Written by: Jacob Dayan

Depending on who you ask, businesses have been using the double-entry accounting method for a thousand years or more, with both Italians and Koreans claiming its invention. This method has endured because, well, it works; double-entry shines where single-entry fails. And while single-entry accounting has its uses for independent contractors or sole proprietorships, it is ineffective for small businesses bookkeeping.

In addition to being more effective for small businesses than single-entry, double-entry accounting follows the accounting rules laid out by GAAP (Generally Accepted Accounting Principles), which are in turn laid out by the Financial Accounting Standards Board (FASB).

In this article, we break down what exactly double-entry accounting is.

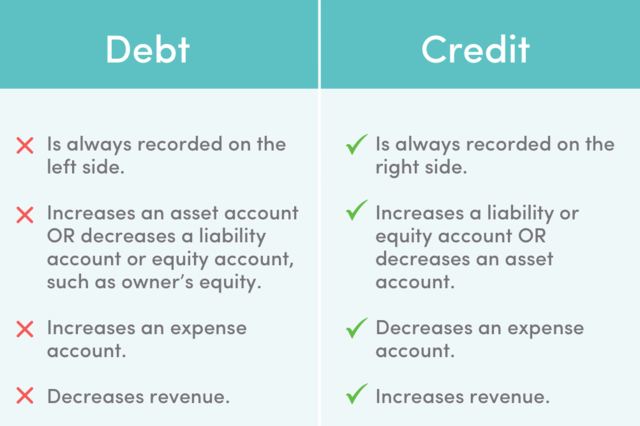

Put simply, double-entry accounting is a ubiquitous bookkeeping system that tracks where money comes from and where it goes. The main tenet of double-entry accounting is after a financial transaction, each entry made into an account has a corresponding opposite entry made into a separate account. This produces two entries — thus, the name. When shown side-by-side in a ledger, the entry listed on the left side is referred to as a debit entry while the entry shown on the right side is called a credit entry.

The differences between debit and credit are as follows:

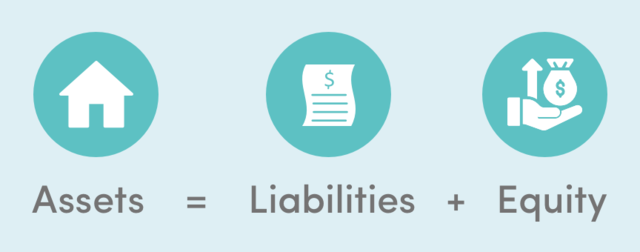

Each entry affects two separate accounts. For example, when you sell a physical good, your cash account goes up to reflect the sale while your inventory account goes down to reflect the good sold. Double-entry accounting makes use of the quintessential Accounting Equation:

The Accounting Equation is simple and concise, but it can be expounded and elaborated upon to produce more complicated financial documents such as the balance sheet. You may have noticed the similarities between this equation and the information presented in a balance sheet, where a company’s total assets are equal to the total liabilities plus shareholders’ equity.

Throughout the accounting process, both sides of the equation must remain balanced.

An example of this in action would be a multi-employee plumber business purchasing work vans on credit for $100,000. The vans have an estimated useful life of eight years. Because the plumbing business acquired assets (the vans), a debit of $100,000 is made to the asset account. And because the vans were purchased on credit, a credit of $100,000 is made to the accounts receivable. Both sides of the equation remain balanced.

These days, most commonly-used accounting software does the double-entry heavy lifting for you.

Most small business owners started their companies because they were experts in providing a good or a service — not at balancing a book. In addition, small business and startup accounting can be difficult and multi-faceted. Nevertheless, good accounting and bookkeeping are imperative to manage any company’s financial health, guide decisions for growth initiatives, and ultimately ensure your business is in good standing with its tax obligations throughout the year. However, it can also be tedious, complicated, and time-consuming — especially for those who own smaller businesses or sole proprietorships. Additionally, the IRS can be unforgiving when it comes to mistakes — for instance, filing your payroll taxes just one day past the deadline incurs a 2% penalty. To make matters worse, these penalties can add up to a hefty 15% of the initial amount owed.

There is good news, however; outsourcing accounting and bookkeeping to an outside firm is a simple and rewarding process that allows business owners to spend less time worrying over books and more time, well, running their businesses. Every day, more and more business owners trust FinancePal’s small business accounting services.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.