Written by: Jacob Dayan

In the big picture, farming and agriculture are the foundations upon which the human race can achieve actualization; cities, nations, and societies cannot exist without agriculture. But in the smaller picture, farming is a trade, a way of life — and a business. And because it is a business, farming is subject to the same rules and regulations all other American businesses must face.

The importance of proper accounting for agriculture business and farming is difficult to understate. As with other businesses, having your books in order and your cash flow accounted for is imperative to maintain good standing with the IRS.

Read More: Bookkeeping vs. Accounting

There are a few substantial differences between agricultural accounting and business accounting, however. These differences are most apparent when it comes to reporting on the profit-and-loss statement (PnL) and the balance sheet. The majority of agricultural business accounting is reported on a cash basis. This makes it much more straightforward and simple than most business accounting, which is reported on an accrual basis. Reporting on an accrual basis allows entries of revenue and expense in the absence of cash transactions allows for consistency in financial reporting across companies and industries. However, this method is much more convoluted than reporting on a cash basis.

Under some circumstances — such as if revenue exceeds $5 million on the PnL statement — agriculture businesses may be required to utilize either the accrual method of accounting or a hybrid of accrual and cash method.

The cash method of accounting is the most common method among farm and agricultural businesses as it is simpler and more straightforward than the accrual method.

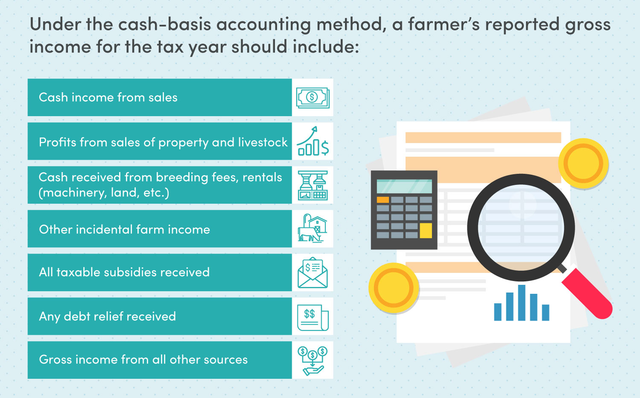

Using the cash method, a farmer’s reported gross income for the tax year should include:

Under the cash method, income is considered constructively received the moment it is credited to a farmer’s account, made available without restriction, or received by an authorized agent acting on behalf of the farmer. It is important to note that income is not considered constructively received if receipt of the income is subject to substantial restrictions or limitations.

A farmer cannot avoid cashing checks or postpone taking possession of any taxable property to avoid paying tax on the income. Also, a farmer must report the income in the year the money or property is received or made available to him/her without restriction

However, when a farmer sells an item under a deferred payment contract that calls for payment the following year, there is no constructive receipt in the year of sale.

Generally, a farmer cannot deduct expenses paid in advance. This rule applies to any expense paid far enough in advance to, in effect, create an asset with a useful life extending substantially beyond the end of the current tax year.

Under the accrual method, revenue and expenses are recorded as they are earned, regardless of when the money is received or paid.

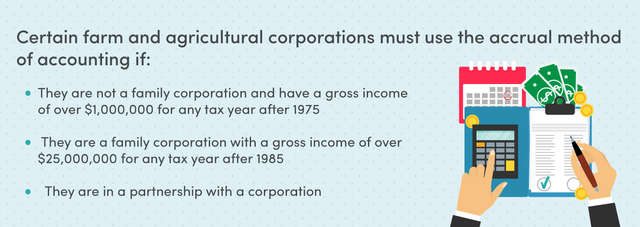

Certain farm and agricultural corporations must use the accrual method of accounting if:

Under the accrual method, uniform capitalization rules apply to all costs of raising crops, even if the pre-productive period of raising crops is two years or less. Uniform capitalization rules also apply to the costs of raising animals.

