Non-Profit Accounting & Bookkeeping Services

US Based

Available 24/7

Dedicated Team

At FinancePal, our client-centered, results-oriented approach to accounting services and catch up bookkeeping services can help any non-profit achieve their objectives. Our services are affordable and flexible; we cater to nonprofits regardless of sector, revenue, or staff size.

Accounting Services for Nonprofits:

- Inventory statements

- Financial statement preparation

- Financial statement compliance

- Asset and staff management

- Audit defense

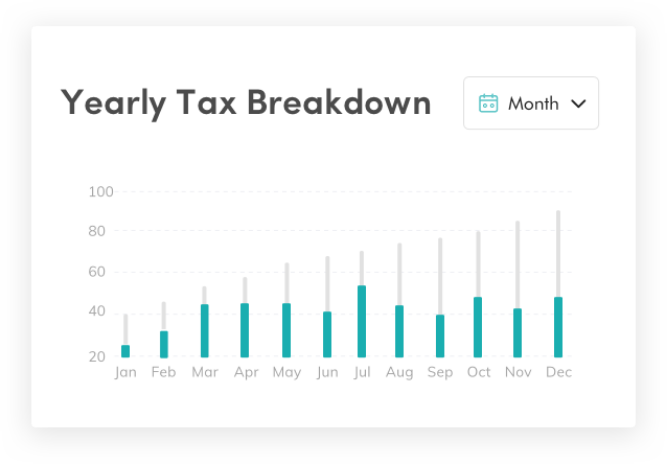

- Quarterly Tax Filing

Bookkeeping Services for Nonprofits:

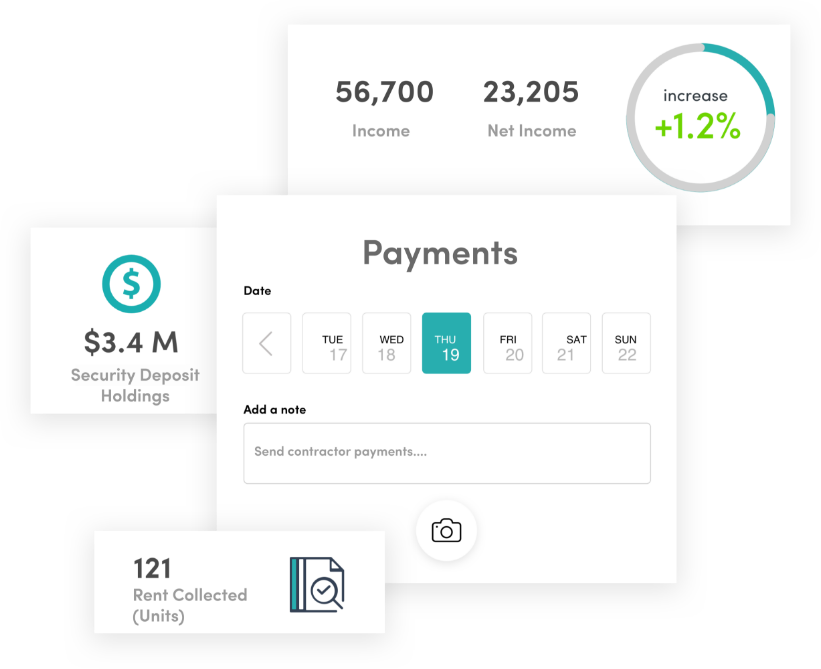

- Accounts payable & receivable

- Daily General ledger upkeep

- Time tracking & job cost reporting

- Payroll

- Bank account and credit card reconciliation

- Statements of financial position

- Statement of activities

Let us help you take your nonprofit to the next level…

At FinancePal, our experienced non-profit accountants are very familiar with the various aspects of accounting for non-profits of all sizes and sectors.

It’s easy to think of accounting as a necessary evil to keep the IRS off your back. however, good accounting is the key to better financial decision-making, increased cash flow, and improved asset management.

Tax Considerations for Non-Profits

Non-profit organizations are taxed differently than for-profit companies and corporations. Non-profits fall under Section 501, which exempts them from federal taxes. Before you apply for exempt status from the IRS, you must obtain non-profit status from your respective state.

Tax-exempt nonprofits are still subject to employment, sales, real estate, and other applicable taxes. Consult with an expert; different non-profit organizations will be on the hook for different taxes.

Audit Defense

Even if you do everything right, your non-profit may still be selected for audit by the IRS. When this happens, meticulous accounting will save your organization from heavy fines, penalties, and further inquiries. Our accountants are trained in audit defense and know how to properly handle dealings with the IRS.

![]()

Considerations for Non-Profit Accounting

Non-profit organizations must use fund accounting, an accounting system specialized for recording resources whose use has been limited by the donor. Fund accounting is important because nonprofits will often receive funds earmarked for a specific purpose by the donor.

Additionally, non-profit organizations must employ the use of purchase orders in order to provide detailed and adequate documentation of how funds are used.

Non-profit organizations must also account for what is known as in-kind donations. In-kind donations are donations that are charitable gifts that do not consist of money. In-kind donations are valued at market value. The IRS defines market value as “what willing buyer would pay and a willing seller would accept for the property, when neither party is compelled to buy or sell, and both parties have reasonable knowledge of the relevant facts.”

For example, if an attorney volunteers their time for your non-profit, this in-kind donation is valued at their regular hourly rate times the hours they gave.

Small in-kind donations (defined by the IRS as totaling under $5,000) can be valued internally. However, in-kind donations totaling over $5,000 must be appraised by an independent expert.

Staff Management

If you are in charge of a larger non-profit, you will likely have staff that needs to be compensated. Your staff may be comprised of hourly, salaried, or commissioned workers. FinancePal will impeccably track and report payroll, hours worked, and commissions to make annual payroll tax filing a breeze for your business.

Impeccable non-profit accounting is vital for smooth and efficient operations. That is why non-profit organizations trust the accounting and bookkeeping experts at FinancePal.

For a free consultation and custom quote, click here.

Who We Work With

We partner with tech-driven industry leaders to bring advanced financial services to businesses like yours. By aligning with these innovators, we’re able to integrate with other business tools and enhance our service offerings. Some of our prestigious partnerships include:

Quickbooks

Hubdoc

T Sheets

ADP

Gusto

Hubdoc

Our Services

We offer a la carte and comprehensive financial services that are customized to your business, including:

Accounting

& Bookkeeping

Sales Tax

Consulting Services

Payroll Services

Entity Formation

Catch-up

Bookkeeping

Financial help customized for small businesses.

Financepal is your one-stop-shop for all your tax and accounting needs

By entering your phone number and clicking the “Contact Us Today” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.