Written by: Jacob Dayan

Accounts payable is a crucial concept for any business operating with credit—every time a business purchases from a supplier on credit, an accounting entry is made for accounts payable. Some larger businesses house entire departments dedicated solely to managing the accounts payable. These departments are typically responsible for resolving payments owed by the company to creditors.

Accounts payable departments aren’t just responsible for paying bills and invoices; they typically undertake at least three essential functions in addition to paying bills.

In any company that requires staff to travel, the accounts payable department will manage their travel expenses. This may include placing reservations for airlines, car rentals, and hotels. Depending on the business’s responsibility structure, the accounts payable department may process requests and disburse funds to cover travel expenses. After instances of business travel transpire, the accounts payable department typically settles the difference between funds distributed and actual spend.

Accounts payable is responsible for distributing internal payments, administering minor cash flow matters, and distributing sales tax exemption certificates. To corroborate reimbursement requests, a business’s employees must turn in either a manual log report or receipts—or both. Trivial expenses such as out-of-pocket office supplies, postage, or a small client lunch are considered minor cash flow matters and handled by Accounts Payable. On top of this, Accounts payable is in charge of sales tax exemption certificates—special certificates issued to managers to ensure qualifying business purchases don’t include sales tax in the total.

The Accounts payable department is responsible for organizing and maintaining vendor information, payment terms, and IRS W-9 information. Accounts payable either handles pre-approved purchase orders or accounts payable verifies purchases after the point of sale depending on a business’s responsibility structure. The Accounts payable department also manages end-of-month aging analysis reports. These reports provide upper-level management with a clear picture of business credit.

In addition to the three functions mentioned above, the accounts payable department reduces costs by recognizing credit patterns and developing strategies to save money in the credit department. For example, some invoices contain inherent discount periods. Accounts payable will settle credit liabilities within the defined timeframe to receive the discount. In addition, accounts payable comprises a direct line of contact between a business and its vendor’s representatives. Maintaining robust and positive business relationships between the company and its vendors may lead to certain benefits, such as relaxed credit terms.

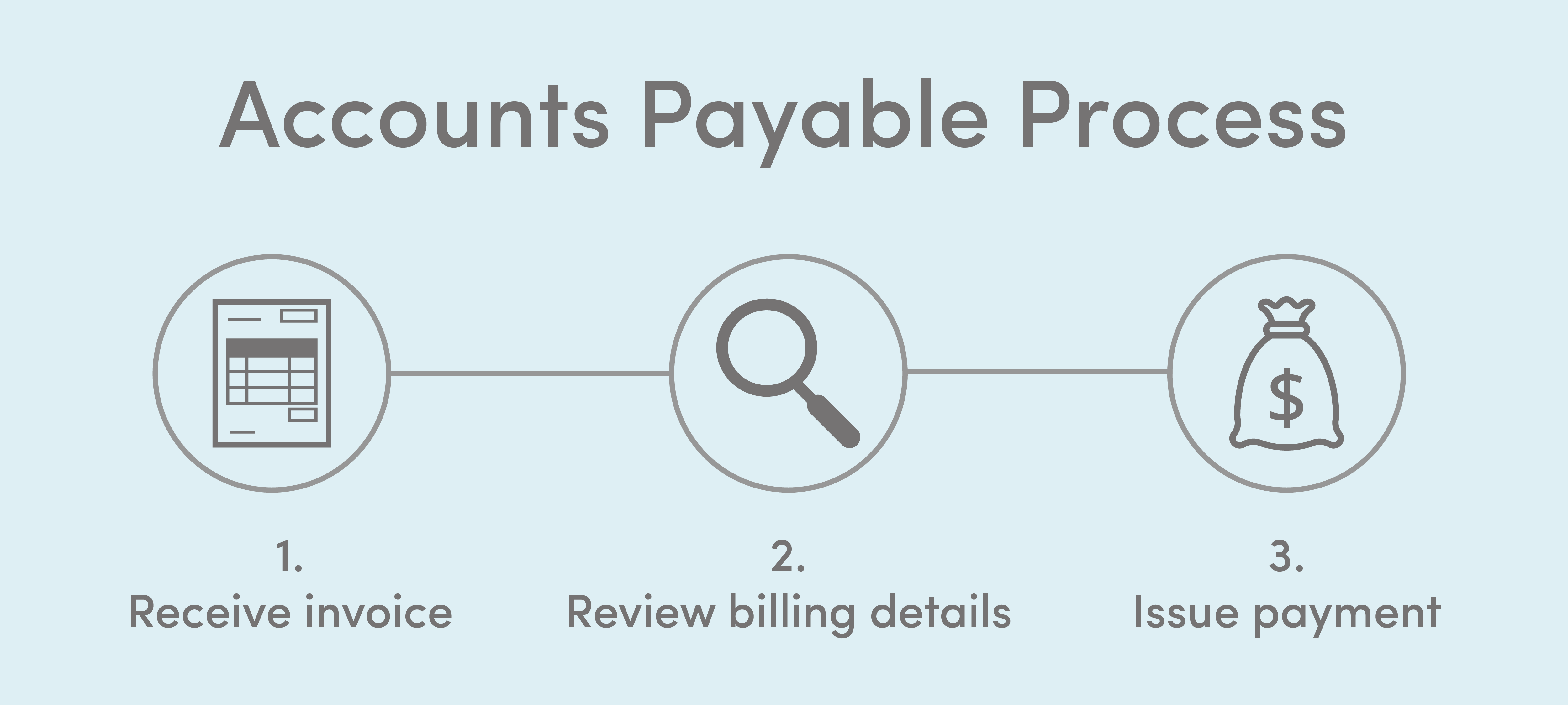

The accounts payable department must follow what is known as the accounts payable process. The accounts payable process is a set of procedures undertaken while making payment to a vendor. Due to the sheer volume of transactions that many accounts payable departments handle, these guidelines are essential to maintaining consistent, accurate reporting.

The accounts payable process is as follows:

To ensure the safety of the company’s cash and assets, the accounts payable process must have internal controls to prevent paying a fraudulent or inaccurate invoice—or accidentally paying a vendor invoice twice.

Accounts payable is listed on a company’s balance sheet as a current liability. Accounts payable consists of a collection of short-term credits extended by a business’s vendors and creditors. An accounts payable department also manages internal payments for business expenses, travel, and minor cash flow matters. Compare balance sheet vs. income statement.

Due to tighter margins, many smaller businesses do not retain dedicated accounts payable departments because financial professionals can be costly. However, at FinancePal, we seek to change the narrative that small businesses cannot afford dedicated financial professionals. Outsourcing your accounting and bookkeeping matters, such as accounts payable, to professionals is the most efficient and most cost-effective way to save your business money come tax time. Accounting for startups provided by FinancePal has helped thousands of small businesses with their financials and taxes on a convenient subscription basis.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handle it.

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.