Written by: Jacob Dayan

Simply put, income is any money you receive on a regular, one-time, or occasional basis. For instance, a weekly paycheck is an example of regular income for an individual or household. Likewise, prize winnings or gifts are examples of a one-time or an occasional income. As far as the IRS is concerned, the average taxpayer has two types of income: taxable and non-taxable.

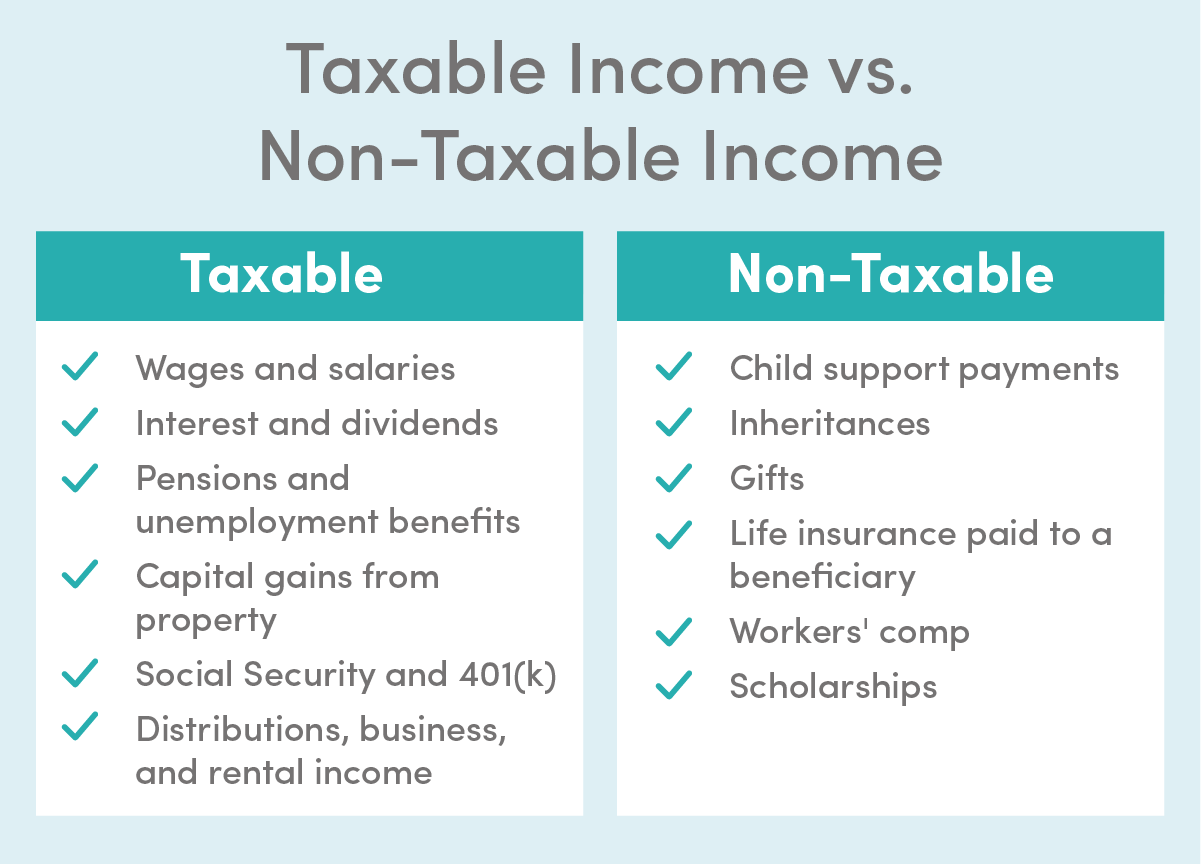

All taxable income is subjected to federal or state income tax. Even income derived from fraud, theft, or other illegal activities is supposed to be taxed, although this is rarely paid for obvious reasons. The most common sources of taxable income are:

On the other hand, non-taxable income is income that is not subjected to federal or state income tax. Common sources of this type of income are child support payments, inheritances, gifts, life insurance paid to a beneficiary, worker’s compensation, garage sale proceeds, scholarships, and welfare benefits.

This article will talk about the taxable income formula, the calculation process, ways to determine taxable income, and more. Use the links below to jump ahead to a specific section.

Individuals and businesses use the taxable income formula to calculate the total income tax. Bear in mind that individuals and companies use the procedure differently, but the principle remains the same.

For instance, individuals use the formula to deduct income tax from their total income earned. On the other hand, businesses use the formula to deduct expenses from their total revenues. Here is the taxable income formula for individuals.

Taxable income formula = total income – exemptions – deductions

It is a simple formula that requires you to calculate taxable income by deducting your total exemptions and deduction from your total gross income. Conversely, for companies, the process requires deducting different entities from the company’s gross sales.

