered strong — and ratios that fall below 1.00 indicate that a business could be in trouble.

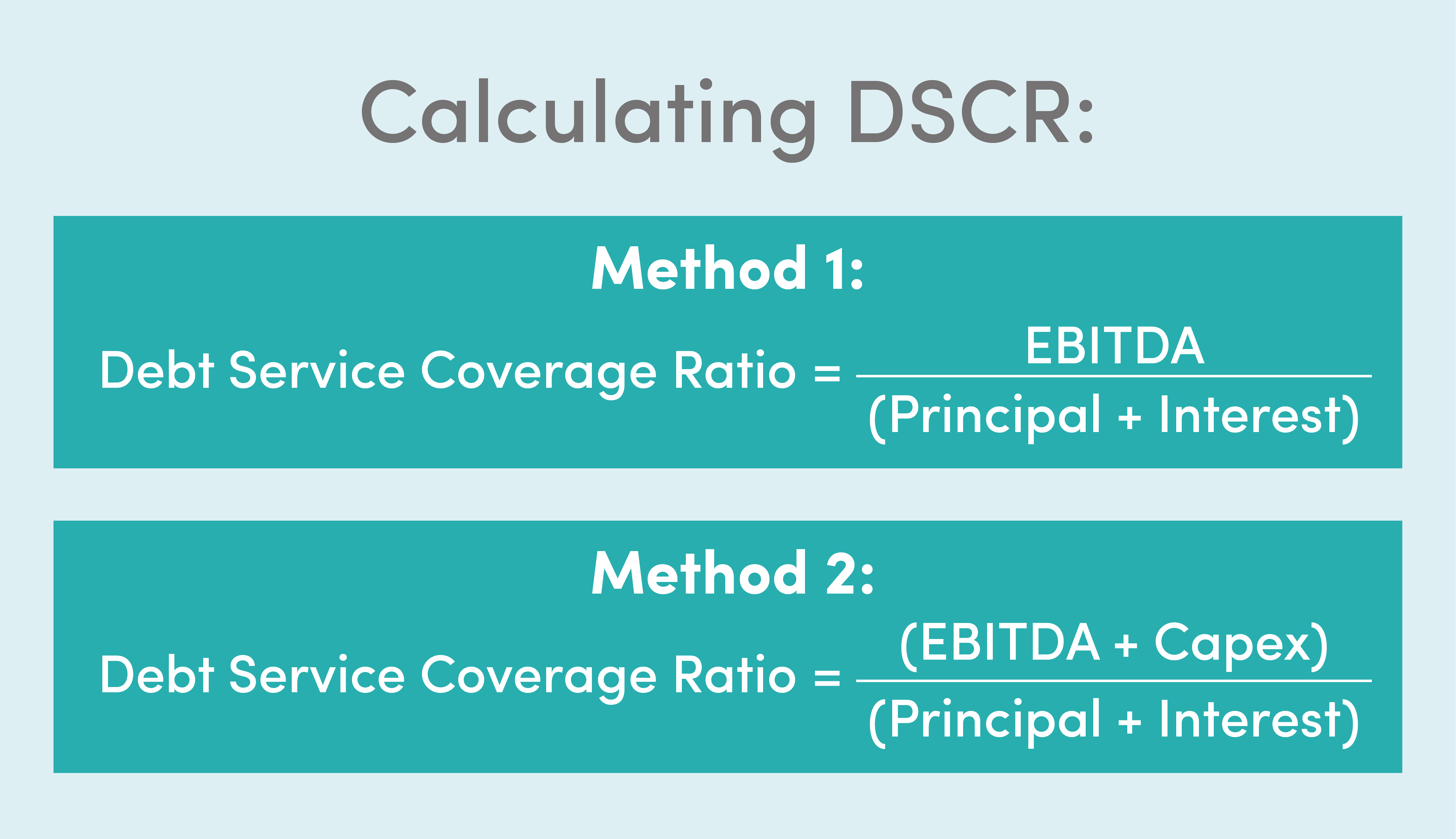

There are two ways to calculate your debt service coverage ratio where:

To find your DSCR using the first method, add your interest amount and your principal amount. Then, divide your EBITDA by the resulting sum. This formula will look like this:

Debt Service Coverage Ratio = EBITDA / (Principal + Interest)

To find your DSCR using the second method, add your EBITDA and your Capex. Then, divide the sum by your interest amount plus your principal amount. This formula should look like this:

Debt Service Coverage Ratio = (EBITDA + Capex) / (Principal + Interest)

Because capital expenditure (Capex) is not expensed on the income statement (rather, it is considered as an (investment), some businesses may feel more inclined to use the first formula.

Let’s say a local food truck restaurant wants to purchase a brick-and-mortar location. The food truck owner seeks to obtain a mortgage loan from a local bank. The lender needs to determine the food truck’s debt service coverage ratio. The reason for this is to determine whether the food truck owner will be able to pay off their loan as the physical location generates income.

The food truck owner predicts net operating income to be around $800,000 per year, and the lender notes that debt service will be $300,000 per year. In this case, the debt service coverage ratio formula will look like this:

Debt Service coverage ratio = $850,000 / $300,000 = 2.83

This means the food truck owner can comfortably pay off the debt obligation.

As opposed to the debt service coverage ratio, the interest coverage ratio (ICR) measures whether a company’s cash flow will cover the interest it must pay on all debt obligations during a specific period. Much like with a DSCR, the ICR is expressed as a ratio.

To calculate the interest coverage ratio, divide the EBITDA by the total interest payments due for that same period, like so:

Interest Coverage Ratio = EBITDA / Interest

The higher the ratio of EBITDA to interest payments, the more financially stable the company. This metric only considers interest payments — not payments made on principal debt balances — which lenders may require.

The debt service coverage ratio is a more comprehensive metric. The DSCR measures a company’s ability to meet its minimum principal and its interest payments — including sinking fund payments — for a given period. Because the debt service coverage ratio takes principal payments and interest into account, the debt service coverage ratio provides a more holistic, comprehensive overview of a business’s financial health.

It is easy to think of small business accounting and bookkeeping as necessary evils to keep the IRS off your back. But a highly competent financial team can provide essential business insights, find crucial tax savings, and allow business owners to spend less time stressing the financials and more time serving customers. Sign up to get a custom quote today for FinancePal’s professional financial services.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.