A farmer can determine allocated costs under the uniform capitalization rules by using either the farm-price or the unit-livestock-price inventory method. If a farmer values livestock inventory at or lower than market value, IRS approval is not required to change to the unit-livestock-price method. However, if a farmer values livestock inventory using the farm-price method, then they must obtain IRS permission to change to the unit-livestock-price method.

A farmer must use the same method for all inventories, including:

In the agriculture industry, all accounting must follow the Generally Accepted Accounting Principles (GAAP) guidelines to avoid the aforementioned fees, fines, and criminal charges. GAAP refers to a common set of accounting principles, standards, and procedures issued by the Financial Accounting Standards Board (FASB).

There are ten main principles of GAAP.

– The Principle of Regularity: the adherence to GAAP rules and regulations as a standard.

– The Principle of Consistency: the application of the same standards throughout the reporting process to ensure financial comparability between periods.

– The Principle of Sincerity: the provision of an accurate and impartial depiction of a company’s financial situation.

– The Principle of Permanence of Methods: the commitment to using procedures used that are consistent, allowing comparison of the company’s financial information.

– The Principle of Non-Compensation: the reporting of both positives and negatives with full transparency and without the expectation of debt compensation.

– The Principle of Prudence: the commitment to using fact-based financial data representation without speculation.

– The Principle of Continuity: the commitment to operating a business while simultaneously valuing assets.

– The Principle of Periodicity: the reporting of revenue during the appropriate accounting period.

– The Principle of Materiality: the commitment to fully disclose all financial data and accounting information in financial reports.

– The Principle of Uberrimae Fidei (utmost good faith): the commitment to honesty in all transactions.

All publicly-traded companies must adhere to GAAP, per the Securities and Exchange Commission (SEC). While not required by law for non-publicly traded companies, GAAP compliance is critical for favorable views from creditors and lenders. Most banks and financial institutions require GAAP-compliant financial statements when issuing business loans.

GAAP-compliance is usually determined by an external audit.

Accounting for agriculture can be more complex than accounting for other businesses when it comes to assets, liabilities, costs, and revenue.

If arable land is managed properly, its value may increase. Conversely, mismanaged land can depreciate. The cost of maintaining your land should always be accounted for. Keep track of all money spent on fertilizer, irrigation, drainage, soil pH management, weed removal, and pest control.

As a farmer, your land is one of your most important assets. All money spent on land maintenance is considered a business spend.

Agriculture is critical to the self-sufficiency of any nation. For that reason, most governments provide subsidies to their farmers.

When it comes to agricultural subsidies, the only constant is change; the government may subsidize milk production one year, and pork production the next. Make sure to keep track of subsidies and account for them, especially if they’re made as direct payments.

If you have a good handle on agricultural subsidy timeframes, you can inform your long-term strategy to maximize your revenue.

For accounting purposes, crops are treated differently than livestock. It’s also important to note that not all livestock is treated the same, either. As defined by Accounting Standards, crops are grains, vegetables, fruits, berries, nuts, and fibers. Livestock is defined as cattle, sheep, hogs, horses, poultry, and small animals. Production animals are defined as animals that provide a service or primary product other than their offspring. Examples of production animals include dairy cows for milk, poultry for meat and eggs, and sheep for meat and wool.

Crops are considered inventory. Both the direct and indirect costs that go into the growing of crops accumulate until the crop is harvested. Post-harvest costs are usually estimated, accrued, and allocated to the harvested crop. Additional costs of growing crops, such as soil preparation, fertilizer, or pesticides are also allocated to the harvested crop.

Production animals with short lives are usually considered inventory; the shorter lifespan (operating cycle) lends well to the inventory designation. All other livestock, such as breeding animals, cattle, sheep, goats, and longer-lived production animals are usually considered assets. Both the direct and indirect costs of care and development are tracked and accumulated until maturity. Then, they are capitalized on the asset.