For example, you will deduct the cost of products or services sold, business operations’ expenses, and interests from your total revenue. Similarly, it is crucial to adjust your credit and tax deduction to achieve an accurate final income. Here is the formula modified for businesses:

Taxable income formula = gross sales or revenues – the cost of products or service – operating expenses – interest paid on debts – tax deduction/credit

All businesses, including small and medium-sized enterprises, file annual tax returns with the IRS. The purpose is to pay income taxes on the revenues generated or profits earned. It is important to note the filing requirements depend on your business status, the type of organization you run, and federal or state requirements.

It is crucial to understand the process of taxable income calculation. Otherwise, you can’t determine the income taxes due, leading to various discrepancies and challenges. At the same time, when you fail to determine or calculate your taxable income, you can’t track or evaluate your company’s net profit. Here are the steps to calculate taxable income.

Calculating your taxable income requires careful planning and preparation, meaning you need to collect all necessary documents and records. The process begins at the start of the tax year, allowing you to gather the required information and make it available for the tax filing season.

You will need cash register records, bank statements, and sales receipts to document your company’s revenues. Remember, you will also need statements and receipts for expenses. In addition, gather payroll documents and records, such as employees’ mileage logs, if applicable.

Determining gross revenues is an essential step for calculating your company’s taxable income. It involves gross sales and allowances for products or services, including returns and discounts.

Add interests received and sales profits of investments and assets to this figure. For example, your company’s gross revenue is $2.6 million if you had sales of $2.5 million and received $100,000 interest on bank deposits.

If you run a retail company or business, you determine sales revenue from your suppliers’ resale of purchased goods. Remember, some companies sell products, while others offer both products and services. Likewise, some businesses, such as a web development company, an accounting firm, and a law firm, provide only services.

Some businesses, such as beauty salons and spas, offer both products and services. If your company sells products to customers, you must subtract your products’ costs from your gross revenue.

For example, if you are a retailer and paid $500,000 for the products you sold, subtract this amount from your $2.6 million gross revenue. Your taxable income is the excess amount after the calculation.

The last step of the process involves deducting allowable expenses from the gross revenues, especially after subtracting the goods’ cost. Allowable expenses usually include interest on debts, rent, utilities, service fees, equipment repairs, payroll, and accounting processes.

Employee benefits, retirement plan costs, wages, and payroll taxes are other expenses you need to include in the allowable costs. For example, if you have $100,000 total business expenses, subtract the amount from gross revenue. If you fail to generate enough revenue, you may have a negative taxable income.

Related Reading: Balance Sheet vs. Income Statement

Calculation of your taxable income starts with gross income. After analyzing your gross income, you subtract excluded income, personal exemptions, and allowable deductions. You must determine your accounting method in determining the number of items of income and deductions for any taxable year.

For almost all individuals and business owners, the accounting method involves cash receipts and disbursement strategies. For example, you will receive the income and spend the deductions. According to the Internal Revenue Service (IRS), the following income sources are acknowledged as taxable income:

According to the IRS, tax credits decrease your taxes, while deductions lead to reduced amounts of taxable income. For example, you can deduct items like alimony, retirement contributions, and certain medical or business expenses.

If your total gross revenue is $50,000 and you claimed $17,000 in tax deductions, you will have $33,000 in taxable income. Bear in mind that this figure determines your tax bracket, meaning you will have to pay the amount you failed to pay in payroll taxes. Tally your total deductions and subtract this figure from your earnings to calculate your tax bracket.

In addition, the IRS offers a handy withholding estimator tool, which can help paint a clear picture of how much taxes will be withheld.

Taxable income refers to your earnings after subtracting all types of taxes or liabilities from your earned revenue or income. The basic principle of the taxable income formula remains the same for individuals and businesses.

The difference is the number of entities used in the formula. For instance, the formula is simple for individuals and slightly complex for businesses. Here is an example of the individual taxable income formula.

A man derives income from three sources: a web development job, salon business, and rental property. From his regular job, he makes $100,000 in total income after all potential exemptions and deductions. His income from the salon business is $120,000. Likewise, the property rental income is $80,000. He has invested in the standard tax deduction for $12,400. He calculates his total gross income as:

Gross total income = $100,000 + $120,000 + $80,000 = $300,000

Total Taxable income = 300,000 – 12,400 = $287,600

Taxable income is a legal way to keep your cash flow streamlined after determining and paying your tax liabilities. Individuals and businesses must know and use the taxable income formula to calculate their gross or total income and calculate their taxable income.

Outsourcing your accounting and bookkeeping to professionals is the most efficient and most cost-effective way to save your business money come tax time. The small business accounting services and sales tax consulting services at FinancePal have helped thousands of small businesses with their financials and taxes on a convenient subscription basis.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.