Written by: Jacob Dayan

There are five types of financial statements that are integral to the smooth operation of a business of any size. These are: (1) the profit and loss statement; (2) the balance sheet; (3) the cash flow statement; (4) the statement of change in equity; and (5) the statement of financial position.

In this article, we delve into one of the most critical of the five: the profit and loss statement. Due to the information and insights it provides, the profit and loss statement is indispensable for owners of businesses, no matter the size.

The profit and loss statement (also called the income statement or shortened to “the P&L statement”) includes vital cashflow information such as revenue, costs of goods sold and operating expenses during a particular period of time. It also shows the resulting net income or loss for that specific period.

An operating expense includes expenses such as payroll, rent, and non-capitalized equipment — basically, any expense related to day-to-day operations. A non-operating expense includes expenses unrelated to the main business operations such as depreciation or interest charges.

In a similar vein, operating revenue includes revenue generated from primary business activities while non-operating revenue includes revenue not pertaining to core business activities.

There are five main components to an income statement: (1) revenue; (2) expenses; (3) gross profit or EBIDTA; (4) expenses; and (5) net profit. Typically, profit and loss statements are assessed on a monthly, quarterly, and annual basis.

A profit and loss statement is calculated by totaling all of a business’s revenue sources and subtracting from that all the business’s expenses that are related to revenue. This can be boiled down to the basic formula used for calculating profit:

Profit = Revenues – Expenses

While the equation itself is simple, it contains more information than meets the eye. Here is an example of an effective process to prepare a proper profit and loss statement.

To help visualize this process, the supposedly simple equation listed above can be expounded upon to produce this two-step equation:

EBIDTA = Revenues – Expenses

EBIDTA – Interest – Taxes – Depreciation – Amortization = Profit

Being able to accurately interpret a profit and loss statement is an important skill for any business decision-maker. This is because the insights gleaned from the P&L can help inform choices regarding your business’s future.

Profit and loss statements are especially useful for tracking key performance indicators (KPIs) such as breakeven point, gross and net profit margins, debt ratios, liquidity ratios, working capital ratios, return on investment (ROI), inventory turnover, accounts receivable, accounts payable turnover, and expenses ratios, among other performance indicators.

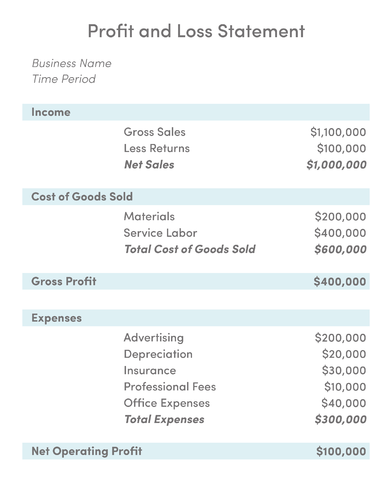

We at FinancePal understand that visualization is a powerful tool when it comes to understanding concepts. That is why we provided you with an example of a small business profit and loss statement.

Most small business owners started their companies because they were experts in providing a good or a service — not at balancing a book. Nevertheless, good accounting and bookkeeping are imperative to manage any company’s financial health, guide decisions for growth initiatives, and ultimately ensure your business is in good standing with its tax obligations throughout the year. However, it can also be tedious, complicated, and time-consuming — especially for those who own smaller businesses or sole proprietorships. Additionally, the IRS can be unforgiving when it comes to mistakes — for instance, filing your payroll taxes just one day past the deadline incurs a 2% penalty. To make matters worse, these penalties can add up to a hefty 15% of the initial amount owed.

There is good news, however; outsourcing accounting and bookkeeping to an outside firm is a simple and rewarding process that allows business owners to spend less time worrying over books and more time, well, running their businesses. Every day, more and more business owners trust FinancePal’s small business accounting, bookkeeping, and payroll services.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.