Land-use changes are closely tied with economic trends. Some examples include a cultural shift towards vegetarianism, which can lead to pasture being converted to non-animal production. Additionally, as previously mentioned, the government will sometimes subsidize certain crops. Record all land-use changes if you plan on taking advantage of temporary crop subsidies.

Record any changes in land use, no matter how small. Make sure to adjust your land value, if necessary.

The government adheres to their time frames when it comes to classifying animals into maturity groups. If livestock is born late, early, or out-of-season, they run the risk of not being compliant with the government’s livestock age standards. If you don’t carefully plan livestock breeding with the government’s age timetables in mind, you could quickly end up with a huge accounting headache.

Most farmers will be very familiar with their current stock; it’s part of the job, after all.

But stock numbers are anything but static, especially during tough seasons and lambing or calving season.

Recording stock changes is imperative to have a healthy account of your farming business.

The cost of new equipment for your farm or agricultural business can be offset against your taxes. But with regular wear and tear, this equipment will depreciate — this can muddle any tax situation as the value of your equipment will affect your tax bill.

It’s important to record any losses in your accounts because it will reduce your overall tax bill; You cannot be taxed on something that’s been destroyed or on a small business profit that you haven’t made.

In the farming and agriculture business, you will have losses. Crops will fail and accidents will lead to loss of productivity. And all farmers have to grapple with the weather; droughts and storms alike can wreak havoc on your inventory. Just this August, a derecho event destroyed an estimated 200–400 million bushels of crops in Iowa alone, reducing the state’s projected yield by up to half.

There are several methods of measuring farm productivity. The first is the Economic Farm Surplus, which is a favorite of accountants. The Economic Farm Surplus can help farmers gauge performance based on inventory and asset metrics.

You can also gauge your farm’s profitability by looking at the month-to-month profit on your PnL. The one downside to this method is that it is not necessarily indicative of future performance.

The cost-per-product ratio is also a good key performance indicator (KPI) that will help you understand your farm’s performance. In the dairy industry, for example, a popular KPI is the expense per kg of milk solids.

Another useful KPI is revenue per unit of area — a measure of how much revenue or profit is generated for each unit area of farmland, such as dollars per hectare. While this gives a good idea of current farm performance, it can gloss over underlying costs; as farmland with recent development will perform better under this KPI but may not bring in as much profit as less fecund farmland that requires less maintenance.

Despite all these methods and KPIs, there is only one tried-and-true method to accurately gauge your farm’s profitability — accounting professionals. Accounting professionals, such as the pros at FinancePal, have a wealth of experience and a knack for analyzing numbers in creative ways to determine the true performance of a business.

While farming may be seen as a rustic and ancient way of getting back to the roots of nature, effective agriculture is inundated with cutting-edge technology. Whether it be machine-learning software that can build the best planting strategy or an upgraded tractor that requires little maintenance, it is always a good idea to invest in technology.

On top of both hard and soft technology, the internet can be a farmer’s best friend. Farmers can — and should — utilize the internet to check stock prices and trends, research government subsidy initiatives, access documentation such as kill sheets, view long and short-range weather forecasts, and utilize apps on the cloud to save storage space.

The internet also makes it incredibly easy to outsource your accounting to experts.

Having your books in order is imperative for any business owner in the agriculture and farm sector. However, it can also be tedious, complicated, and time-consuming — especially for smaller farms. Additionally, the IRS can be unforgiving when it comes to mistakes — filing your payroll taxes just one day past the deadline incurs a 2% penalty. These penalties can add up, too — up to a hefty 15% of the initial amount owed.

If you felt confused or overwhelmed reading this article, don’t fret; outsourcing accounting and bookkeeping to an outside firm is a fairly simple and rewarding process that allows farmers and agriculture business owners to spend less time worrying over books and more time on the farm. Every day, more and more small businesses make the switch to outsourced bookkeeping and accounting with FinancePal.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.